By Alizay Fatema, Associate Portfolio Manager, BMO ETFs

(Sponsor Blog)

As we begin the new year, it’s only fitting to cast a retrospective gaze in 2023 and unravel the pivotal moments that altered the landscape of the global markets. 2023 was a year where several themes dominated the global economy while it was still recovering from the aftershocks of the COVID-19 pandemic.

Looking in the rear-view mirror, some of the key contributors to financial markets volatility were the banking crisis, inflation concerns and central banks monetary tightening policies, rise of the artificial intelligence and geo-political risks stemming from the ongoing wars.

Unveiling the Banking Turmoil

Unlike the subprime mortgage crisis of 2008 that was triggered by risky mortgage lending practices, the banking upheaval of March 2023 started owing to deficiencies in risk management and lack of proper supervision which ultimately caused multiple small-medium sized regional banks to fail in the U.S.

During the month of March 2023, Silvergate Bank, Silicon Valley Bank and Signature Bank faced bank runs over fears of their solvency and collapsed [1][2]. As a result, share prices of other banks such as First Republic Bank (FRB), Western Alliance Bancorporation and PacWest Bancorp plunged. FRB was later closed, and its deposits and assets were sold to JP Morgan Chase. Internationally, the jitters of the US banking crisis spilled over into Switzerland, where Credit Suisse collapsed owing to multiple scandals, and was acquired by its competitor, the UBS Group AG, in a buy-out on March 19, 2023 [3].

The Federal Reserve (Fed), Bank of Canada (BoC), European Central Bank, and several other central banks announced significant liquidity measures to calm market turmoil and mitigate the impact of the stress [4].

The Interest Rate Hiking Odyssey

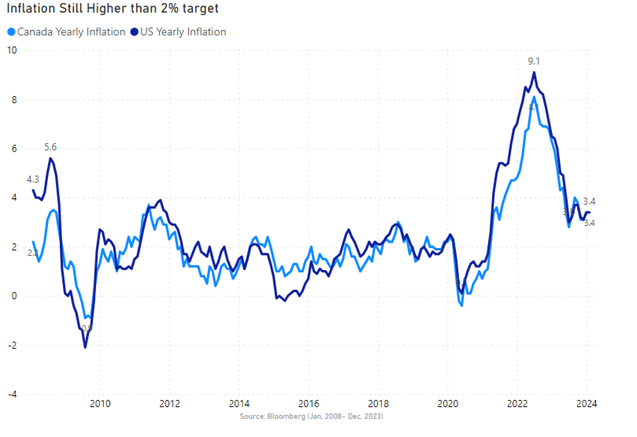

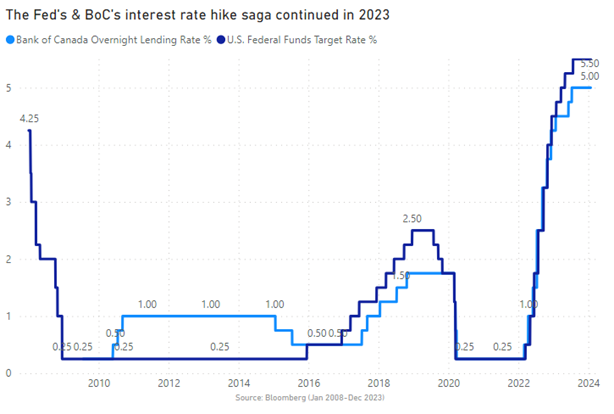

Deeming inflation as transitory during 2021, central banks finally embraced inflation as a persistent problem and engaged in interest rate hiking saga starting from March 2022 which continued into 2023. These aggressive rate hikes had a significant impact on the financial markets as they made borrowing more expensive and led to record high bond yields. The chart below shows that the Fed conducted multiple hikes to bring the rates to 5.5%, highest level in more than 22 years [5]. BoC also increased its policy rate to 5% in a similar fashion.

Any “good news was bad news” in 2023 as robust labour market and resilient economic growth meant that central banks would have to keep interest rates higher for longer to the detriment of equities. Given the effect of monetary policy changes are subject to a lag, we would have to wait and see the full impact on the economy in the coming months.

The Rise of Generative Artificial Intelligence (AI) reshaping the future

2023 left an indelible imprint on the trajectory of technological evolution due to the rise of artificial intelligence and its profound effects that reverberated across numerous industries. We witnessed a pivotal juncture in the progression of generative AI in 2023 ever since Open AI released ChatGPT on November 30, 2022 [6], and within a few months it became one of the fastest growing applications in history and created a massive frenzy in the tech world. Despite concerns about the repercussion of higher interest rates in 2023, investors’ enthusiasm for AI took centre stage and the Nasdaq 100 index achieved the best year in over a decade owing to a stellar performance of the leading tech companies.

The Ascendance of Money Market ETFs in an Uncertain Financial Landscape

Assets in money-markets, high-interest savings accounts (HISAs) and other cash-like investments reached an all-time high during 2023 after the most aggressive monetary tightening cycle that was started by the Fed & BoC in 2022. There is nearly $6 trillion parked in these funds and cash deposits in the U.S. [7], and over $25 billion in cash and HISA ETFs in Canada.

Yielding over 5%, these money market funds attracted retail investors, serving as a great avenue to park cash with guaranteed liquidity, minimum risk, low volatility, and flexibility. However, the recent shift in the Fed & BoC stance is signaling the end of the tightening campaign and projecting rate cuts in 2024. The latest ruling by office of the Superintendent of Financial Institutions (OSFI) to uphold 100% liquidity requirements on HISA ETFs may impact the dynamic of these money market/HISA funds during this year.

Geopolitical Risks amidst two Ongoing Conflicts

2023 went down in history as being a year marked by two big wars: an ongoing conflict in Ukraine that started in 2022 as it fights off a Russian invasion and the outbreak of violence in the Middle East in October 2023 between Israel and Hamas [8].

Fear of potential escalation in the Middle East conflict and prospects of the war spilling over in the wider region added to uneasiness in the markets as the region is a crucial supplier of energy and a key shipping passageway. The market reacted to the news of the conflict by shifting towards safe-haven assets as this unforeseen geopolitical event increased uncertainties [9].

Dodging Recession, Double Digit Equity Returns and a Comeback in Fixed Income

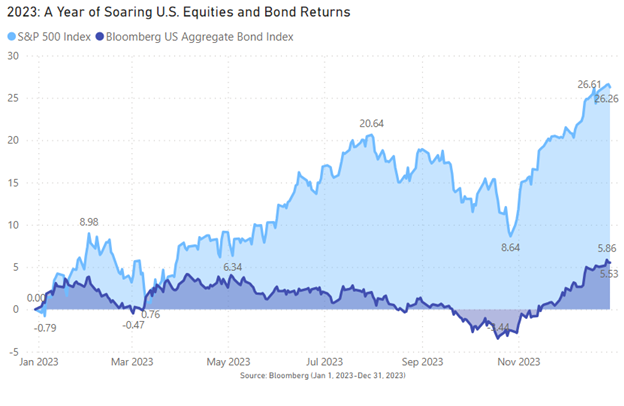

During 2023, many investors feared that higher-for-longer interest rates would trigger a recession in the U.S and would take a toll on corporate profits and bond returns. As the Fed embarked upon the most aggressive rate hiking cycle, the yield curve inverted, sending a classic warning signal of a looming recession.

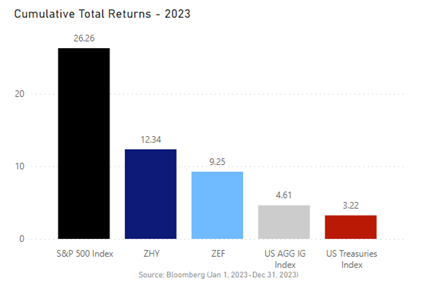

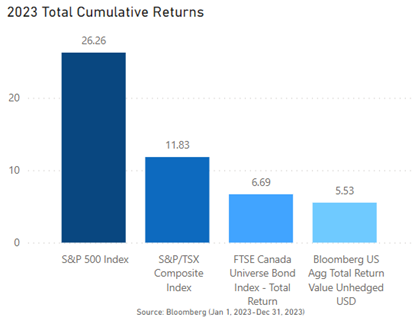

Moreover, the U.S. Institute for Supply Management’s (ISM) manufacturing index dropped below 50 in November 2023, indicating a contraction in manufacturing activity. Despite having the highest prediction of a recession with heightened volatility in the markets throughout 2023, the US economy avoided recession and equities posted double digit returns. Moreover, fixed income rebounded in 2023 and reported positive returns after persistently declining for two years, thanks to the bond rally in the last two months of 2023 as markets priced in rate cuts for early 2024.

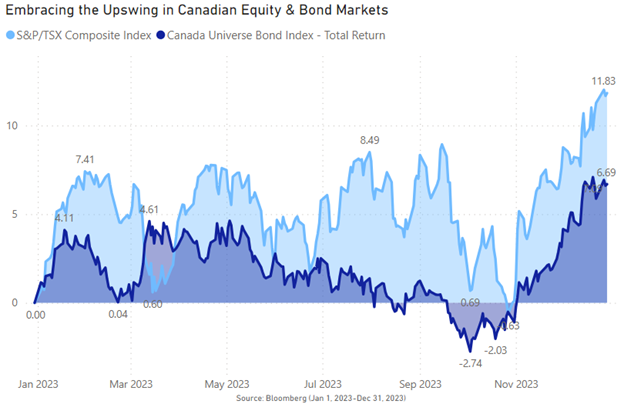

The Canadian economy also dodged recession, largely attributed to substantial immigration which bolstered overall spending and economic growth. However, the GDP per capita declined, indicating that spending hasn’t matched the influx of newcomers primarily due to the increasing costs of home ownership and rent further exacerbating the housing crisis.

“Index returns do not reflect transactions costs, or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.”

“Index returns do not reflect transactions costs, or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.”

Could 2024 be the Year of Fixed Income?

After having a humbling experience in 2023, the market consensus has now shifted for 2024 with the majority of fund managers in the U.S. expecting a soft landing for the economy [10], which might fuel rate cuts now that the sky-high inflation is subsiding and heading down towards the Fed’s & BoC’s target.

The chance of higher policy rates going forward is slimmer and the potential for rate cuts in 2024 is much stronger if inflation cools off further, the labour market weakens, consumer demand diminishes, and economic growth slows down. Both central banks indicated that future policy decisions will be data dependent and any rate cuts in 2024 will be contingent on inflation cooling off meaningfully, i.e., in line with their 2% target.

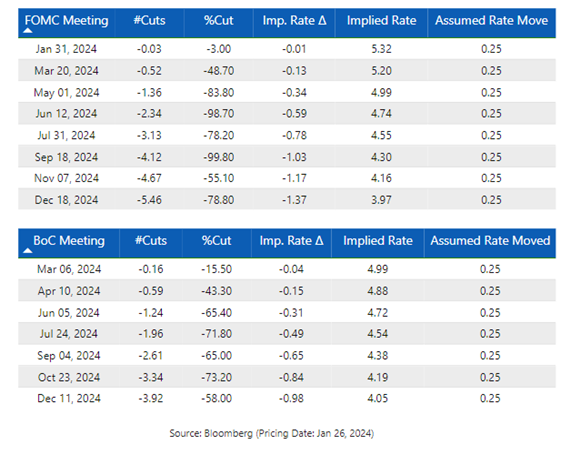

The market is currently anticipating rates to remain elevated till Q2 of 2024 as the labour market still seems robust and the December Consumer Price Index (CPI) print pushed the expectation of rate cuts even further.

There are high probabilities priced in for the first rate cut in the U.S. and Canada on May 1, 2024, and June 5, 2024, policy meetings respectively. However, if the current inflation trajectory doesn’t materialize owing to sticky prices and stronger than expected growth, the expectation for rate cuts could be undermined. Geopolitical risks may also change the course of rate cuts given the two ongoing global conflicts and national elections in over 70 countries, including the US, the UK, and India [11].

High Yield Credit shines bright as 2023’s Unambiguous Winner

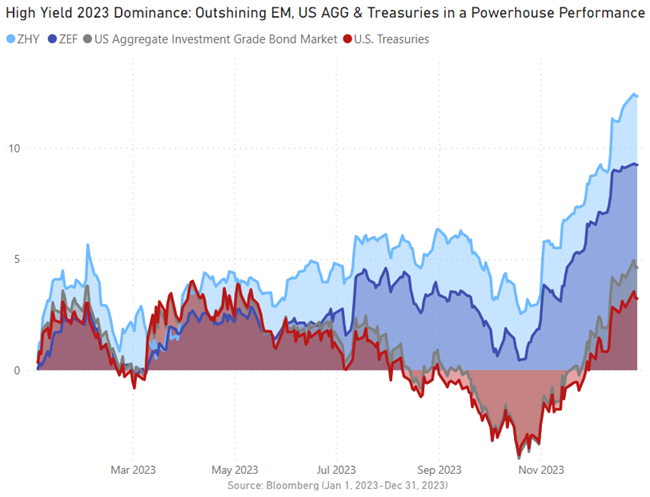

U.S High-Yield (HY) credit was the best performing fixed-income class in 2023. It has exhibited lower volatility than equities historically [12], so adding high-yield credit to a portfolio during expectations of a soft landing in 2024 can be a strategic move. In a soft-landing scenario, where inflation cools off and economic growth moderates without causing a recession, high-yield bonds might show resilience.

In a falling interest rate environment, high-yield credit performs relatively well as the cost of borrowing for HY issuers tend to decline which benefits their financial position. Their performance can also benefit from stable economic conditions and relatively low default rates. Although leverage and interest coverage had begun to weaken during the last two quarters of 2023 as rates were over 5%, high-yield corporate balance sheets remain well-positioned and will benefit more after the rate cuts. High-yield average credit quality has been near all-time highs, and they have been addressing their near-term bond maturities quite efficiently, thereby reducing the chance of a rise in corporate defaults [13].

Adding a high-yield ETF in your portfolio such as BMO High Yield US Corporate Bond Index ETF (ZJK) or its hedged version, BMO High Yield US Corporate Bond Hedged to CAD Index ETF (ZHY), in a falling interest rate environment can provide higher relative yield as compared to other fixed instruments and potential for capital appreciation as bond prices rise. However, it’s important to consider the credit and default risks associated with high yield which may become more pronounced in case of a worst than expected economic downturn.

Unlocking the Potential of Emerging Markets

Emerging markets (EM) sovereign debt can be an attractive asset class within fixed income in 2024 as their spreads are being supported by resilient global economic conditions. If inflation continues to decline on track with accommodative monetary policies in the emerging markets along with a weakening U.S. dollar, EM sovereign debt can experience positive performance as bond prices may go up.

Although EM US dollar denominated sovereign debt (hard currency bonds) took a hit in performance predominantly due to the rate hikes in 2022, the tables turned in 2023 and this asset class outperformed both U.S. treasuries and investment grade credit. However, it underperformed the U.S. high-yield corporate bonds.

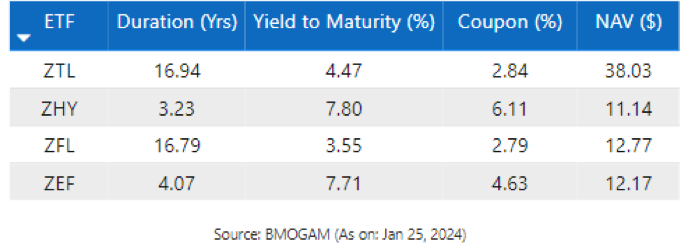

Adopting a shorter duration[1] approach to investing in emerging markets bonds using BMO Emerging Markets Bond Hedged to CAD Index ETF (ZEF) would enable investors to unlock the opportunity of getting exposure to a diversified portfolio of EM countries (up to three bonds per emerging market country), reduce both interest rate and duration risk, while still benefiting from an attractive yield.

With a mixed bag of fiscal & monetary policy stances in the EM countries, adding roughly 4 years duration through ZEF is a good place to be given some emerging market countries such as Brazil and Kazakhstan are cutting rates while China & Poland are holding rates after a few cuts. Mexico, Indonesia, and Pakistan have decided to hold their rates for now after an aggressive hiking cycle. On the other hand, Turkey is still hiking the interest rates to tame its red-hot inflation.

Moreover, on top of the two global conflicts which can stir up geopolitical risks, 2024 is also going to be a year of elections. Many emerging markets countries such Brazil, Mexico, Pakistan, Turkey, Romania, Poland, Indonesia etc. have upcoming elections. Elections can lead to uncertainties and political instability in case of contested outcomes. While political uncertainty can be unsettling for investors, in case of EM sovereign debt, politics may only cause minimal disruption to global growth and inflation trends.

Enhancing Portfolios with Duration in a Falling Interest Rate Environment

Bond prices have an inverse relationship with interest rates. In other words, if interest rates rise, bond prices fall and vice versa. Given interest rates are expected to fall, bond prices will go up, so it makes sense to extend the duration of a fixed income portfolio to capture the potential gains from price appreciation. Duration measures the sensitivity of a bond’s price to changes in interest rates. The duration of a bond is the maturity-weighted average of all the cash flows and is expressed in terms of years.

Federal Bonds and Treasuries are now perceived as safe havens or diversification instruments in times of equity sell-offs. If the economy slows down, extending duration by holding long-duration government bond ETFs like BMO Long Federal Bond Index ETF (ZFL) or BMO Long-Term US Treasury Bond Index ETF (ZTL) can serve as a hedge against equity market volatility and contribute to stabilizing your overall investment portfolio.

Furthermore, government bonds tend to do well in a worse-than-expected recession scenario as opposed to a stronger economy which could reignite inflationary pressures, forcing the return of a hawkish Fed which could be a risk for both stocks and bonds (less likely scenario).

Alizay Fatema is an associate at BMO ETF team, where she is responsible for assisting in fixed income trading and portfolio management. She focuses primarily on fixed-income segments such as sovereign, provincial, corporate – high yield & investment grade bonds as well as emerging markets debt. Over the past few years, Alizay has acquired experience in various areas of treasury and capital markets such as fixed income trading, ALM, FX sales, product development and product control. Prior to joining BMO, she worked with CIBC. Alizay holds a master’s degree from the University of London, majoring in accounting and finance and is a CFA charterholder.

Alizay Fatema is an associate at BMO ETF team, where she is responsible for assisting in fixed income trading and portfolio management. She focuses primarily on fixed-income segments such as sovereign, provincial, corporate – high yield & investment grade bonds as well as emerging markets debt. Over the past few years, Alizay has acquired experience in various areas of treasury and capital markets such as fixed income trading, ALM, FX sales, product development and product control. Prior to joining BMO, she worked with CIBC. Alizay holds a master’s degree from the University of London, majoring in accounting and finance and is a CFA charterholder.

References:

- https://www.cnbc.com/2023/03/08/silvergate-shutting-down-operations-and-liquidating-bank.html

- https://www.nytimes.com/interactive/2023/business/bank-failures-svb-first-republic-signature.html

- https://www.bloomberg.com/news/features/2023-03-20/credit-suisse-ubs-takeover-how-a-166-year-old-bank-collapsed

- https://www.cnbc.com/2023/03/23/banks-ramp-up-use-of-new-fed-facility-created-in-crisis.html

- https://www.cnbc.com/2023/07/26/fed-meeting-july-2023-.html

- https://www.forbes.com/sites/bernardmarr/2023/05/19/a-short-history-of-chatgpt-how-we-got-to-where-we-are-today/?sh=114d21e8674f

- https://www.reuters.com/markets/us/6-trillion-cash-hoard-could-fuel-more-us-stock-gains-fed-pivots-2023-12-15/#:~:text=Total%20money%20market%20fund%20assets,will%20likely%20drop%20alongside%20them.

- https://www.cnbc.com/2023/12/28/with-all-eyes-on-gaza-and-ukraine-analysts-fear-these-conflicts-could-erupt.html

- https://www.reuters.com/world/middle-east/attack-israel-could-boost-appeal-gold-safe-haven-assets-2023-10-08/

- https://www.livemint.com/market/mark-to-market/chart-beat-global-fund-managers-are-increasingly-betting-on-soft-landing-11705473289098.html#:~:text=The%20latest%20survey%20by%20BofA,nine%2Dmonth%20peak%20in%20optimism.

- https://www.economist.com/interactive/the-world-ahead/2023/11/13/2024-is-the-biggest-election-year-in-history

- https://ddqinvest.com/are-high-yield-bonds-really-more-risky-than-equities/

- https://www.morganstanley.com/im/en-us/individual-investor/insights/articles/higher-for-longer-yes-but-not-much-higher.html

Disclaimer: This material is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance. The viewpoints expressed by the author represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only. Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent prospectus. "Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated. For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination. BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. ®/™Registered trademarks/trademark of Bank of Montreal, used under licence. [1] "A measure of the sensitivity of the price of a fixed income investment to a change in interest rates. Duration is expressed as number of years. The price of a bond with a longer duration would be expected to rise (fall) more than the price of a bond with lower duration when interest rates fall (rise)." [2] (YTM) "A measure of the sensitivity of the price of a fixed income investment to a change in interest rates. Duration is expressed as number of years. The price of a bond with a longer duration would be expected to rise (fall) more than the price of a bond with lower duration when interest rates fall (rise)."