By Bob Lai, Tawcan

Special to Financial Independence Hub

As an engineer by education & training and an analytical person, it shouldn’t come as a surprise to readers that I ponder a lot. I like to think about something carefully before deciding or reaching a conclusion. Although this approach may not work in all situations, I enjoy being analytical on major life decisions.

The interesting idea is simple: Should we go all in on QQQ with our RRSPs?

Since this is an interesting idea, I thought I’d turn it into a blog post, analyze the idea thoroughly, and hopefully come to a conclusion.

Things to consider

A few things before we dive into the analysis.

An RRSP is a tax-deferred account. When you contribute to one, you get a tax deduction for 100% of your contributions. If you contribute $10,000 to your RRSP, it will reduce your net income by $10,000, and potentially bring you down to the lower tax bracket.

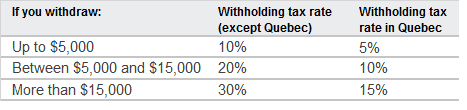

When you withdraw money from your RRSP, you will be subject to withholding tax. The amount of withholding tax is based on how much you take out.

You also must convert an RRSP to a retirement income option such as a RRIF by the end of the year that you turn 71. Although there are no mandatory withdrawal requirements in the year you set up your RRIF, you must start withdrawing money the year after setting up your RRIF (effectively at age 72). Furthermore, there’s a minimum withdrawal rate for RRIF. The withdrawal rate increases as you age.

Note: You can convert your RRSP before age 71. If you do, there’s a minimum withdrawal rate starting at age 55.

Just like the RRSP, money withdrawn from an RRIF is taxed like working income, or at 100% of your marginal tax rate.

In other words, it doesn’t matter whether the money is from capital gains or dividend income, money withdrawn from an RRSP and an RRIF is taxed at 100% of your marginal tax rate. You don’t get any preferential dividend tax treatment like in non-registered accounts.

When we do start living off our investments (aka live off dividends), our withdrawal strategy is very similar to Mark from My Own Advisor – NRT. This means drawing down some non-registered (N) assets along with registered assets (R), leaving TFSAs (T) for as long as possible.

- N – Non-registered accounts – we most likely will work part-time to keep ourselves engaged and live off dividends to some degree from our non-registered accounts. The preferential dividend tax credits will come in handy.

- R – Registered accounts (RRSPs) – we plan to make some early withdrawals from our RRSPs slowly. We may collapse our RRSPs entirely before age 71. We may also convert our RRSPs to RRIFs. This is not entirely decided (if we do convert to RRIFs, we want to make sure the dollar amount is relatively small). Early withdrawals will help us from having a large amount of money in our RRSPs and having a big tax hit when we start withdrawing. In other words, this will help smooth out our taxes.

- T – TFSAs – since any withdrawals from TFSAs are tax-free, we intend not to touch our TFSAs for as long as possible so they can compound over time.

Mark, along with Joe (former owner of Million Dollar Journey), ran an analysis for us many years ago via their Casflows and Portfolios Retirement Projections to reinforce this withdrawal plan.

Note: if you’re interested in this retirement projections service, mention TAWCAN10 to Mark and Joe to get a 10% discount.

Current RRSP Holdings

Although RRSPs are best for holding U.S. dividend stocks to avoid the 15% withholding tax, we hold U.S. and Canadian dividend stocks and ETFs inside our RRSPs.

At the time of writing, we hold the following stocks and ETFs inside our RRSPs:

- Apple (AAPL)

- AbbVie (ABBV)

- Amazon (AMZN)

- Brookfield Renewable Corp (BEPC.TO)

- BlackRock (BLK)

- Bank of Nova Scotia (BNS.TO)

- CIBC (CM.TO)

- Costco (COST)

- Emera (EMA.TO)

- Enbridge (ENB.TO)

- Alphabet Inc. (GOOGL)

- Hydro One (H.TO)

- Johnson & Johnson (JNJ)

- Coca-Cola (KO)

- McDonald’s (MCD)

- Pepsi Co (PEP)

- Procter & Gamble (PG)

- Qualcomm (QCOM)

- Invesco QQQ (QQQ)

- Royal Bank (RY.TO)

- Starbucks (SBUX)

- Telus (T.TO)

- Tesla (TSLA)

- TD (TD.TO)

- Target (TGT)

- TC Energy Corp (TRP.TO)

- Visa (V)

- Waste Management (WM)

- Walmart (WMT)

- iShares ex-Canada international ETF (XAW.TO)

In terms of dollar value, my RRSP makes up about 70% while Mrs. T’s RRSP (spousal RRSP) makes up about 30%. Ideally, it would be great if our RRSP breakdown were 50-50 (I’m ignoring my work’s RRSP so in reality the composition is more like a 25-75 split).

Because we started Mrs. T’s RRSP a few years later than mine it hasn’t had as much time to compound. Furthermore, I converted over $120,000 worth of CAD to USD in my RRSP when CAD was above parity. Over time, this gave my self-directed RRSP an automatic 30% performance boost.

We purchased QQQ earlier this year inside Mrs. T’s RRSP. Dollar-wise, it makes up a very small percentage of our combined RRSPs.

Some info on QQQ

For those readers who aren’t familiar with QQQ, it’s an ETF from Invesco. Since launching in 1999, the ETF has demonstrated a history of outperformance compared to the S&P 500.

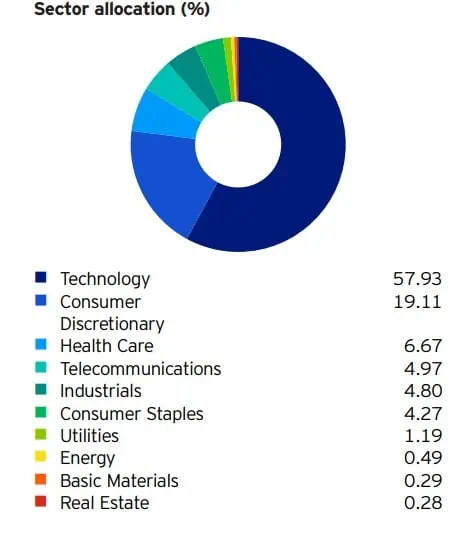

The top 11 – 20 holdings for QQQ are AMD, Netflix, PepsiCo, Adobe, Linde, Cisco, Qualcomm, T-Mobile US, Intuit, and Applied Materials. These holdings make up 15.71% of QQQ.

Due to the nature of the Nasdaq 100 Index, QQQ is heavily exposed to technology and consumer discretionary sectors.

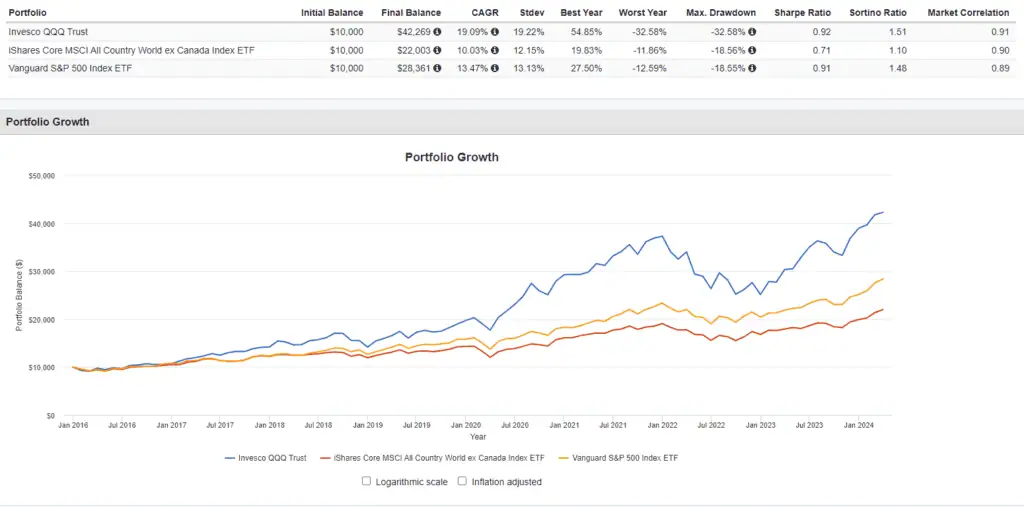

As you can see from above, $10,000 invested in QQQ in 2016 would result in over $42,000 in 2024 whereas the same amount invested in XAW and VFV would result in less than $30,000.

Case for going all-in on QQQ

Why would we consider going all in on QQQ?

Because QQQ has done very well historically compared to the major U.S. and Canadian indices.

Per the chart above, QQQ had an annualized return of 19.09% since 2016. In the last 20 years, QQQ has had an annualized return of 14.03% and an annualized return of 18.12% in the last 10 years.

Assuming we invest $150,000 in QQQ and enjoy an annualized return of 15% for the next 10 years, we’d end up with $606,833.66, assuming no additional contributions. On the flip side, if we have the same money and have an annualized return of 10% (long-term stock return), we’d end up with $389,061.37. This means investing in QQQ would result in more than $217.7k of difference in return on capital or 56%. This is a pretty significant difference.

Yes, historical returns don’t guarantee future returns. However, the high exposure to technology stocks should allow QQQ to continue the superior return for years to come.

Due to the fact that RRSP and RRIF withdrawals are taxed 100% at our marginal tax rate, it makes sense to attempt to maximize the total return inside of RRSPs/RRIFs instead of a mix of dividend income and capital return.

Case against going all in on QQQ

The biggest case against going all in on QQQ? Our dividend income would take a big hit.

Our RRSPs contribute about 30% of our annual dividend income. With our 2024 target of $55,000, selling everything in our RRSPs and holding QQQ only would reduce our total dividend income to about $38,500 (ignoring QQQ distributions completely).

But focusing on dividend income alone is a bit silly when we should be considering total return and the total portfolio value.

Out of the 18 U.S. stocks that we hold in our RRPS, QQQ holds 9 of them already. The stocks that QQQ doesn’t hold are:

- Abby

- Johnson & Johnson

- Coca-Cola

- McDonald’s

- Procter & Gamble

- Target

- Visa

- Waste Management

- Walmart

These 9 stocks make up about 25% of our RRSP in terms of dollar value. Since we purchased these stocks many years ago, they have all done very well, with a few of them being multi-baggers. I would hate to sell the likes of Visa and Waste Management.

Investing in QQQ does mean that when we start to live off our investment portfolio, rather than withdrawing mostly from dividends inside our RRSPs in the first few years (to increase our margin of safety), we’d need to sell QQQ shares and touch our principal.

If there are a few years of poor returns at the beginning of our retirement, this could cause a significant reduction in our portfolio value. Essentially, selling shares may not have as much margin of safety compared to relying on withdrawing dividends only.

Another case against going all in on QQQ is that QQQ is currently highly concentrated in technology stocks so it’s not all that diversified compared to other index ETFs like XAW. The latest AI hype has significantly bumped up the share price of many technology stocks. Would we see a Dot Com type of bubble in the future and hamper the return of QQQ? That’s certainly possible.

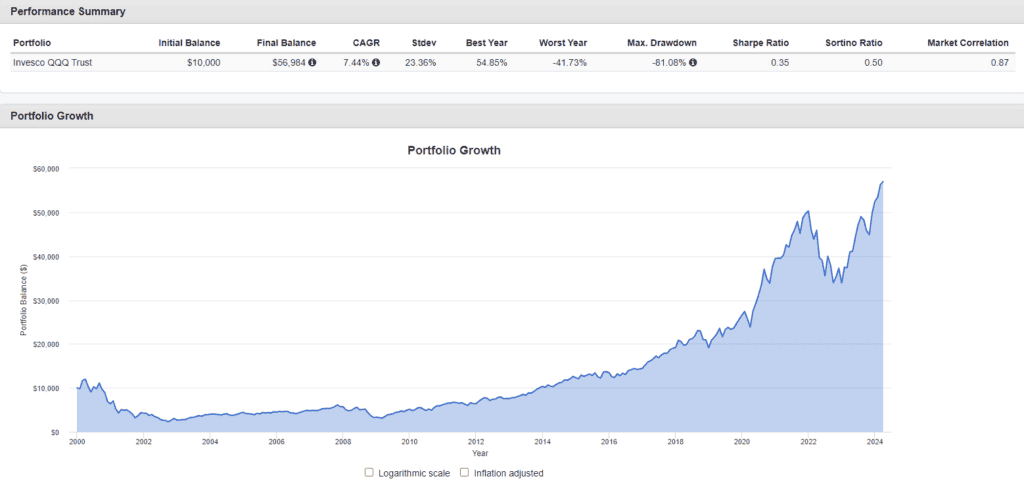

As you can see from the chart above, QQQ didn’t recover from the Dot Com bubble for about 14 years. This is a risk we would take on if we were to go all in on QQQ.

Potential Alternatives to going all-in on QQQ

Instead of going all in on QQQ, there are some potential alternatives.

First, we can simply add more QQQ shares in the next few years to have QQQ make up a larger percentage of our dividend portfolio. This is already our plan of record but we stay focused on this goal instead of purchasing more dividend paying stocks in our RRSPs.

Second, since we hold QQQ inside of Mrs. T’s RRSP and she holds mostly Canadian dividend stocks in her RRSP, we can consider closing out these positions and using the money to buy QQQ shares.

If we were to do that, we’d only lose about 12% of our forward annual dividend income, going from $55,000 to $48,400. Assuming QQQ continues the superior performance over other indices, holding only QQQ and Apple in Mrs. T’s RRSP and continuing to contribute to her RRSP only may mean that we have a higher chance of ending up with a 50-50 RRSP split down the road.

Some additional logistics to consider

The second option mentioned above is quite intriguing. But there are some logistics to consider if we were to forward with this option.

Second, we’d need to convert CAD to USD and take a hit on the exchange rate. Utilizing Norbert’s Gambit would allow us to save on the additional current exchange fees. The alternative solution would be to journal as many of the holdings to the U.S. exchange, close the positions, and end up with USD.

Another option is to consider the Canadian equivalents, like XQQ, ZQQ, HXQ, or ZNQ to avoid currency conversion. As many of you know, I’m all for simplicity and straightforwardness, so it makes sense to hold the original ETF QQQ instead of other alternatives.

Conclusion – Should we go all in on QQQ?

So, have I reached a decision after all the considerations?

I’ll admit, the second option mentioned (holding only QQQ in Mrs. T’s RRSP) is very intriguing to me. But I am going to sleep on it for a bit and discuss the idea with Mrs. T before making any major decisions. In the meantime, we will continue to add more QQQ shares in Mrs. T’s RRSP so QQQ makes up a bigger percentage of our dividend portfolio.

Readers, what would you do? Would you go all in on QQQ?

Hi there, I’m Bob from Vancouver, Canada. My wife & I started dividend investing in 2011 with the dream of living off dividends in our 40’s. Today our portfolio generates over $2,700 in dividends per month. This post originally appeared on Tawcan on July 15, 2024 and is republished on the Hub with the permission of Bob Lai.

Hi there, I’m Bob from Vancouver, Canada. My wife & I started dividend investing in 2011 with the dream of living off dividends in our 40’s. Today our portfolio generates over $2,700 in dividends per month. This post originally appeared on Tawcan on July 15, 2024 and is republished on the Hub with the permission of Bob Lai.

I think the best option is to simply add more QQQ shares in the next few years to have QQQ make up a larger percentage of our dividend portfolio. You don’t have to sell stock to go all into QQQ which presents diversification issues or lack thereof. I’d just simply keep buying QQQ from here.