By Ambrose O’Callaghan, Harvest ETFs

(Sponsor Blog)

The U.S. healthcare sector has faced unique challenges in late 2024 and the first half of 2025. Last year, we provided an in-depth look at global healthcare as a long-term opportunity and examined some of the catalysts and innovations that were impacting the sector. Today, the U.S. and global healthcare space continues to evolve while combatting headwinds in some key areas.

The state of U.S. healthcare equities

Healthcare performed relatively well in the early part of 2025, despite broader trade uncertainty and macroeconomic headwinds. The medical technology and tools sub-sector experienced some short-term volatility that was driven by the uncertainty surrounding tariffs. That comes as little surprise, considering companies in the space reliance on oversees manufacturing and revenue generation.

Domestic names, like those in Managed care and select Biopharmaceuticals, remained relatively insulated during this period. This stemmed from an easing in the tariff narrative, which was triggered by a sharp drop in several macroeconomic indicators that included manufacturing activity and consumer confidence. As we progressed further into 2025, a cloud of uncertainty crept into healthcare. That contributed to some recent volatility across several sub-sectors. In this article, we have provided some recent catalysts to help investors make sense of the current situation in healthcare.

Drug pricing in 2025

On May 12, 2025, President Donald Trump signed an Executive Order (EO) titled “Delivering Most-Favored-Nation Prescription Drug Pricing to American Patients.” This EO proclaimed that the Trump administration “will take immediate steps to end global freeloading and, should drug manufacturers fail to offer American consumers, the most-favoured-nation lowest price, my Administration will take additional aggressive action.”

Ultimately, the aim is to align U.S. drug prices more closely with lower prices paid internationally. This EO echoes a summer 2020 Trump-era EO that was blocked in court and failed to be implemented. The current version faces similar hurdles. There is no bipartisan backing for the policy, the legality surrounding it is dubious, and there is opposition among both Democrat and Republican lawmakers.

All of these make the implementation of this EO unlikely. However, we could see pilot programs within the Department of Health and Humans Services (HHS), making attempts to fold the current EO’s proclamations into future IRA negotiations, or more comprehensive legislative proposals.

In addition, there are those who have predicted the policy could reduce the research and development (R&D) budgets further. That could potentially impact innovation and companies that have been propelled due to strong R&D spending. However, the risk may truly lie in the negative sentiment that continues to emerge in the news cycle.

Vaccine market uncertainty

The appointment of Robert F. Kennedy Jr. as the United States Secretary of Health has damaged sentiment for healthcare companies that manufacture vaccines. RFK Jr. is a vocal “vaccine sceptic.” Moreover, the Trump administration has pursued leadership changes at the Food and Drug Administration (FDA), which raises questions about stricter vaccine approval processes going forward.

Merck & Co, the U.S.–based pharmaceutical giant, with its vaccine-related businesses, has felt the pressure. In addition to the political uncertainty, a recent CMS technical document has added to the complexity in the vaccine arena. The report suggested that reformulated drugs may no longer be classified as “new” for Medicare negotiations. This development could impact companies with operations in the “combination therapy” space like Johnson & Johnson’s Darzalex Faspro, or Bristol Myers’ subcutaneous version of Opdivo. That could affect future patent projections as well.

On the other hand, this could be purely headline-related risk, meaning news that negatively impact companies as market tries to fully assess the full impact of the CMS technical document findings/suggestions. Afterall there is significant systemic value surrounding the innovation of combined drugs that meaningfully alter the delivery of a drug from several hours of intravenous (IV) to just minutes using a subcutaneous delivery.

Pressure on PBMs and insurers

Going back to the recent EO (mentioned above), President Trump also targeted Pharmacy Benefit Managers (PBMs). PBMs are companies that work in conjunction with multiple stakeholders, for example negotiating drug prices on behalf of insurance companies through to processing the payment of prescription drug claims.

The executive order adds a layer of uncertainty for the sub-sector including Managed Care companies. The UnitedHealth Group does have PBM exposure and came under pressure adding to some pressure following financial guidance changes driven in part by recent CMS reimbursement code changes. These changes resulted in utilization rates – individuals seeking treatment – rising more than they had expected. This could be a temporary phenomenon that has provided UnitedHealth the opportunity to price the 2026 Medicare advantage plans, which they are in the process of doing right now, with more clarity on their cost trends.

Andrew Witty, UnitedHealth’s CEO, told analysts: “Our Medicare Advantage plan designs and pricing for 2026 will be fully informed by these trends.” UnitedHealth Group is the largest U.S. insurer. It insures some 50+ million Americans and we continue to view UnitedHealth as essential to the healthcare system going forward. However, we also reiterate that diversity across the healthcare sector has always been important, in the current environment with tariff tantrums and political clouds that come in and out, it is essential.

Looking back into history, we observed a similar process that played out in 2018. At that time, the President made similar comments targeting PBMs. However, any meaningful reform remains elusive. Also, when any reform is achieved, it tends to unfold very slowly, if at all.

On the other side of the coin, amidst the shift in tone in the tariffs, many of the medical device companies, including Boston Scientific and Stryker Corp., have recovered strongly from the tariff-induced sell-off to be near all time highs in May. This helps to reinforce the benefits of diversification.

Where that leaves us . . .

Valuation multiples across the healthcare sector have compressed significantly due to the recent bouts of market turbulence. Also, sentiment has turned markedly cautious. Notwithstanding, history shows that sentiment can shift rapidly. The real bottom line is that with all that’s unfolding, we continue to see strong long-term fundamentals in the healthcare space. At these levels, valuations may be attractive.

Taking a prudent approach, our investment team has sought to hold off on writing initial calls on select positions it views as oversold. That allows the fund to participate more fully in a recovery from oversold levels. As a reminder, healthcare remains a cornerstone sector, despite the headline noise. There are permanent and non-cyclical drivers that make this sector appealing in the long term.

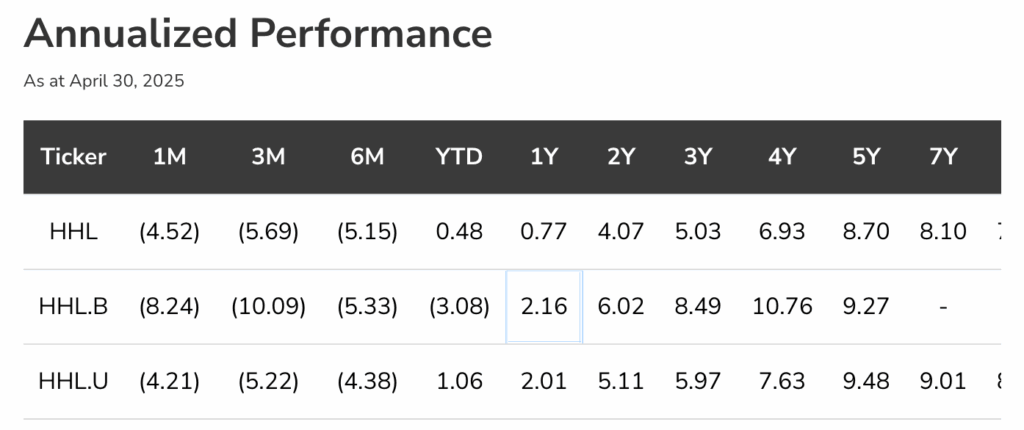

The Harvest Healthcare Leaders Income ETF (HHL:TSX) offers steady income through a time-tested active covered call writing strategy. Moreover, it offers growth opportunities from a portfolio of large-cap U.S. healthcare leaders. It increased its monthly cash distribution to $0.06 per unit in 2024. HHL has paid out over a half billion in total cash distributions since inception (10 years and counting). Unitholders over that period have enjoyed and benefited from 124 months of consistent distribution along with some capital appreciation.

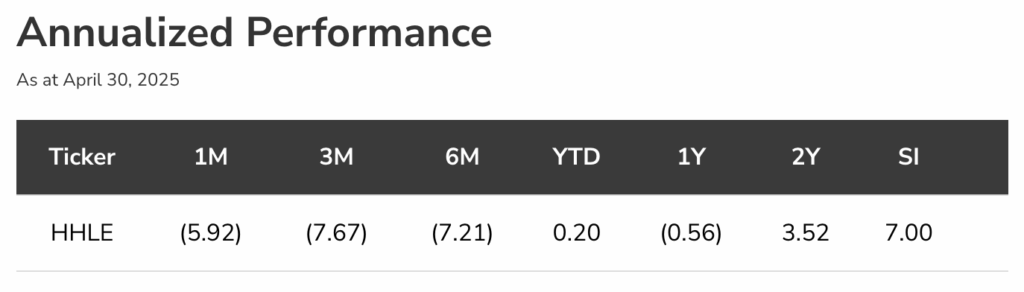

For investors seeking even higher levels of monthly income and growth potential, we offer a levered version of the ETF with exposure to the same underlying securities in the sector. The Harvest Healthcare Leaders Enhanced Income ETF (HHLE:TSX) applies modest leverage to an investment in HHL. It last paid out a monthly cash distribution of $0.0934 per unit.

Ambrose O’Callaghan is Senior Copy Writer at Harvest ETFs. Ambrose brings over a decade of experience in the financial services industry to the Content Editor role. He is responsible for providing context to current trends, developments, and analyses to help make sense of the ETF market and emerging themes. With a strong knowledge of the Canadian equity markets and Harvest products, Ambrose regularly provides commentary on a broad array of market topics.

Ambrose O’Callaghan is Senior Copy Writer at Harvest ETFs. Ambrose brings over a decade of experience in the financial services industry to the Content Editor role. He is responsible for providing context to current trends, developments, and analyses to help make sense of the ETF market and emerging themes. With a strong knowledge of the Canadian equity markets and Harvest products, Ambrose regularly provides commentary on a broad array of market topics.

Disclaimer Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The indicated rates of return are the historical annual compounded total returns (except for figures of one year or less, which are simple total returns) including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. Tax investment and all other decisions should be made with guidance from a qualified professional. Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions "expect", "intend", "will" and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.