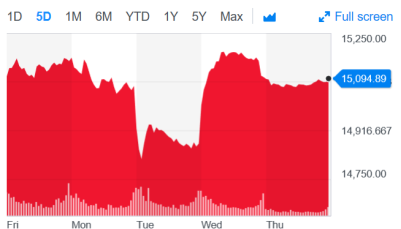

And here’s the performance of the Canadian Markets (TSX Composite), 2018 year to date:

While that might look like a wild ride it’s all more of a kiddie coaster compared to the real thing such as the Leviathan at Canada’s Wonderland in Vaughn, Ontario. That coaster makes the 12 Scariest Rides according to tripsavvy.com.

Canadian markets are down by about 5% for the year. Once again: Kiddie Coaster. Serious stock market roller coaster rides will take you down by about 30%, 40%, even 50% or more. Yup, in a major correction you might have to watch your monies get cut in half if you’re in an all-stock portfolio. That 50% haircut has happened twice in the last 20 years. Many of us have been ‘lucky enough’ to invest through the two biggest market corrections since the Depression of the 1920s/1930s.

Those real roller coaster rides taught us some valuable lessons. Some investors did lose a lot of money through those corrections. Why? Because they invested outside of their risk tolerance level. They took on too much risk. They were not emotionally prepared to watch their investment portfolio drop by 40%, 50% or more. They perhaps needed some of those shock absorbers known as bonds.

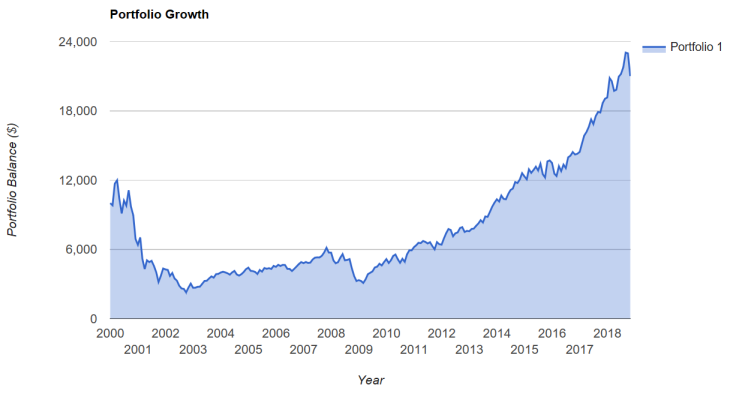

Those of us who were heavily invested in the tech-heavy indices such as the Nasdaq 100 (QQQ) or science and technology funds had to watch those investments drop by some 80%. Imagine watching every $100,000 fall to $20,000. Of course, many would jump off that roller coaster before hitting the bottom. Here’s a roller coaster ride that would make the list of Scariest Investment Rides. This is the QQQ ticker Nasdaq, chart courtesy of portfoliovisualizer.com. Full disclosure: I was ‘on’ that ride, and I don’t want to talk about it. Once again the stock market can teach us some expensive lessons.

We can see that investors who did hang on were eventually rewarded with positive returns, even more than a doubling of their initial investment. In fact, if an investor had been consistent and had kept investing on a regular schedule through those ups and downs they could have seen returns approaching 9% annual.

Buy. Hold. Add.

We might say that the risk assessment is deciding what roller coaster ride you can handle.

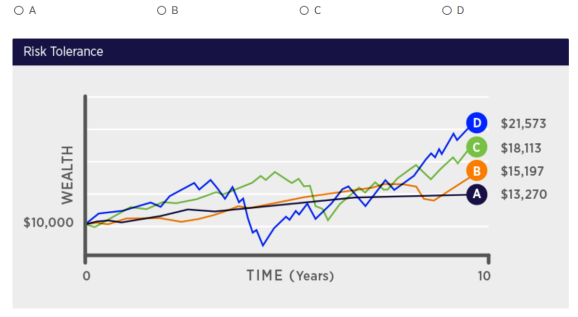

This is the most important decision with respect to investing. We must invest within our risk tolerance level. The Canadian Robo Advisors will not show you roller coasters to gauge your tolerance for risk (but maybe that’s not a bad idea). But they will gauge how you might feel in certain investment rides. As part of the Investor Profile here’s a chart offered from Justwealth. It’s a framing of the risk and return proposition. What ride do you want to get on? Are you willing to take on more risk for the potential of greater returns?

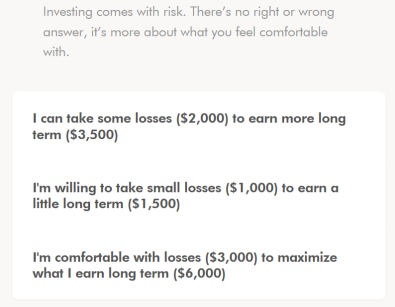

Wealthsimple will gauge your risk tolerance with this offering. Once again, it’s a clear framing of the risk and return proposition. And of course with the Robo Advisors you have access to advisors and customer support help. The Robo’s are all very human. That human and digital advice can be more than important when it comes to getting you in the risk-appropriate investment.

For more on the Canadian Robo Advisors you can have a read of the very comprehensive reviews from Rob Carrick at the Globe and Mail. Rob looks at 14 digital advice providers that would fit that Robo Advisor handle. You can download the Excel report and compare by features. It’s a wonderful robo tool.

For more on the Canadian Robo Advisors you can have a read of the very comprehensive reviews from Rob Carrick at the Globe and Mail. Rob looks at 14 digital advice providers that would fit that Robo Advisor handle. You can download the Excel report and compare by features. It’s a wonderful robo tool.

For more on stock market volatility and risks, have a read of boomerandecho’s Stock Market Volatility Edition. Also from Robb Engen, a very interesting read on renting vs buying. Is Renting Throwing Away Money?

And recently here on The Hub, Investing 101: How Currency Hedging Affects Your Investment Return. And that leads to a very important aspect for Canadians: we do need to diversify and to hold US and International Assets. While the Canadian market has been a weak performer over the last decade, the US markets have been on a tear. If we throw in the strength of the US dollar, Canadian investors would have seen an additional boost.

I also enjoyed this piece on The Retirement Manifesto On Being A Writer. I had offered to Fritz that learning and knowing what to leave out is perhaps the most important trait or tool for a writer. I learned that in my previous life as an ad writer, where we had to create 30-second movies known as television commercials.

And on the retirement front I would suggest that Frederick Vettese’s Retirement Income For Life: Getting More Without Saving More is a must-read. I am making my way through that book and it is a ‘simply wonderful’ read. There are many inspiring surprises that can help make us feel more optimistic about our retirement prospects. Mr. Vettese blows up many of the retirement rules of thumb such as the 4% rule for retirement funding.

The research that Mr. Vettese will reference certainly aligns with my experience as an advisor with Tangerine. My greatest surprise in the land of money and personal financial planning has been that so many Canadians with very modest savings and investments enjoy a very happy and fruitful retirement. The keys are no debt and sensible spending plans. Retirement Income For Life will show you that we typically spend much less than we would expect or guess; hence we don’t need as much as is often suggested. I will certainly be back with a full review of this book. In fact there are several blog posts that will be inspired by the many surprises held within those pages.

Thanks for reading. Happy Thanksgiving to my American friends and family and readers on Cut The Crap Investing and on Seeking Alpha . You can share these Friday and weekend reading ideas with those handy share buttons. You can follow this blog, found at the very bottom of this page. You can connect on twitter @67Dodge