If you invest overseas, your holdings may be valued in foreign currency. When markets are volatile, a portfolio manager can use currency hedging to protect the value of the investment.

Let’s look at how currency changes can affect how your money works. For instance, let’s say you book a vacation in Miami, Florida for your family. You’ll fly down from Toronto and enjoy some fun in the sun in the wintertime. You can relax while your kids cool off in the hotel swimming pool.

But between booking your reservation in the summer and actually paying your bill at the end of your stay in January, you notice that your costs jumped nearly 10 per cent – even though the bill in US dollars was the same as when you booked it months before! What gives?

If you had purchased US dollars at the time you booked and paid for your vacation with it, you’d be fine. But you used a credit card (like most folks), and had to pay the difference in the value of the currency. Now the vacation is over and you spent more than you intended.

A similar thing can happen with investments. Let’s see how it works.

Non-hedged vs. hedged investing: a simple example

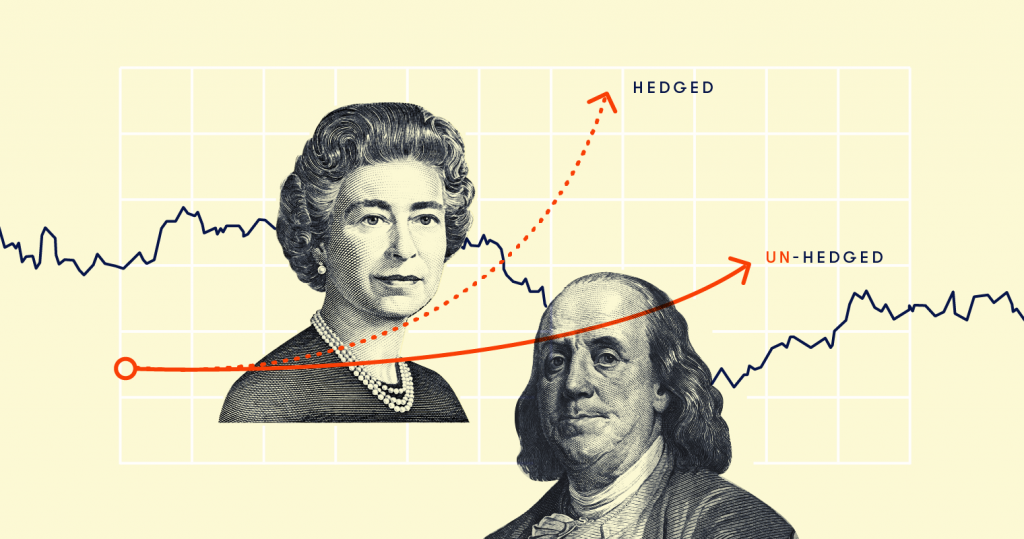

Imagine a Canadian investor with diversified, international holdings. A few months ago, they bought some tech stocks that looked ready to go up. And lo and behold, they did! Their US tech company stock went up 8 per cent (measured in US dollars).

But there was another factor working against this investor: Canada! Surging oil prices powered the economy ahead at full speed. The Canadian dollar appreciated by an impressive 6 per cent against the US dollar!

What’s the result of this non-hedged investment? The investor’s US tech stock investment gives them a positive return of just 2 per cent. Not so impressive.

What would have happened if the investor hedged their investment? In that case, the investor gets the full 8 percent return!

See, hedging is like an insurance policy, when volatility is high. But here’s the catch: hedging is complicated. It’s time-consuming. You need high-level expertise and bandwidth to watch the market carefully.

For most Canadian investors, that’s not an option. It’s probably something you want to let your portfolio manager (like ours) take care of for you.

Hedging on an income stream to ensure steady returns. That’s how we do it

Let’s say there is an income stream from a dividend-paying investment, like in our bond and income-generating ETFs. That income stream is where we look to hedge the investment.

We also invest in the American ETFs. That gives us exposure to the biggest, strongest-performing equities sector in the world! In addition, we invest in the European market, where opportunities abound. It’s all about protecting cash flow. That ensures the best possible outcome for our investors.

Neville Joanes is the Chief Investment Officer of WealthBar, a robo-adviser. WealthBar provides unlimited financial planning with lower-fee ETF portfolios and actively managed Private Investment Portfolios. Through their financial advisers, easy-to-use online dashboard and financial tools, they make investing more accessible to all Canadians. This blog originally ran on the WealthBar website on Oct. 23, 2018.

Neville Joanes is the Chief Investment Officer of WealthBar, a robo-adviser. WealthBar provides unlimited financial planning with lower-fee ETF portfolios and actively managed Private Investment Portfolios. Through their financial advisers, easy-to-use online dashboard and financial tools, they make investing more accessible to all Canadians. This blog originally ran on the WealthBar website on Oct. 23, 2018.

How currency can impact Canadians’ investments