Special to the Financial Independence Hub

The anniversary of the implementation of the Ontario Fair Housing Plan has come and gone, and the playing field is just starting to even in the province’s housing market. Designed to cool demand and price growth in the Greater Golden Horseshoe, the 16-part package of housing regulations has effectively done just that, with sales down double-digit percentages throughout the region, and prices softening for the most expensive housing types.

Housing analysts argue that this result is mainly due to psychological factors, rather than the new regulations – which include a foreign buyer’s tax, and overarching rent controls – themselves.

But what do Ontarians really think about the new regulations? To find out, Zoocasa conducted a survey of 1,400 respondents on their sentiments around the highlights of the plan, and whether they support the government’s intervention in the free housing market.

Following BC’s footsteps

If Ontario’s attempt to tax foreign purchasers of real estate seems familiar, that’s because it closely resembles what occurred in British Columbia; the province initially implemented a 15-per-cent levy on foreign buyers within the Metro Vancouver area in August 2016, before upping the tax to a full 20 per cent, and extending the affected geographical area, in February of this year.

While Ontario’s version, called the Non-Resident Speculation Tax (NRST) still taxes just 15 per cent of a home’s purchase price, it will apply to anyone buying a home within the GGH – including homes for sale in Hamilton, or condos for sale in Mississauga, who is not a Canadian citizen or permanent resident (those who obtain such status, or who are enrolled in a minimum two-year full-time post-secondary program within a year of their home purchase are eligible for a full rebate on the NRST).

At the time of its implementation, former Ontario premier Kathleen Wynne was adamant that the tax was not intended to discourage newcomers to Canada from settling in Ontario.

“The Non-Resident Speculation Tax has nothing to do with new Canadians or people who want to make Ontario their home,” she stated to a media scrum on April 20, 2017. “This is targeting people who are not looking to raise a family, who are just looking for quick profit or a place to park their money.”

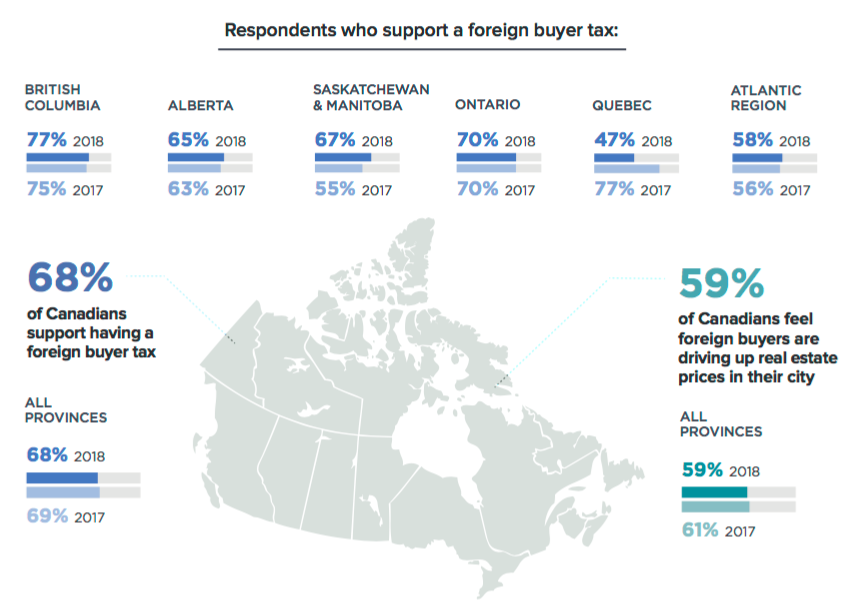

The measure appears to have resonated well with all Canadians; according to survey results, 69 per cent of respondents from all provinces indicated they support the tax, while 61 per cent felt foreign ownership directly impacts prices in the local housing market.

Perhaps not surprisingly, respondents from provinces with the most competitive real estate marketplaces were most likely to support the tax: 77 per cent of British Columbians and 70 per cent of Ontarians indicated they were pro-tax.

Support extends beyond affected Housing markets

Support extends beyond affected Housing markets

However, even respondents from provinces where foreign investment and homeownership is not considered a stressor on the market, indicated support for the tax; 65 per cent of Albertans indicated support, even though only 40 per cent feel out-of-country buyers impact housing prices in their region.

The trend continues in Saskatchewan and Manitoba (polled together), which reveal 67 per cent are in support, yet only 51 per cent feel it’s an issue. Among respondents from the Atlantic provinces, 58 per cent are in favour of a foreign buyer’s tax, while just 30 per cent perceive it to be an issue in their market.

These findings are roughly unchanged from the data collected by Zoocasa on the same topic in 2017.

However, one province stands out for its changing level of support for the tax: Quebec, which indicated 47 per cent support in 2017, fell to just 30 per cent this year, with slightly fewer respondents (48 vs 50 per cent) feeling foreign ownership impacts their local markets. As the presence of foreign ownership is perceived to have increased in the province following the implementation of the tax in Ontario and British Columbia, with investor interest shifting to La Belle Provence, and specifically Montreal, it’s an interesting shift in sentiment.

Rent Controls: harming or helping?

The new rent controls introduced in the FHP have made a considerable splash in Toronto’s rental market. A cornerstone of the Plan, they require that rents for all units, regardless of age, be capped at the provincially-prescribed maximum upon lease renewal.

This effectively does away with the previous two-tied system, where rent controls only applied to units built prior to 1991. Previously, landlords of newer rentals could adjust rents as they saw fit when leases were up.

In Toronto’s excessively tight rental market, where vacancy remains below 1 per cent, this led to a spike in rent prices from 2016 – 2017, with some rents being hiked upwards of 100 per cent annually. The issue garnered hot media attention, and prompted the Wynne government to take measures to better protect renters.

Under the new rules, landlords may still increase rents as they wish for brand new leases.

Both developers and landlord associations sounded warning bells in response to the FHP, saying that capping rents would have the opposite of the intended effect; supply would dwindle further, as private landlords – for example, investors in condos for sale in Toronto – would be dissuaded from renting their units, while builders would eschew rental purpose projects for more lucrative condo developments. Indeed, over 1,000 pre-construction units previously earmarked for rental purpose were converted to condos in the GTA in the months following the Plan’s announcement.

So, one year later, how do renters feel about these new protections? According to the data, 56 per cent do feel they’ve been effective in improving their own affordability (19 per cent disagree, while 25 per cent aren’t sure).

However, renters also reported being increasingly fearful that the regulations would negatively impact them in the future; 36 per cent feel rent caps have caused overall rents to increase (40 per cent aren’t sure and 24 per cent disagree).

As well, an additional 47 per cent feel rent caps will make it tougher for them to find another affordable rental, when it comes time to move.

As well, an additional 47 per cent feel rent caps will make it tougher for them to find another affordable rental, when it comes time to move.

Penelope Graham is the Managing Editor of Zoocasa.com, a leading real estate resource that uses full brokerage service and online tools to empower Canadians to buy or sell their home faster, easier, and more successfully.