Special to the Financial Independence Hub

At the time of this writing, the latest numbers from the Johns Hopkins University of Medicine attribute more than 2.5 million cases and 171,810 deaths worldwide to the Coronavirus pandemic.

In the United States, those figures are 788,920 and 42,946, respectively. In Canada, they are 36,831 and 1,690.

The devastating loss of life due to the COVID-19 virus will continue to get worse in the coming weeks and months. Another consequence of this global pandemic that is also continuing to worsen is the financial damage faced by so many everyday consumers.

As markets plunge at an unprecedented pace and social distancing measures close down countless businesses that have been forced to lay workers off, nearly every person’s personal finance situation is taking on water and managing those finances can be tough.

LendEDU, a personal finance company, tracked how the Coronavirus pandemic is impacting the financial lives of everyday people. The company conducted two surveys, each of 1,000 adult respondents, over the course of two weeks, and the survey-to-survey results painted an increasingly gloomy financial picture for most consumers.

In two weeks, Unemployment due to Coronavirus doubles

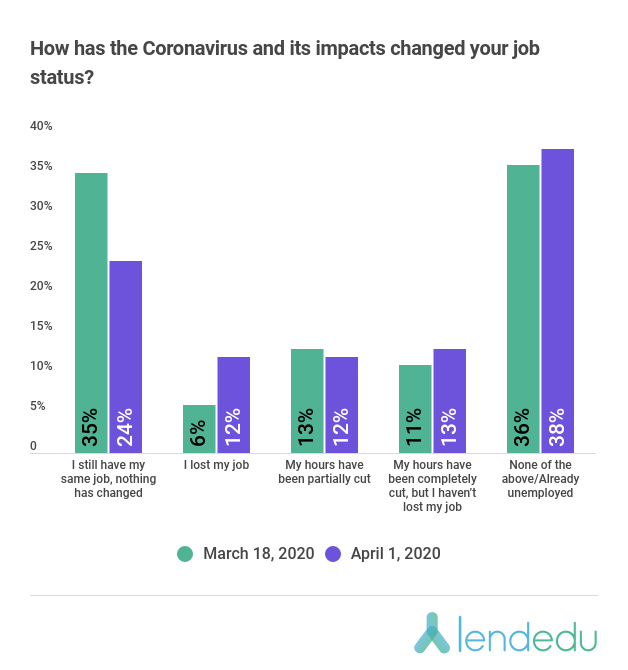

LendEDU’s first Coronavirus survey was conducted on March 18, and it found that 6% of poll participants had lost their jobs due to the Coronavirus, while 35% had seen no changes to their jobs, 13% had their hours partially cut, and 11% had been furloughed.

Two weeks later, LendEDU’s second Coronavirus survey that was conducted on April 1 revealed much different results to the same question. (See graph at the top of this blog). The percentage of people that had been laid off due to the Coronavirus pandemic doubled from survey-to-survey from 6% to 12%.

Additionally, only 24% of respondents had seen no changes to their jobs, 12% had their hours cut, and 13% had been furloughed.

Expenses nearly double & more people dipping into Emergency Funds

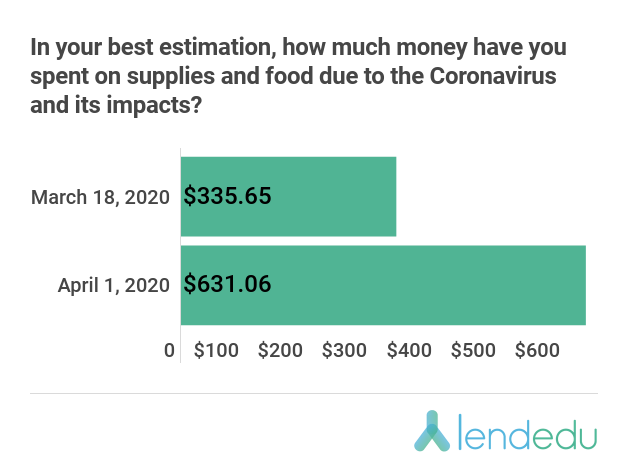

LendEDU’s first survey found that the average poll participant had spent $335.65 on food and supplies in preparation for the COVID-19 pandemic. Two weeks later, that expense figure increased by 88% to $631.06.

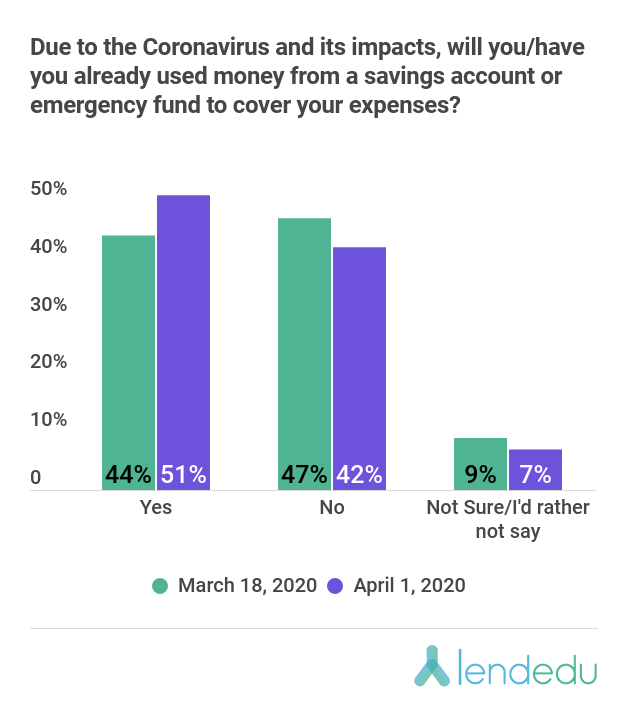

As Coronavirus-related expenses mount, more consumers are being forced to utilize a savings account or emergency fund to cover costs.

For example, 44% of respondents on March 18 indicated that they had reached into a savings account or emergency fund to cover their expenses. On April 1, 51% of poll participants taken the same action.

LendEDU’s second survey also found that 63% of consumers are concerned about running out of money in their accounts if things continue on the way that they are going.

Fears over Retirement Savings also grow

As mentioned above, financial markets are doing terribly during this global pandemic. At this point, a recession appears to be a certainty.

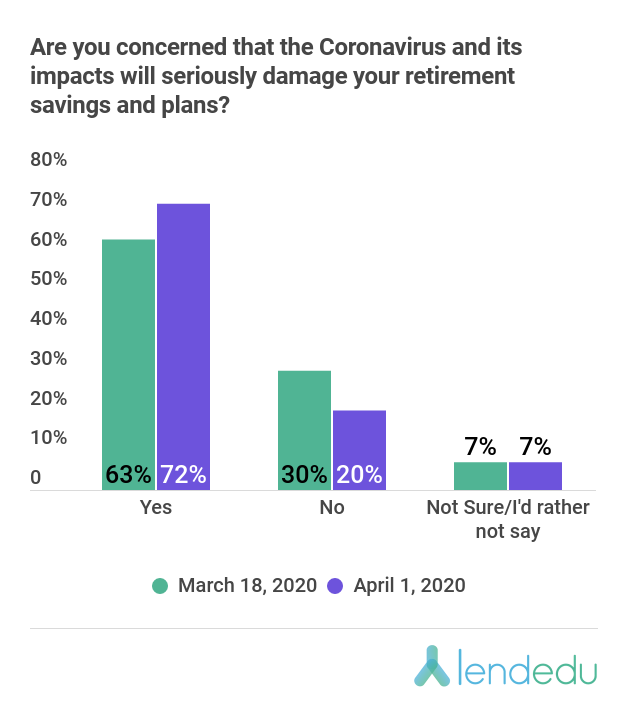

From survey-to-survey, LendEDU saw a notable increase in the percentage of respondents that are worried about their retirement nest eggs going forward.

On March 18, 63% of respondents indicated that they are concerned about their retirement savings due to the Coronavirus and its impacts. On April 1, there was an increase of nine percentage points to the same question as 72% of poll participants were worried about their retirement savings.

Not surprisingly, 71% of respondents ages 55 and up were worried about their retirement nest eggs from the second survey, which was an increase from 67% two weeks prior for the same cohort.

As the Coronavirus pandemic continues to consume all aspects of life, these financial numbers are only likely to get worse for consumers. However, it is always important to remember that we will bounce back from this and so too will our finances.

In his role at LendEDU, Mike Brown uses data, usually from surveys and publicly-available resources, to identify emerging personal finance trends and tell unique stories. Mike’s work, featured in major outlets like The Wall Street Journal and The Washington Post, provides consumers with a personal finance measuring stick and can help them make informed finance decisions. This blog ran on April 6, 2020 and is republished here with permission.

In his role at LendEDU, Mike Brown uses data, usually from surveys and publicly-available resources, to identify emerging personal finance trends and tell unique stories. Mike’s work, featured in major outlets like The Wall Street Journal and The Washington Post, provides consumers with a personal finance measuring stick and can help them make informed finance decisions. This blog ran on April 6, 2020 and is republished here with permission.