Special to the Financial Independence Hub

There are a variety of life insurance policies available in Canada: the best type of plan depends on the insured’s needs and budget. The following is only a snapshot of the different types of plans.

In general, life insurance policies are classified according to two criteria:

- By length of coverage

- By medical exam requirements

Let’s look at each of this classification in detail.

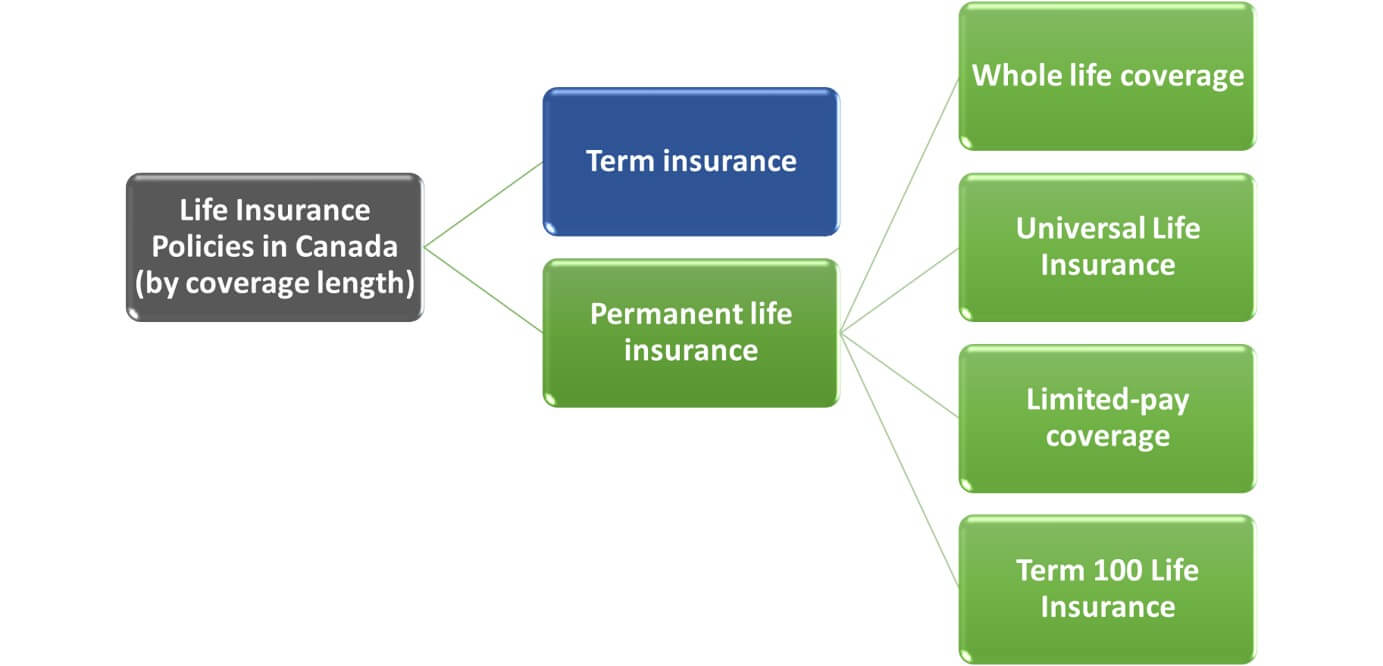

Types of life insurance based on coverage length

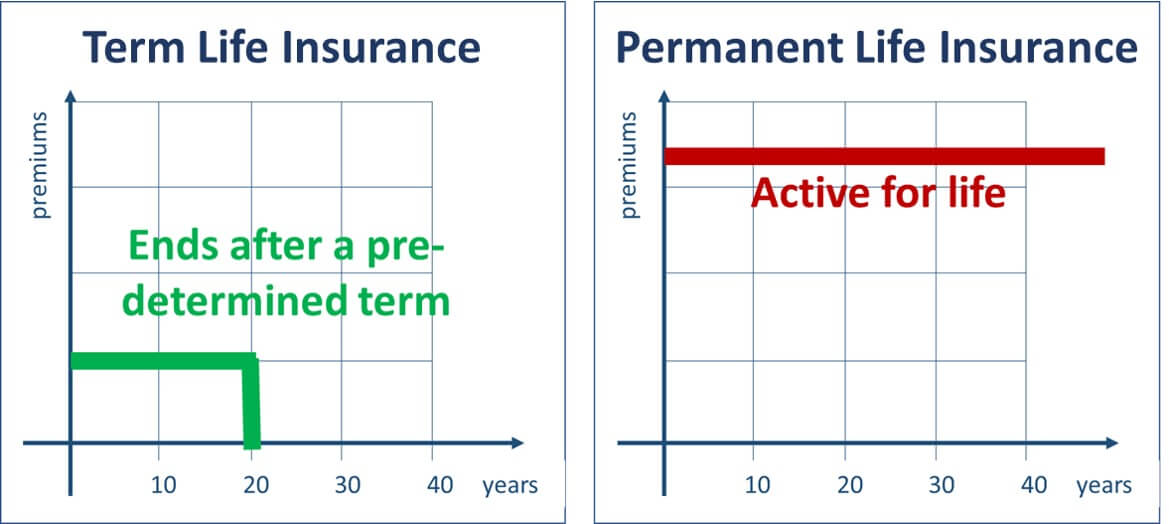

Life insurance in Canada is generally grouped into two major types, if it is about coverage length: temporary insurance and permanent insurance.

Here is a breakdown of these insurance types and below you will find a detailed description of each type:

Here is a breakdown of these insurance types and below you will find a detailed description of each type:

Term life insurance type

Term life insurance policies cover short-term needs. Term coverage is the simplest form of life insurance. It provides the largest benefit for the minimum amount of premium. The insured can use the benefits offered by this coverage to pay off debt or to fulfill any other need. The premiums on these policies start off low, but increase as the insured gets older. Term policies can typically last for 10 years, 20 years or 30 years, but Industrial Alliance offers a Pick-a-Term policy: the insured can pick his/her Term from ten to 40 years.

If you are interested in Term Life Insurance, click here to get a Term Life Insurance quote.

Permanent life insurance type

This type of life insurance provides insurance protection till the policy matures, as long as the insured pays the premiums on time. The four major types of permanent insurance are Whole Life, Universal Life, Limited-Pay, and Term 100.

Whole life insurance type:

Whole life insurance policy provides the benefit of lifetime coverage, once again, as long as the insured pays the premiums on time. The premiums remain leveled throughout the term of the policy and these plans also build a cash value. Loans are also permitted against this policy. Whole Life policies can be non-participating. These plans provide only guaranteed values and participating whole life coverage, which includes guaranteed and non-guaranteed cash values. The non-guaranteed values take the form of a dividend, which are generally tied to long-term interest rates balanced against the insurance companies profitability.

Click here to get a Whole Life Insurance quote.

Universal life insurance type

Universal life insurance coverage provides a facility for flexible premiums and adjustable benefits. The insured can change the amount of insurance as per his/her requirements. These policies can offer level death benefits or increasing death benefits, as well as an increasing cost of insurance and a level cost of insurance option.

Click here to get a Universal Life Insurance quote.

Limited-pay life insurance type

In limited-pay life insurance coverage, the insured has to pay a leveled premium over a period of time that is shorter than the original duration of the coverage. The most common type of limited-pay coverage is a 20-Pay plan. The insured is covered for life and the policy is paid up after 20 years.

Term 100 life insurance type

Term 100 will cover you for your entire lifetime as long as you keep paying the premiums which stay constant throughout your life. If you happen to make it to the age of 100, the insurance company will usually continue to cover you, but you willllno longer have to pay the premiums.

The major difference between whole life insurance policies and term 100 policies is that Term 100 policies generally have level premiums and lifetime protection — but no cash value the way participating whole life policies do.

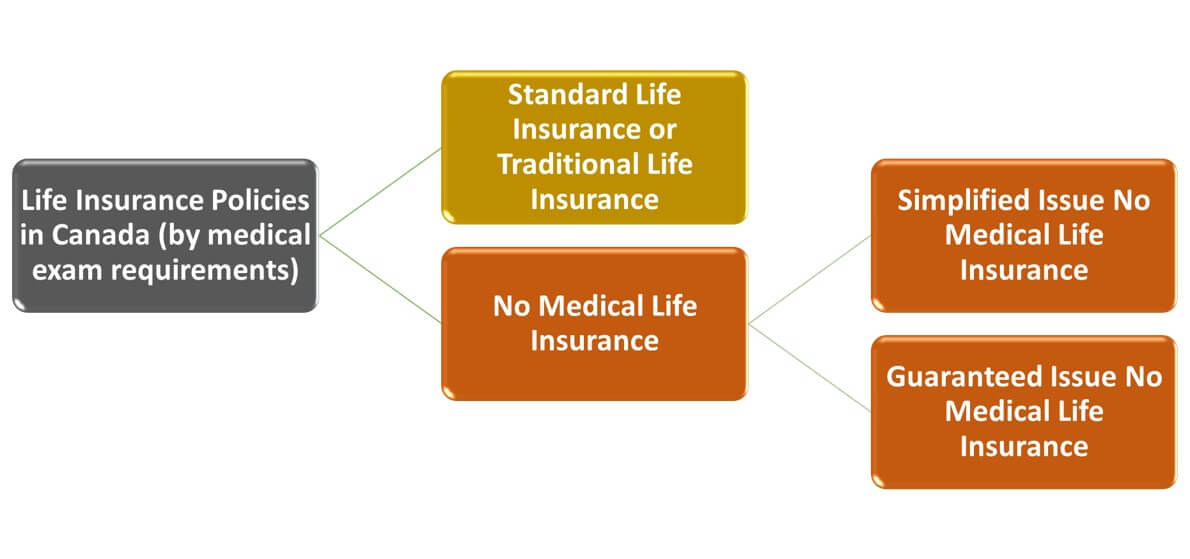

Types of life insurance in Canada based on medical exam requirements

Life insurance is grouped into two major types if it is about medical exam requirements: standard life insurance (also called traditional life insurance) and no medical life insurance.

Here is a breakdown of these insurance types and below you will find a detailed description of each type.

Standard life insurance type / Traditional life insurance type

That is the most typical life insurance policy. When you get this coverage, an insurance company will require that you pass a medical exam / test; for example, a licensed nurse will visit you at home to measure your blood pressure, collect fluids and capture a few other key health data points.

No medical life insurance type

No medical life insurance do not involve medical tests / exams but, depending on its type, may or may not require answering a short medical questionnaire. No medical life insurance cost of coverage is higher than standard life insurance whereas the maximal size of coverage is often limited. Let’s have a look at different types of no medical life insurance policies.

If you are interested in No Medical Life Insurance, click here to get a No Medical Life Insurance quote.

Simplified life insurance type

Simplified issue policies do not require any medical exam, but you still need to answer a limited number of medical questions. You will need to be able to answer “no” to all of the questions to qualify for this policy.

This insurance type is good for individuals who have medical conditions that will prevent them from getting a standard life insurance policy or for anyone who just wants a simple application process. It is important to know that your insurance premiums will be higher than for traditional life insurance and your coverage might be limited.

Guaranteed life insurance type

Guaranteed issue insurance policy offer insurance with no medical exam and you are not require to answer any medical questions. This insurance type is good for people who can’t qualify for simplified issue policies.

It is important to know though that this insurance coverage will cost even more than simplified life insurance and may have even more benefit limitations.

Lorne Marr is a Certified Financial Planner (CFP) and started in the life insurance industry in 1993 after completing his MBA at the University of Windsor. He has won numerous advisor awards and has appeared in the Toronto Star, The Globe and Mail, The National Post, The Toronto Sun, The Investment Executive and Money Sense Magazine. This article originally appeared on the LSM Insurance website and is republished on the Hub with permission.

Lorne Marr is a Certified Financial Planner (CFP) and started in the life insurance industry in 1993 after completing his MBA at the University of Windsor. He has won numerous advisor awards and has appeared in the Toronto Star, The Globe and Mail, The National Post, The Toronto Sun, The Investment Executive and Money Sense Magazine. This article originally appeared on the LSM Insurance website and is republished on the Hub with permission.