By Mark Seed, myownadvisor

Special to Financial Independence Hub

Hey Everyone,

Welcome to some new Weekend Reading, the market smackdown edition.

In case you missed any recent posts, here they are!

Before I started semi-retirement/part-time work this month, I shared some big retirement mistakes I hope to avoid in the coming years.

After reading about a 23-year-old athlete earning $2 million, I wondered if he was “set for life”?

And finally, I shared our latest dividend income update below – despite the stock market going down our income stream went up!

Weekend Reading – Market Smackdown edition

Wild week.

10% tariffs.

Then 104% tariffs.

Then reciprocal 84% tariffs.

I can’t keep up…

Quite the infographic on this subject:

Given the market turbulence, sage words from one Globe and Mail article I read (subscription via Carrick on Money) which was the inspiration for this headline:

“I’ve experienced every single smackdown in the market for over fifty years,” Doug Hartt told me by e-mail recently. “At some point in each market meltdown, my portfolio has dropped equal to the relevant indexes. It’s always come back.”

“Take heart from Mr. Hartt. The market does always come back over time. Declines like we’re seeing right now are hard to watch, but they do build your investing calluses.”

Indeed.

So staying the investing course is usually a good idea as tough as that may be.

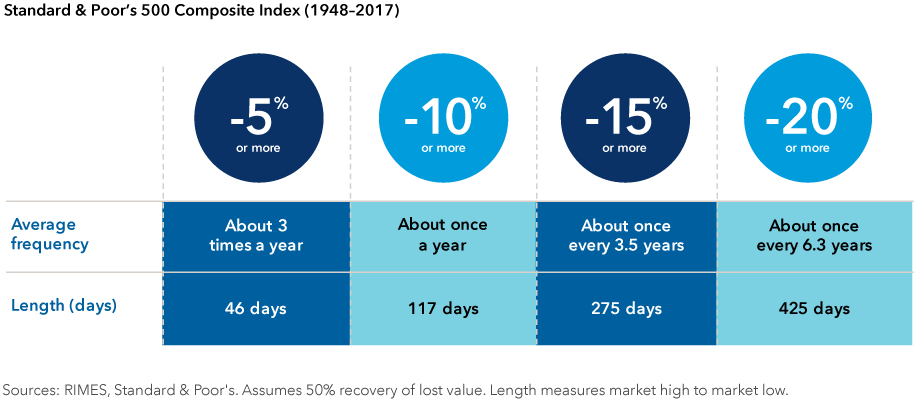

When we look at the S&P 500 corrections over the last 80+ investing years it looks like this:

Source: with thanks to Ben Carlson, A Wealth of Common Sense.

I remind myself of this graphic as well when it comes to corrections:

So, our plan is to be ready for this at all times: given a stock market correction happens at least once every two years, of 10% or more declines, keep cash/cash equivalents ready – always.

I don’t know if any tariffs are here to stay. Maybe they are.

I don’t know how much the stock market will continue to react to tariff news.

I do know I need to keep my investing plan intact.

More Weekend Reading – Market Smackdown edition

Always good stuff from Nick Maggiulli on how not to invest.

Interesting data I read from Wealthsimple about redefining the retirement years. The way I see it, retirement planning isn’t just about money – it’s about lifestyle choices. There are tradeoffs. We’ve recently made ours by deciding to work part-time.

Amazing stuff on Brookfield here:

With thanks from Farnam Street – The Knowledge Project above. Worth the watch IMO. On The Knowledge Project: a rare interview with Bruce Flatt, the quiet force behind Brookfield’s 19% annual returns for 30 years; the investment principles that transformed @Brookfield into a $1T global powerhouse. @farnamstreet

A nice interview with a fellow blogger From Labour to Leisure here.

Mark Seed is a passionate DIY investor who lives in Ottawa. He invests in Canadian and U.S. dividend paying stocks and low-cost Exchange Traded Funds on his quest to own a $1 million portfolio for an early retirement. You can follow Mark’s insights and perspectives on investing, and much more, by visiting My Own Advisor. This blog originally appeared on his site on April 12, 2025 and is republished on Findependence Hub with his permission.

Mark Seed is a passionate DIY investor who lives in Ottawa. He invests in Canadian and U.S. dividend paying stocks and low-cost Exchange Traded Funds on his quest to own a $1 million portfolio for an early retirement. You can follow Mark’s insights and perspectives on investing, and much more, by visiting My Own Advisor. This blog originally appeared on his site on April 12, 2025 and is republished on Findependence Hub with his permission.