Special to the Financial Independence Hub

Investing is simple. We are all familiar with the KISS acronym. Simplicity is the key to successful investing. I have been reading and studying investing and investment strategies for decades and came to the conclusion that for the most part “nobody knows nothing.”

Great. All that research and tens of thousands of hours of study and I came back to the fact that I don’t need to know much at all. What a complete waste of time? No not at all. The thousands of hours of study showed me why I, we, don’t need to know much. We do not need to be experts when it comes to investing. As I like to write: It ain’t rocket surgery. Here’s how you find Easy Street.

What is an investment portfolio? In its basic form we can think of a portfolio as having two components: great companies for greater growth potential and bonds to manage the risk. Those bonds work like shock absorbers on the portfolio to reduce the risk or volatility. The more bonds in the portfolio, the lower the risk level of the portfolio.

A typical portfolio will hold great blue-chip companies (stocks) such as Apple, Google, Microsoft, Facebook, Johnson & Johnson, Berkshire Hathaway (Warren Buffett’s company), Coca-Cola and on and on. On the Canadian side we’ll hold Tim Hortons, the big Canadian banks, the telco companies such as Bell, Rogers and Telus, plus railroad companies such as CN and CP Rail and major energy players such as Suncor and Enbridge and on and on.

The rich are business owners

We know that the richest people on earth are usually business owners. We’re going to join them. We’re going to own a piece of those businesses. When enough of those companies do well, you do well. And certainly not every business is going to do well: that’s why you own a bunch of ’em. And that’s why you’ll own great companies in Canada, US and around the globe. And we don’t have to know how to analyze those companies, we can simply go and buy the ‘entire’ stock market. Here’s What is Index Investing and why it’s simply a superior form of investing. It’s so easy we call it Couch Potato Investing.

And back to risk or volatility. Certainly stock markets mostly go up over time, but they do correct or go down with regularity; it’s a normal and expected part of investing. For the potential of those 9-10% annual returns from stocks we need to accept some risk. Keep in mind that stocks can go down by 50% in major stock market corrections. That’s not everyone’s cup of tea to watch their investment portfolio get cut in half. That’s why many or most investors will need some bonds in the portfolio. Bonds are fixed-income investments and are typically less risky than stocks. A bond pays you a fixed payment on a regular basis and bonds can also go up in value when stocks go down – think teeter totter.

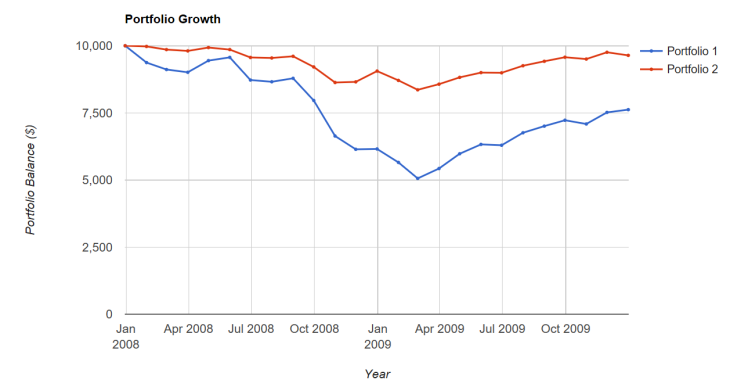

A portfolio with a very generous amount of bonds would have only decreased by about 10%-15% in the last major market correction. For the period of 2008 to end of 2009, here’s a comparison of the US stock market (S&P 500) as Portfolio 1, and a Balanced Portfolio as Portfolio 2.

We see that the all-stock portfolio declined by 50% while the Balanced Portfolio with a 70% bond component declined by just over 15%. By the end of 2009 that conservative Balanced Portfolio is almost back in positive territory while the all-stock portfolio still has more of that hill to climb.

Percentage in Bonds a critical decision

The most important decision that will be made, or the most important question answered will be “What percentage of bonds do you need?” What is your risk tolerance level? What roller coaster do you want to ride? You get to decide.

As a general framework for performance during a 50% stock market decline:

- Balanced Portfolio with 70% bonds might decrease 10-15%

- Balanced Portfolio with 40% bonds might decrease 20-30%

- Balanced Portfolio with 25% bonds might decrease 35-40%

Keep in mind that past performance does not guarantee future returns, but the above is the scenario that past stock and bond market performance suggests.

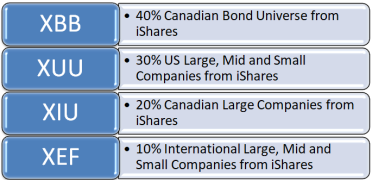

Once again, the Canadian Balanced Portfolio is going to include Canadian companies, US companies, International companies and Canadian bonds. Very aggressive investors may hold no bonds in their portfolio. From the Model Portfolio section on this site, here’s what a down-the-middle Balanced Portfolio might look like for a Canadian investor who creates their own ETF or Exchange Traded Fund portfolio. The fees of ETF portfolios are incredibly low. While Canadians pay some of the highest investment fees in the world at 2.20%, we can create a Balanced portfolio for fees that are below .20%. Yes that decimal point is in the right place, that’s one-fifth of one percent. Imagine keeping an additional 2% in your portfolio pocket, every year.

Here are the stock market tickers and holdings. You press a couple of buttons, you buy an entire market index fund.

If you’re not yet comfortable creating and managing your own portfolio you can opt for a low-fee managed portfolio. The above simple and balanced format is largely followed by robo advisors as well.No nNo

Here’s my blog What And Who Are The Canadian Robo Advisors? While each robo advisor has their own unique processes and fund selection criteria, the basic construct is the same. Some robo advisors will add some foreign bonds or more ‘sophisticated’ income or stock components, but at the core is that Canada, US and International stock market core supported with bonds.

No need for high-fee mutual funds

It’s that simple. Once again, you don’t have to continue down that route of paying some of the highest mutual fund fees in the world. You can create your own simple portfolio, or you can opt for the many low-fee managed portfolio solutions. It’s easy to cut your investment fees by 50-90% or more. Imagine if you found a way to cut your insurance costs by 90%, buy that car for 90% less, cut your Bell or Rogers bill by 90%? Yes you’d jump at the opportunity. You and your investment dollars should also jump at the opportunity to take a walk down Easy Street.

I am happy to help. I am a former investment advisor who coached Canadians on lower-fee index-based portfolios. I can offer assistance or I can point you in the right direction. These days I work for karma. There’s no catch, I am simply on a mission helping Canadians say goodbye to paying some of the highest fees in the world.

It’s easy.

Leave a comment or send a note to cutthecrapinvesting@gmail.com

Thanks for reading,

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. This blog originally appeared on his site on June 28, 2018 and is reproduced here with his permission.

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. This blog originally appeared on his site on June 28, 2018 and is reproduced here with his permission.

If you are looking at a 60/40 stock/bond split – the Mawer Balanced fund (after all fees) has trounced the Couch Potato over the last 5, 10 and 15 year periods.