- Ch-ch-ch-ch-changes

- Turn and face the strange

- Ch-ch-changes

- Don’t want to be a richer man

- Ch-ch-ch-ch-changes

- Turn and face the strange

- Ch-ch-changes

- There’s gonna have to be a different man

- Time may change me

- But I can’t trace time — Changes, by David Bowie

By Noah Solomon

Special to Financial Independence Hub

There is a basic principle that most people follow when it comes to their spending decisions. In essence, people generally try to either

(1) Get the most they can for the least amount of money, or

(2) Spend the least amount of money on the things they want (i.e. get the best deal)

In other words, rational utility maximizers try to be as efficient as possible when parting with their hard-earned dollars.

Strangely, many investors abandon this principle when it comes to their portfolios. With investing, what you get is return (hopefully more than less), and what you pay (other than fees) is risk. People often focus on return without any regard for the amount of risk they are taking. Alternately, many make the mistake of reducing risk at any cost, regardless of the magnitude of potential returns they leave on the table.

The foundation of successful investing necessitates achieving an optimal balance between return and risk. Different types of assets (volatile speculative stocks, stable dividend paying stocks, bonds, etc.) have very different risk and return characteristics. Relatedly, a portfolio’s level of exposure to different asset classes is the primary determinant of its risk and return profile, including how efficient the balance is between the two.

Offense, Defense, & Bobby Knight

Robert Montgomery “Bobby” Knight was an American men’s college basketball coach. Nicknamed “the General,”h e won 902 NCAA Division I men’s basketball games, a record at the time of his retirement. He is quoted as saying:

“As coaches we talk about two things: offense and defense. There is a third phase we neglect, which is more important. It’s conversion from offense to defense and defense to offense.”

Nobody can escape the fact that you can’t have your cake and eat it too. You can’t increase potential returns without taking greater risk. Similarly, you can’t reduce the possibility of losses without reducing the potential for returns.

Picking up Pennies in Front of a Steamroller vs. Shooting Fish in a Barrel

Notwithstanding this unfortunate tradeoff, there are times when investors should focus heavily on return on capital (i.e. being more aggressive), times when they should be more concerned with return of capital (i.e. being more defensive), and all points in between.

Sometimes, there is significantly more downside than upside from taking risk. Although it is still possible to reap decent returns in such environments, the odds aren’t in your favour. Reaching further out on the risk curve in such regimes is akin to picking up pennies in front of a steamroller: the potential rewards are small relative to the possible consequences. At the other end of the spectrum, there are environments in which the probability of gains dwarfs the probability of losses. Although there is a relatively small chance that you could lose money in such circumstances, the wind is clearly at your back. At these junctures, dialing up your risk exposure is akin to shooting fish in a barrel – the likelihood of success is high while the risk of an adverse event is small.

John F. Kennedy & the Chameleonic Nature of Markets

Former President John F. Kennedy asserted that “The one unchangeable certainty is that nothing is certain or unchangeable.” With regard to markets, the risk and return profiles of different asset classes are not stagnant. Rather, they change over time depending on a variety of factors, including interest rates, economic growth, inflation, valuations, etc.

Given this dynamic, it follows that determining your optimal asset mix is not a “one and done” treatise, but rather a dynamic process that takes into account changing conditions. Yesterday’s optimal portfolio may not look like today’s, which in turn may be significantly different than the one of the future.

It’s not just the risk vs. return profile of any given asset class that should inform its weight with portfolios, but also how it compares with those for other asset classes. As such, investors should use changing risk/return profiles among asset classes to “tilt” their portfolios, increasing the weights of certain types of investments while decreasing others.

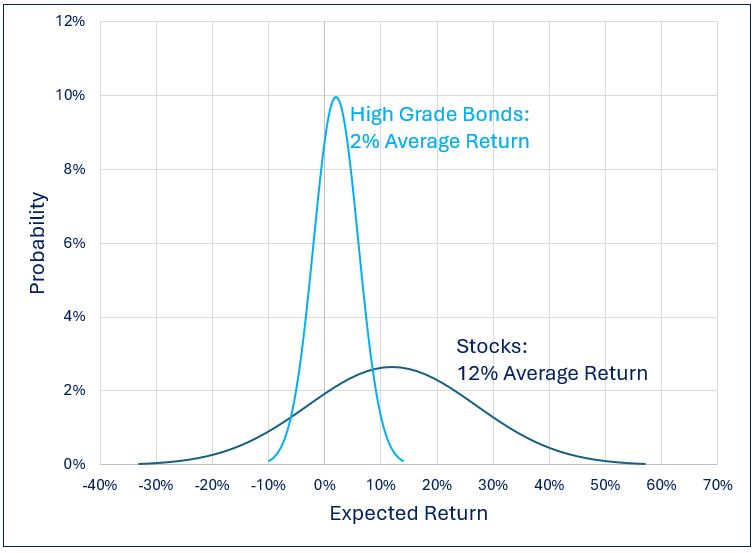

In “normal” times, the expected return from stocks exceeds the yields offered by cash and high-grade bonds by roughly 3% per annum. However, this difference can expand or contract depending on economic conditions and relative valuations among asset classes.

In the decade plus era following the global financial crisis, not only did rates remain at historically low levels, but the prospective returns on equities were abnormally high given the positive impact that low rates have on spending, earnings growth, and multiples. Against this backdrop, the prospective returns from stocks far exceeded yields on safe harbour investments. Under these conditions, it is no surprise that investors who had outsized exposure to stocks vs. bonds were handsomely rewarded.

Expected Return on Stocks vs. Yield on High Grade Bonds: Post GFC Era

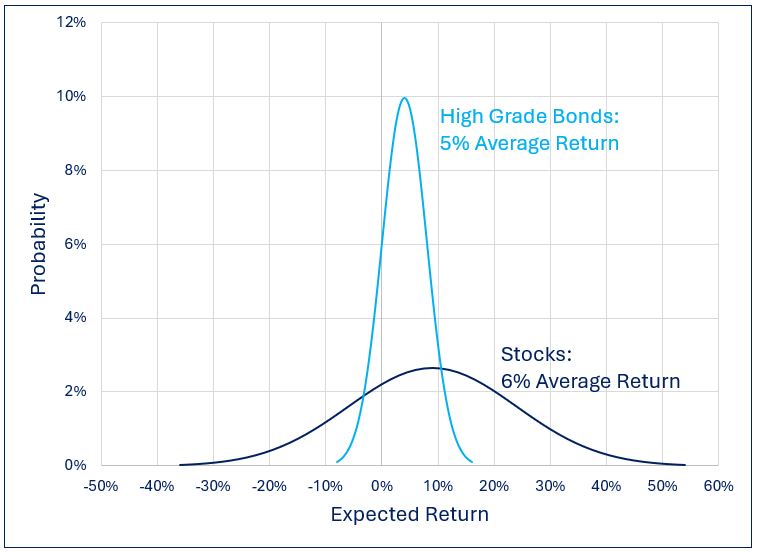

As things currently stand, the picture is markedly different. Following the most significant rate-hiking cycle in decades, bonds are once again “back in the game.” Moreover, lofty equity market valuations (at least in the U.S.) suggest that the S&P 500 Index will deliver below-average returns over the next several years.

Given these conditions, stocks have lost much of their previous advantage over bonds while still harbouring far higher risk.

Expected Return on Stocks vs. Yield on High-grade Bonds: Current Environment

Counting Cards & Playing the Odds over the Long Term

There are no certainties in markets. Although lower probability events occur less than 50% of the time, they do happen regularly. Similarly, whereas higher probability events materialize more than half the time, they often fail to do so. Over shorter-term periods, you can diligently play the odds and still come up short, and you can bet against the odds and still get lucky. Even the best card counters regularly lose individual hands at the blackjack table. However, playing the odds will result in success over the long term. Short-term fluctuations notwithstanding, “Playing correctly means you’ve already won”

If you can consistently gauge the probability curves across asset classes and shift your portfolio accordingly, you will almost certainly be able to either (1) achieve above-average results over the long term given your specific risk-tolerance, or (2) reap your desired level of return by taking the least amount of risk possible.

In my view, playing the odds as they stand in today’s markets necessarily entails lightening up on high-volatility growth stocks (particularly in the U.S.), and redeploying the proceeds into lower-volatility, dividend-paying companies (i.e. bonds in disguise) and high-grade bonds.

Noah Solomon is Chief Investment Officer for Outcome Metric Asset Management Limited Partnership. From 2008 to 2016, Noah was CEO and CIO of GenFund Management Inc. (formerly Genuity Fund Management), where he designed and managed data-driven, statistically-based equity funds. Between 2002 and 2008, Noah was a proprietary trader in the equities division of Goldman Sachs, where he deployed the firm’s capital in several quantitatively-driven investment strategies. Prior to joining Goldman, Noah worked at Citibank and Lehman Brothers. Noah holds an MBA from the Wharton School of Business at the University of Pennsylvania, where he graduated as a Palmer Scholar (top 5% of graduating class). He also holds a BA from McGill University (magna cum laude). Noah is frequently featured in the media including a regular column in the Financial Post and appearances on BNN. This blog originally appeared in the January 2025 issue of the Outcome newsletter and is republished here with permission

Noah Solomon is Chief Investment Officer for Outcome Metric Asset Management Limited Partnership. From 2008 to 2016, Noah was CEO and CIO of GenFund Management Inc. (formerly Genuity Fund Management), where he designed and managed data-driven, statistically-based equity funds. Between 2002 and 2008, Noah was a proprietary trader in the equities division of Goldman Sachs, where he deployed the firm’s capital in several quantitatively-driven investment strategies. Prior to joining Goldman, Noah worked at Citibank and Lehman Brothers. Noah holds an MBA from the Wharton School of Business at the University of Pennsylvania, where he graduated as a Palmer Scholar (top 5% of graduating class). He also holds a BA from McGill University (magna cum laude). Noah is frequently featured in the media including a regular column in the Financial Post and appearances on BNN. This blog originally appeared in the January 2025 issue of the Outcome newsletter and is republished here with permission