By Penelope Graham, Zoocasa

By Penelope Graham, Zoocasa

Special to the Financial Independence Hub

It’s no secret that Canadian real estate is expensive, with home ownership financially out of reach for many in the nation’s largest urban centres. Detached Toronto houses, for instance, fetched an average of $1,282,240 in February: and that follows an 18.6 per cent decline from the year prior.

Affordability in Vancouver remains at an all-time low; according to a recent report from RBC, the lender’s Senior Vice President and Chief Economist Craig Wright stated Vancouver home buyers “are being challenged by the worst affordability levels ever recorded in Canada.”

Well beyond expert advice

Financial experts commonly recommend that for homeownership to be financially sustainable, shelter costs should not exceed a third of a household’s take-home pay. This is easier said than done in the majority of Canada’s markets: and not at all possible in some regions for those purchasing a home on a single income, according to data compiled by Zoocasa.

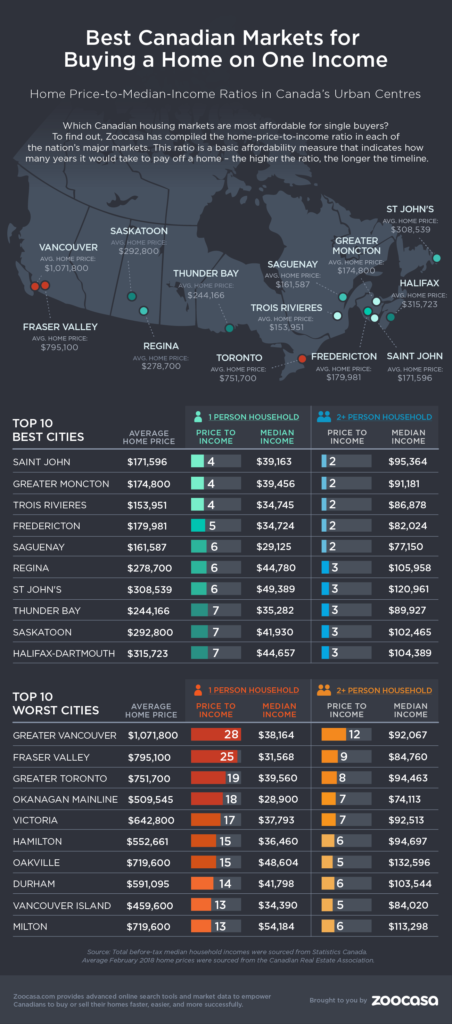

To determine the level of affordability in each market, the study determined the median home price-to-income ratio, based on regional home prices reported by the Canadian Real Estate Association, and median household incomes from Statistics Canada.

This ratio determines how many years it would take to pay off a home using 100 per cent of a household’s annual income: the higher the ratio, the longer the timeline. And, while dual-income households have their fair share of affordability challenges in hot markets, the numbers paint an impossible picture for solo buyers.

For example, in Vancouver, where a single-income household brings in a median annual salary of $38,164, and the average home cost $1,071,800, homeownership outweighs incomes by multiple of 28. A home in the City of Toronto would set said buyer back 19 years for their home purchase.

Even most affordable markets too pricey for Singles

However, in a market as varied as Canada’s, affordability can change drastically by market, yet single-income households are still theoretically paying too much on homeownership in even the most affordable regions. Houses for sale in Hamilton, a popular secondary market to Toronto, still cost single buyers 15 times their income while in Saint John — the most affordable Canadian market — the average home price of $171,596 still outstrips the regional median income of $39,163 by four times.

Check out the top 10 best (and worst) markets for purchasing a home on both a solo and multiple income in the infographic at the top of this blog.

The 5 most affordable housing markets for single-income households:

- Saint John: 4 (average home price: $171,596, median one-person income: $39,163)

- Greater Moncton: 4 (average home price: $174,800, median one-person income: $39,456)

- Trois Riviers: 4 (average home price: $153,591, median one-person income: $34,745)

- Fredericton: 5 (average home price: $179,981, median one-person income: $34,724)

- Saguenay: 6 (average home price: $161,587, median one-person income: $29,125)

The 5 least affordable housing markets for single-income households:

- Greater Vancouver: 28 (average home price: $1,071,800, median one-person income: $38,164)

- Fraser Valley: 25 (average home price: $795,100, median one-person income: $31,568)

- Greater Toronto: 19 (average home price: $751,700, median one-person income: $39,560)

- Okanagan Mainline: 18 (average home price: $509,545, median one-person income: $28,900)

- Victoria: 17 (average home price: $642,800, median one-person income: $37,793)

Penelope Graham is the Managing Editor of Zoocasa.com, a leading real estate resource that uses full brokerage service and online tools to empower Canadians to buy or sell their home faster, easier, and more successfully.

Penelope Graham is the Managing Editor of Zoocasa.com, a leading real estate resource that uses full brokerage service and online tools to empower Canadians to buy or sell their home faster, easier, and more successfully.

Poor that you did not include Winnipeg!