By Ian Duncan MacDonald

Special to the Financial Independence Hub

An investor asked If he should invest in American Airlines, Delta Airlines and United Airlines. He had noticed that the share prices of these industry leaders had reached new lows.

Is investing in airline stock currently a risky speculative play? Just how much of a gamble would it be?

A quick Google search discloses that Warren Buffett recently sold all his airline stocks (4 billion dollars worth); air travel has dropped to 5% of its pre-pandemic level; airline employees are being offered early retirement; airline executives have taken pay cuts; capital expenditure projects have been shelved and billions of dollars in emergency loans from the government have been taken out. The daily cash burn rate of the airlines is reported to be over US$100,000,000 a day

The US government’s passing of a 50 billion dollars in aid for the airline industry was contingent on the airlines not furloughing employees or cutting their pay. This seems to have ignored the reality that hundreds of thousands of the 750,000 employees in that industry are now redundant.

Historically commercial risk dictates that when there are too many suppliers to serve a market, the weakest supplier must disappear through merger or insolvency. The survivors then become stronger with the acquisition of the departed’s market share.

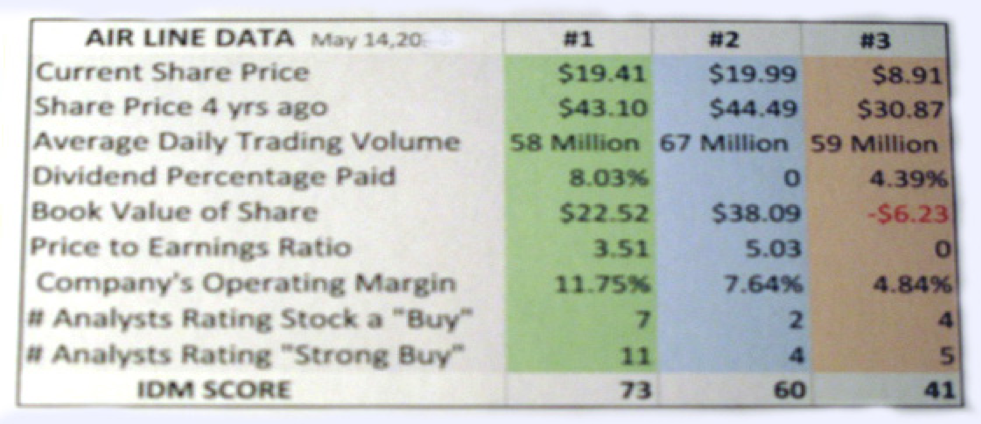

Which of the three airlines in the following chart seems weakest? Which seems to be in the best financial condition? Does it surprise you that analysts are still recommending buying all 3 of these stocks or does it indicate that these businesses are deteriorating faster than financial information can be provided to make accurate projections?

Try to identify each of the airlines in the chart

While the Information in the chart is for the 3 major airline stocks (AAL, DAL and UAL) I have deliberately not identified them by name. Who do you think is in the number one, two and three columns? By going to Yahoo finance and entering in these three stock symbols you can quickly find information that identifies which they are. You will also see, if you have never done it before, just how easy it is to gather facts to help you evaluate a potential stock purchase.

The IDM Stock Scoring software on the bottom line of the chart is a measuring/summary tool that was developed to grade stocks by their potential. A score cuts through pages of data available on every common stock. It helps investors quickly and easily determine if a stock is a desirable purchase or not. This score is compiled from the 9 factual items itemized in the chart. The “best” score seen, reported so far, was a Canadian bank with a score of 78. The “worst” or lowest score was an 8 for a company that soon became defunct. Purchasing stocks scoring less than 50 is thought to be too speculative.

Dividends are paid from the Operating Margin. Does it surprise you that the airline in the chart with the highest operating margin and highest dividend also has the highest score and the highest number of analysts recommending it as a buy?

A reliable score enables investors to add stocks to their portfolios without the need to rely on the questionable advice of investment advisors. Periodic rescoring of stocks in a portfolio allows investors to react to positive and negative changes easily and quickly. Scoring puts a stop to making stock purchases blindly based on questionable rumours or recommendations.

Being aware that stocks can be easily and accurately graded makes many investors reluctant to invest in mutual funds and Exchange Traded Funds. They quickly realize they have no certainty as to what these bundled investments are putting their money into.

A fund manager can change the investments in the fund without their approval. The sales costs and management costs of mutual funds also makes them expensive with no guarantee that they will perform as well as 20 carefully selected, scored stocks you could add to your portfolio. A self-directed investor incurs a one-time fee of less than $10 to buy $50,000 worth of a stock versus paying more than $ 1,000 each year he owns a $50,000 mutual fund.

Speculators might pick an airline with a score of 70

Speculators would probably gravitate towards investing in the airline with the score of 70 in the chart. They would think it had the best chance of survival and with the current “low” price of the stock, they would look forward to doubling their money in the future. The need for air travel is not going to disappear. Most likely one of these major airline companies will survive and prosper.

A value investor would probably conclude, not from these scores — which they might see as being based on “old” information — but from all the negative information on airlines currently available, that no investment in the travel industry can be justified at this time. They would seek to invest stocks in “safe” industries like pharmaceuticals and internet entertainment with good scores who have not been negatively impacted by the pandemic.

Which are you, a speculator, or a value investor? As you can see, investing is never black and white. You do not have to be a mathematical genius or a chartered accountant to score stocks and be a self-directed investor. Purchasing common stocks has become straight forward, easy, and inexpensive. Thousands of dollars in advisor commissions and fees can be saved each year by investors who buy and sell their own stocks. Four free Power Point lessons are available at informus.ca for those seeking more information on scoring and self-directed investing.

Next time we’ll look at two major Canadian airlines: Air Canada and WestJet.

After graduating from McMaster University, with $100 left in his pocket (but no student debt), Ian Duncan MacDonald hitch hiked home to Sudbury to work four months as a labourer in International Nickel’s smelter. In four months, he had saved enough to seek his fortune in the big city.

After graduating from McMaster University, with $100 left in his pocket (but no student debt), Ian Duncan MacDonald hitch hiked home to Sudbury to work four months as a labourer in International Nickel’s smelter. In four months, he had saved enough to seek his fortune in the big city.

In Toronto, he was immediately hired by Dun & Bradstreet as a credit reporter. While he had expected to be a reporter for the rest of his life, D&B had other plans. Within four years, he was General Manager of their Marketing Services Division. Three years later, at the age of 28, he was responsible for the sales, marketing and advertising for all three divisions of the company.

At 32, he left D&B to build Screening Systems International Ltd, for a large conglomerate, which led to his interest in collections. Moving to Creditel of Canada Ltd. he became Senior Vice President. Subsequently bought by Equifax, he remained there until his retirement in 2005. In anticipation of his retirement he incorporated Informus

At 32, he left D&B to build Screening Systems International Ltd, for a large conglomerate, which led to his interest in collections. Moving to Creditel of Canada Ltd. he became Senior Vice President. Subsequently bought by Equifax, he remained there until his retirement in 2005. In anticipation of his retirement he incorporated Informus

Inc. to sell his art, his publications and consulting services (www.informus.ca.)

His book “Income and Wealth from Self-Directed Investing” provides a detailed system, plus stock scoring software, which arms someone who has never invested with the knowledge they need to successfully and safely generate income and wealth for the rest of their lives.