By Fauzi Zamir, CPA, CA

Special to Financial Independence Hub

I have diabetes so I am careful about eating sugary foods. In this short statement lies the secret of simple financial management. You may say that’s an odd conclusion, but you will shortly see the principles underlying the analogy in the first sentence and its applicability to your finances.

The first element (I have diabetes) is “knowing” that I have a problem and the second element (I am careful about eating sugary foods) is “doing something about it.” In the same way, financial management requires that you first know what you own, what you owe, and what your cash inflows and outflows are. The second thing is to determine which debts to pay off first and which discretionary expenses you can reduce: in other words, you want to reduce your expenses so that you can generate savings that can subsequently be invested.

Let’s use another analogy. I need to get in shape. I enthusiastically join a club and start going regularly. But soon I am overwhelmed by the choice of machines and different exercises and my visits start to decline and eventually stop. What happened? I was probably over ambitious, didn’t have the discipline and made it overly complicated. I could have taken a simpler approach by focusing first on my diet and then doing something simple like regular walking to create the sustained discipline that is needed for long-term results. The message here is, start with something simple and sustain the routine.

You can apply the same principles to personal financial management. Most of us spend what we earn and don’t have the level of savings/investments that we should have. We are overwhelmed by financial information and advice from innumerable sources, don’t know what to do and we end up doing very little to change our spending and saving patterns. So, let’s change that by taking some small steps:

- Start or use a savings account into which you will automatically transfer a set amount of money from your chequing account. It will be like a tax deduction that is processed when you get you get your paycheck. You never see it; you never spend it. Start with any amount you are comfortable with and plan to increase it as you get a better handle on your finances.

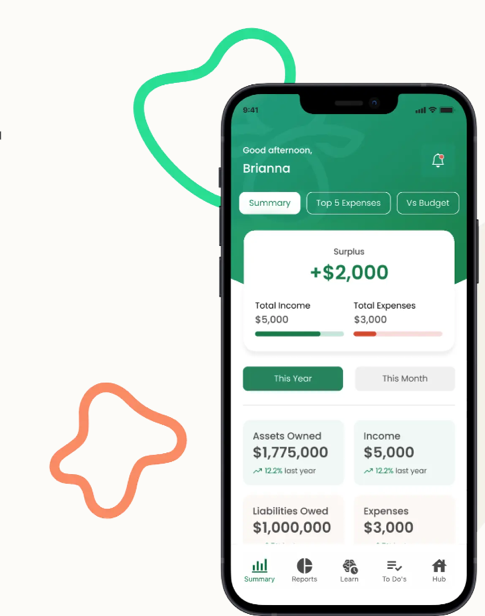

- Now summarize what you own and what you owe, so that you know what your net worth is. You also need to know what your cash flows are. A lot of people find this part too daunting. They think it’s too much effort and takes too much time or that they have some idea which is good enough. It ‘isn’t. There are a number of personal financial applications that will make this task a lot easier and quicker. I have recently launched an application (moolahmate.com), that will download all your transactions from multiple banks and credit card companies, categorize them automatically and then generate reports that tell you where your money is coming from and where it’s going. Now you can see things more clearly and know exactly which expenses to focus on; for example, specific discretionary expenses like entertainment or groceries which could be reduced. Now it’s easier to do this regularly with minimal effort.

- Based on your risk tolerance, start investing your savings regularly in a fixed interest instrument like a GIC/Certificate of Deposit or a stock index fund Alternatively, you could engage the services of a financial planner. There’s a lot to be said here, but that is for another blog.

Taking the above simple steps will help you nurture the discipline that you need to guide your financial success.

Fauzi Zamir is a CPA, CA who has been a Chief Financial Officer and Chief Operating Officer of companies and divisions large and small for several decades. He is also an entrepreneur who transformed personal lending by fully automating the lending process in the early 2000’s. More recently he has launched a personal financial portal (www.mooolahmate.com) that helps individuals save more, spend less, and reduce their financial stress.

Fauzi Zamir is a CPA, CA who has been a Chief Financial Officer and Chief Operating Officer of companies and divisions large and small for several decades. He is also an entrepreneur who transformed personal lending by fully automating the lending process in the early 2000’s. More recently he has launched a personal financial portal (www.mooolahmate.com) that helps individuals save more, spend less, and reduce their financial stress.