By Chris Ambridge, Transcend

Special to the Financial Independence Hub

The objective for most investors is to earn value-added performance. Unfortunately there are fees and other costs that can diminish investment returns. The reality is that the costs associated with investing in these products can lead to underperformance when measured against industry standard benchmarks.

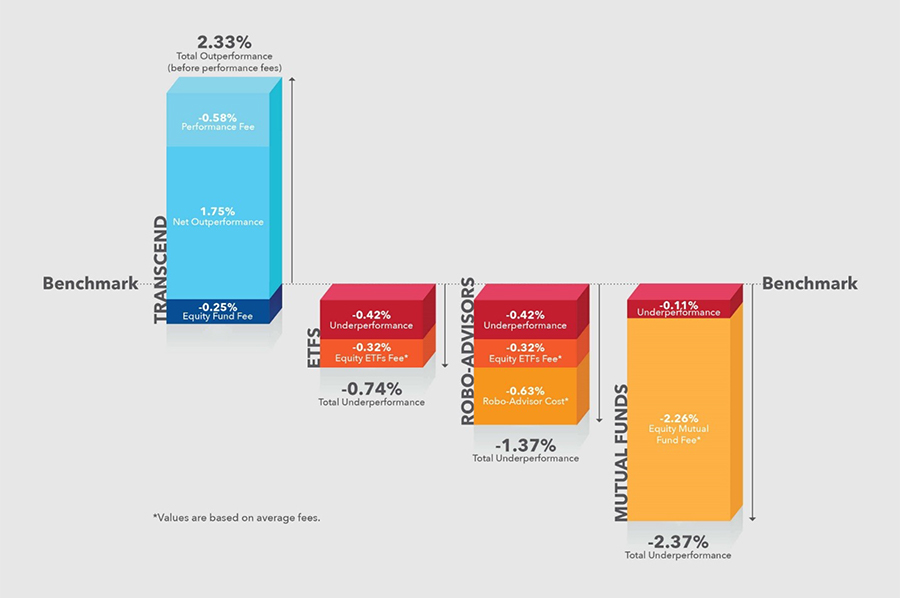

The above chart shows the average annual fees and their impact on investment performance for Equity Mutual Funds, Exchange Traded Funds (ETFs), robo-advisors and Transcend’s Pay-for-Performance™ model. This is illustrated by comparing their returns against a benchmark. The benchmark is a universally accepted representation of a particular stock market that is used to measure the performance of a portfolio manager. For example, a benchmark for Canadian equities is the S&P/TSX and a benchmark for U.S. equities is the S&P 500.

Ultimately, excessive fees reduce clients’ investment performance and hampers their ability to reach their financial goals.

While ETFs and robo-advisors are gaining in popularity, mutual funds are still the prevalent investment product for retail investors despite numerous studies that have confirmed the weak investment returns of equity mutual funds relative to their benchmarks. In Canada, a fairly new approach developed by S&P Dow Jones Indices called the SPIVA Canada Scorecard confirms performance failings. The latest result based upon five years of data ending December 2016 confirms that equity mutual funds have underperformed their benchmark, often because fees have such a negative impact on the overall portfolio results.

Mutual funds can charge management fees as well as administrative costs and custodial fees. They can also charge clients for trading, legal, audit and other operational expenses. In the chart above, these fees plus investment related underperformance add up to the average true cost (-2.37%) of investing during the last five years for equity mutual funds.

Even low-cost ETFs, which are designed to mirror a benchmark, tend to disappoint. The performance lag can be tied to the level of fees of 0.32%, plus trading and rebalancing costs as well as a potential cash balancing drag of up to 0.42%, based on 2015 data from the Management Reports of Fund Performance (MRFP) found on the SEDAR.ca website. This analysis does not include the negative impact of brokerage costs to buy and sell, and potential custodian or registration fees. With that in mind, the chart reveals that ETF investors underperform the market appropriate benchmark by -0.74%.

Robo-advisors to the rescue?

Another relatively new entrant to the low cost investment marketplace is the robo-advisor. Employing several common assumptions such as an average portfolio size of $50,000 and trading costs of 0.2% per year, it can be determined that the average robo-advisor fee in Canada is 0.63%.

This cost shows that it is more efficient than traditional wealth management fees, but still lags behind the Pay-for-Performance™ model. While everyone is talking about robo-advisors, the true question should be about getting value for your money and how much fees can impact actual outcomes.

For example, using the average fee on a $50,000 portfolio, the cost of an equity ETF is $367 per year, a robo-advisor would set you back at $682 and an equity mutual fund has a total average annual cost of $1,185.

These high costs are exactly why some investors are reconsidering and questioning traditional methods of investing. Lise Allin of Lise Allin Insurance and Estate Planning Services is an advisor we work with in Ontario and she recalled one case involving a senior, now her client, who in a 10 year time span with an investment bank saw his wealth at retirement go from $1,200,000 to $750,000. This person had worked for 40 years to accumulate his wealth and the decline of his capital was very worrisome, given that he is now a widower with children living far away.

“Many still want to be able to leave their kids an inheritance, but they have to be on the right investment path,” Allin says. Since that time, Allin has been working with us to stabilize her client’s investments around the $750,000 mark, while he is still able to withdraw the $40,000 he needs on a yearly basis. This is a clear illustration of how fees and poor investment choices can quickly erode capital and create a risky situation, especially for senior investors.

What’s new?

Find a firm that puts clients first and adheres to a set of prudent wealth management principles. The goal with your investments should be to build a portfolio that combines effective risk management techniques with superior investment returns.

Recognizing the impact of fees on performance, Transcend.ca offers a revolutionary platform. A client-friendly fee structure that charges much less in fixed costs while manager compensation is based on merit, not asset size, when delivering returns that outperform the market.

Chris Ambridge is President of Transcend & Chief Investment Officer of Provisus Wealth Management, a portfolio manager launched in 2007 that manages over $450 Million in assets for private clients. He began his investment career in 1987 as a Financial Analyst at IBM Canada, and worked in investment counsellors and private client investing in Canada and abroad. After returning to Canada he became Head of Investment Management Services for First Asset Advisory Services in 2003. Chris has an MBA from the University of Windsor and is a Chartered Financial Analyst.

Chris Ambridge is President of Transcend & Chief Investment Officer of Provisus Wealth Management, a portfolio manager launched in 2007 that manages over $450 Million in assets for private clients. He began his investment career in 1987 as a Financial Analyst at IBM Canada, and worked in investment counsellors and private client investing in Canada and abroad. After returning to Canada he became Head of Investment Management Services for First Asset Advisory Services in 2003. Chris has an MBA from the University of Windsor and is a Chartered Financial Analyst.