By Erin Allen, CIM®, BMO ETFs

(Sponsor Blog)

Introduction

The importance of asset allocation in investment management cannot be understated. Pioneering research by Brinson, Hood, and Beebower attributed over 90% of a portfolio’s performance variability to asset allocation decisions, making it the most important determinant in long-term investment outcomes1.

ETFs are remarkably effective market access tools, offering investors precision, liquidity, and cost efficiency to enhance portfolio construction.

This article explores asset allocation in depth, focusing on how Asset Allocation ETFs can serve as evidence-based approach for building resilient and diversified portfolios.

Theoretical Foundations of Asset Allocation: Modern Portfolio Theory (MPT)

Harry Markowitz’s (1952) Modern Portfolio Theory (MPT) laid the groundwork for efficient portfolio construction2, pointing out the benefits of diversification to manage risk levels. According to MPT, an optimal portfolio balances risk and return by combining assets with low or negative correlations, thereby reducing overall portfolio volatility2. This is the idea of diversification with which we are likely more than familiar, not putting all your eggs in one basket. While some investments go up, others will go down, thereby mitigating losses.

MPT allows investors to find an optimal asset mix that reflects both their return aspirations and their risk tolerance, minimizing the prospect of unexpected outcomes.

BMO’s suite of Asset Allocation ETFs, such as the BMO All Equity ETF (ZEQT), enables investors to achieve broad global diversification — a key principle of MPT — by providing exposure to multiple geographies and sectors within a single vehicle. Regular rebalancing helps to align your portfolio with your personal risk tolerance and types of assets needed to meet your financial goals.

Asset allocation decisions must align with an investor’s risk tolerance and time horizon. Younger investors with longer time horizons may favor equity-heavy allocations, while retirees may prioritize income and capital preservation through fixed-income or conservative balanced strategies.

The key here is that individual investor needs are unique, and ETFs provide the tools for investors to create the optimal portfolio for their needs or, in the case of asset allocation ETFs, to choose from a pre-set mix ranging from conservative all the way to 100% equity.

A Note on Diversification

Diversification determines the level of volatility in your portfolio. A paper by S&P Dow Jones Indices research team titled Fooled by Conviction, showed that Between 1991 and May 2016, the average volatility of returns for the S&P 500 was 15%, while the average volatility of the index’s components was 28%.3 Looking at the variability between one stock and 500 is an extreme example, but it illustrates the important point that if the typical active manager owns 100 stocks now and alters to holding only 20, the volatility of his portfolio will likely increase.

Behavioral Finance and Asset Allocation

Behavioral biases, such as loss aversion, confirmation bias or overconfidence, often lead investors to deviate from their optimal asset allocation strategy.4 Common mistakes include choosing portfolios that may be too conservative to meet their financial needs, panic selling, following the latest meme trend, or failing to strategically rebalance their portfolio over time.

It’s not about timing the market; it’s about time in the market that pays off in the long run.

Rebalancing a portfolio is another potentially daunting task for investors. You have to remember to do it on a monthly or quarterly basis, but there’s also the emotional/psychological aspect which can often get in the way. Rebalancing is essentially selling your winners and adding to your loser. Not an easy thing to do, though we all know to buy low and sell high, as the old adage goes.

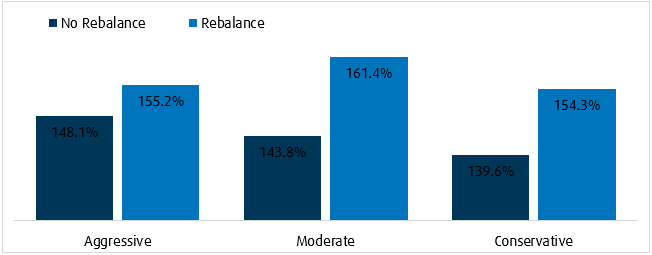

Allen Roth did a study around the benefit of rebalancing over time5. In a moderate or balanced portfolio, you can see that it added close to 20% to returns over a year period of almost 20 years. Although there is no guarantee rebalancing will add to your returns going forward, history has shown that it is effective, and it is an important risk control measure.

Investment Performance 12/31/99 – 12/31/17

Total Returns with/without Rebalance

Boosting Returns with Rebalancing, Allan Roth and etf.com, 2018 – For illustrative purposes only

An automated rebalancing facility, such as the one embedded in BMO’s Asset Allocation ETFs, can help mitigate the risks of a portfolio that becomes concentrated due to a failure to rebalance, ensuring portfolios remain aligned to their predetermined asset mix and risk levels.

A Passive Approach to Investing

Asset allocation ETFs take a strategic approach to portfolio construction, using passive index-based investing tools to build the underlying portfolio. Passive investing brings the benefits of being lower cost, efficient, diversified, and transparency to a portfolio. Here is a common misconception that is easily negated with SPIVA (Standard and Poors Index versus Active) research (SPIVA | S&P Dow Jones Indices). The evidence shows that active managers are highly cyclical but can add alpha or outperformance. In the majority of cases, however passive out-performs because it does not make predictions or assumptions. As is often said, the market, or its index, is a giant weighing machine that tracks capital movements over an economic cycle.

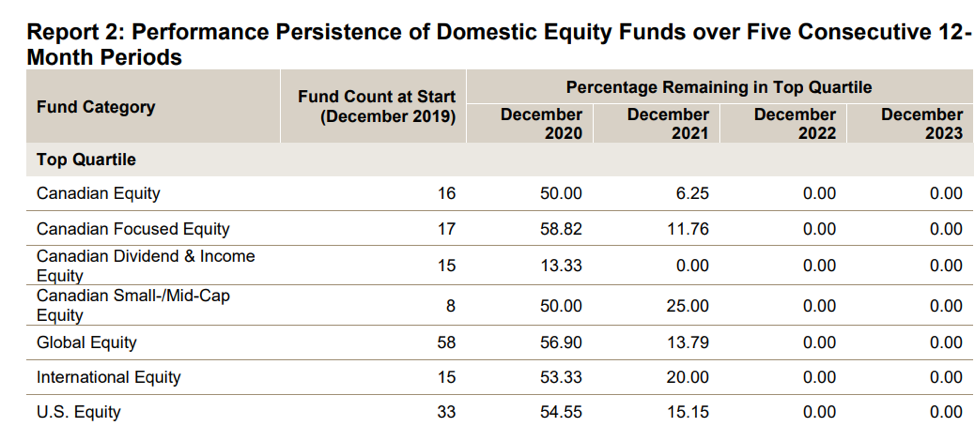

Adding to this, if we look at the Persistence Report Card6, outperforming active managers do not outperform for very long, making it exceedingly difficult to know when to rotate managers. It is as impossible to time manager changes as it is to time market trading.

| Percentage of funds that underperformed their benchmark (Dec 31 2024) | ||||||

| Fund Category | Comparison Index | 1 YR (%) | 3 YR (%) | 5 YR (%) | 10 YR (%) | |

| Canadian Equity | S&P/TSX Composite | 88.73 | 89.87 | 92.54 | 95.51 | |

| U.S. Equity | S&P 500 (CAD) | 85.00 | 96.69 | 94.56 | 95.56 | |

Source: S&PDJI SPIVA SPIVA | S&P Dow Jones Indices

Strategic Asset Allocation (SAA): A proven Portfolio Construction Method

Strategic Asset Allocation is a long-term approach that establishes target weightings for asset classes based on an investor’s goals and risk tolerance. These weightings are rebalanced quarterly to maintain alignment with the original strategy.

BMO’s Asset Allocation ETFs offer risk profiles from conservative, balanced and growth, to all-equity solutions. These funds provide a blend of global equities and fixed income to ensure diversification.

Advantages of Asset Allocation ETFs

- Cost Efficiency:

ETFs generally have lower expense ratios compared to mutual funds. BMO ETFs maintain this advantage, allowing investors to compound the fee savings into their returns.

- Transparency:

ETFs disclose holdings daily, enabling investors to monitor their exposures and to make informed decisions

- Liquidity and Flexibility:

ETFs offer intraday liquidity and the ability to implement strategies quickly.

- Diversification:

Asset Allocation ETFs are comprised of 6-8 underlying ETFs, meaning you have access to thousands of individual securities.

How to use Asset Allocation ETFs

Asset allocation ETFs can be used as a complete portfolio for those who want a simple approach to investing: a one-ticket solution that simplifies investing providing a neat and tidy nest egg to pass along to the next generation.

Another common approach is to use an Asset Allocation ETF as a core portfolio, a disciplined foundation. From there, investors can add satellite positions to explore areas of the market where they have a focussed conviction. They can add sector or thematic ETFs which they expect to add value to their portfolios, or even individual stocks.

Conclusion

Asset allocation is the bedrock of portfolio success, determining both the risk and return characteristics of investments. Investors interested in the principles of diversification, risk management, and systematic rebalancing, can access portfolios that align with their financial goals while simultaneously limiting the impacts of emotional biases. BMO’s Asset Allocation ETFs provide a robust suite of tools for implementing asset allocation strategies, offering low-cost, transparent, and diversified solutions for both novice and experienced investors.

Learn more here: Asset Allocation ETFs | BMO Global Asset Management

Erin Allen, CIM®, is Director of BMO Exchange Traded Funds. Erin has been a part of the BMO ETFs team driving growth since the beginning, joining BMO Global Asset Management in 2010 and working her way through a variety of roles gaining experience in both sales and product development. For the past 5+ years, Ms. Allen has been working closely with capital markets desks, index providers, and portfolio managers to bring new ETFs to market. More recently, she is committed to helping empower investors to feel confident in their investment choices through ETF education. Ms. Allen hosts the weekly ETF Market Insights broadcast, delivering ETF education to DIY investors in a clear and concise manner. She has an honors degree from Laurier University and a CIM designation.

Sources

- Brinson, G. P., Hood, L. R., & Beebower, G. L. (1986). Determinants of Portfolio Performance. Financial Analysts Journal, 42(4), 39-44.

- Markowitz, H. (1952). Portfolio Selection. The Journal of Finance

- Fooled by Conviction – https://www.spglobal.com/spdji/en/documents/research/research-fooled-by-conviction.pdf

- Biases in Behavioral Finance – https://www.worldscholarsreview.org/article/biases-in-behavioral-finance

- 5. https://www.etf.com/sections/index-investor-corner/boosting-returns-rebalancing

6 Canada Persistence Scorecard: Year-End 2023 – SPIVA | S&P Dow Jones Indices – https://www.spglobal.com/spdji/en/spiva/article/canada-persistence-scorecard/

References

BMO Global Asset Management. (2024). BMO ETF Solutions and Product Guide.

CFA Institute. (2023). Guide to Asset Allocation and Portfolio Diversification.

Definitions

Alpha: A measure of performance often considered the active return on an investment. It gauges the performance of an investment against a market index or benchmark which is considered to represent the market’s movement as a whole. The excess return of an investment relative to the return of a benchmark index is the investment’s alpha.

Liquidity: The degree to which an asset or security can be quickly bought or sold in the market without affecting the asset’s price. Cash is considered to be the most liquid asset, while things like fine art or rare books would be relatively illiquid.

Volatility: Measures how much the price of a security, derivative, or index fluctuates. The most commonly used measure of volatility when it comes to investment funds is standard deviation.

Disclaimer This article may contain links to other sites that BMO Global Asset Management does not own or operate. Also, links to sites that BMO Global Asset Management owns or operates may be featured on third party websites on which we advertise, or in instances that we have not endorsed. Links to other websites or references to products, services or publications other than those of BMO Global Asset Management on this [article, presentation, communication, material - revise as appropriate] do not imply the endorsement or approval of such websites, products, services or publication by BMO Global Asset Management. We do not manage, and we are not responsible for, the digital marketing and cookie practices of third parties. The linked websites have separate and independent privacy statements, notices and terms of use, which we recommend you read carefully. Any content from or links to a third-party website are not reviewed or endorsed by us. You use any external websites or third-party content at your own risk. Accordingly, we disclaim any responsibility for them. Past Performance is not indicative of future results. The viewpoints expressed by the author represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only. All investments involve risk. The value of an ETF can go down as well as up and you could lose money. The risk of an ETF is rated based on the volatility of the ETF’s returns using the standardized risk classification methodology mandated by the Canadian Securities Administrators. Historical volatility doesn’t tell you how volatile an ETF will be in the future. An ETF with a risk rating of “low” can still lose money. For more information about the risk rating and specific risks that can affect an ETF’s returns, see the BMO ETFs’ simplified prospectus. Risk Profile - Comprised of a client’s risk tolerance (i.e. client’s willingness to accept risk) and risk capacity (i.e. a client’s ability to endure potential financial loss). This article is for information purposes only. The information contained herein is not, and should not be construed as investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated and professional advice should be obtained with respect to any circumstance. BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or simplified prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated. For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s simplified prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination. BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. “BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

Excellent article, for many/post people a low cost asset allocation ETF should be the core part of their investment portfolio, IMO. Thanks for sharing this.