Special to the Financial Independence Hub

Student loan debt in the United States is a rapidly developing issue for consumers. More than 44 million Americans owe around US$1.5 trillion in student loan debt; that figure means student loan debt only trails credit card debt when it comes to the highest forms of outstanding debt.

However, student loan debt is one form of debt that is virtually impossible to discharge in bankruptcy whereas debts from things like credit cards or automobiles can be discharged much more easily.

To look at bankruptcy figures in regards to student debt, we used exclusive anonymized data provided by Upsolve, a non-profit that assists low-income individuals file for Chapter 7 bankruptcy free of charge. This data was then analyzed to discover what percentage of bankruptcy filers carry student loan debt and what percent of their total debt is comprised of student loan debt.

How many Bankruptcy filers also carry Student Loan debt?

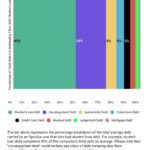

According to the anonymized bankruptcy data provided by Upsolve and analyzed by LendEDU, 32% of all bankruptcy filers also carried some amount of student loan debt.

Further, for these filers with student loan debt, the vast majority of their liabilities totaled is solely from those student loans. On average, student loan debt takes up 49% of this group’s debt. Even including all consumers, those with and without student debt, student loan debt still takes up 21% of all Upsolve user debt.

Filing for Chapter 7 bankruptcy will liquidate a consumer’s total assets and utilize the subsequent funds to pay off as much outstanding debt as possible. According to the data, essentially one-third of consumers who do declare bankruptcy also have student loan debt, and Chapter 7 will not allow for the offloading of this student debt.

Additionally, due to student debt being almost 50% of all debts incurred by that individual, the person can successfully declare Chapter 7 bankruptcy and still have close to 50% of their debts remaining.

Rather than a restart on one’s financial life, which is the point of bankruptcy, only half of their debt discharges and they are still left having to pay off the other half. Since the data shows that student loan debt is such a huge component of the financial situation for nearly one-third of bankruptcy filers, there appears to be a nonsensical policy in place at the moment in regards to student loan debt being impossible to discharge in bankruptcy.

Where we stand with Student Loan Debt & Bankruptcy

Currently within the U.S., whether it be private or federal student loans, student loan debt cannot be discharged in bankruptcy unless the borrower can prove “undue hardship” in the court of law.

Proving undue hardship for student loans is notoriously challenging, and the current standard in which to prove “undue hardship” is to pass the “Brunner test.” This test requires the student loan borrowers to exhibit that they cannot meet a minimal standard of living (e.g., homelessness) if forced to continue to repay their student loans.

A “certainty of hopelessness” must also be proven, in which case the circumstances that constitute “undue hardship” will persist if the consumer is forced to pay off the outstanding student loan debts. Further, the borrower must prove that a good-faith effort has been put forth to repay his or her student loans and all other options have been exhausted to repay their loans.

Recently, Senator Dick Durbin (D-IL) introduced the Student Borrower’s Bankruptcy Relief Act of 2019, which is co-sponsored by presidential hopefuls Elizabeth Warren, Bernie Sanders, and Kamala Harris. This bill would eliminate the section of the bankruptcy code that makes both private and federal student loans non-dischargeable unless undue hardship is proven.

Senator Durbin argues this is an issue that is prevalent on both sides of the aisle, and that despite the hundreds of thousands of cases of bankruptcy, his team was only able to find four instances of student loan debt being discharged in bankruptcy.

Democrats would let student debt be discharged in Chapter 7 bankruptcy

If passed, this act would categorize student loan debt as the same as almost all other forms of consumer debt, such as credit card and mortgage debt, allowing it to be discharged in Chapter 7 bankruptcy cases.

Using the data that was analyzed, this act would be of great help to those with student loan debt who are facing the route of bankruptcy or considering it as a viable. These individuals would no longer have to worry about still having to pay off 50% of their debt in the form of student loans after their other debts have been discharged in bankruptcy; instead, student loan debt would also be discharged alongside the other types of debt, making the road to financial freedom a bit less arduous.

In his role at LendEDU, Mike Brown uses data, usually from surveys and publicly-available resources, to identify emerging personal finance trends and tell unique stories. Mike’s work, featured in major outlets like The Wall Street Journal and The Washington Post, provides consumers with a personal finance measuring stick and can help them make informed finance decisions.

In his role at LendEDU, Mike Brown uses data, usually from surveys and publicly-available resources, to identify emerging personal finance trends and tell unique stories. Mike’s work, featured in major outlets like The Wall Street Journal and The Washington Post, provides consumers with a personal finance measuring stick and can help them make informed finance decisions.