Special to the Financial Independence Hub

A recent study we conducted with Leger (www.leger360.com) asking what Canadians wanted in relation to their RRSP investments unearthed some compelling findings demonstrating that many Canadians have misconceptions that could be costing them money, especially in the long term.

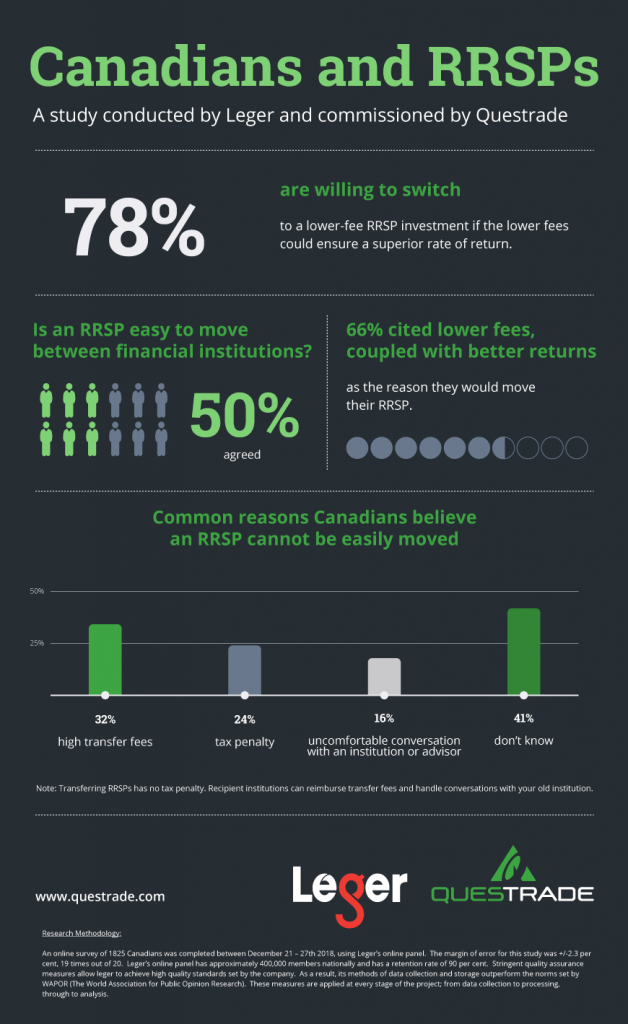

Our research confirmed 78 per cent would be willing to switch to a lower-fee RRSP investment, if the lower fees could ensure a superior rate of return. When we asked if they were able to move their RRSP easily, which factors would be most important, 66 per cent once again said they would move accounts for lower fees and better returns.

In addition to lower fees and higher returns, 31 per cent of people we talked to identified the ability to easily manage their RRSPs and make contributions online as a factor to consider in a switch (highest in those between the ages of 25 – 44 years), speaking perhaps to the rising appeal of newer fintech companies who offer the ability to do everything online.

When asked for other reasons they might consider switching their RRSPs, respondents cited frustrations including feeling like they’re being upsold (28 per cent), having to book an appointment and visit their financial institution in person (27 per cent) and not knowing what their RRSP is invested in (26 per cent).

This strongly suggests Canadians are far from content with their current RRSP contribution process and provider and would be willing to switch; however, there are misconceptions that are holding people back. Most interesting — only 50 per cent believe their RRSPs can easily be transferred between financial institutions.

Common misconceptions

Why? Common misconceptions included high transfer fees (32 per cent), incurring a tax penalty (24 per cent) and even the fear of an uncomfortable conversation with their current advisor or financial institution (16 per cent). While only 50 per cent of Canadians told us that they believe their RRSP can be easily moved between financial institutions, the reality is that RRSPs are easy to transfer. There are no tax penalties incurred when an account is transferred and furthermore, most institutions would cover the cost of any transfer fee that may be charged and by consolidating your RRSPs at an institution with lower fees, you may reach your retirement goals faster.

If you had an option to invest $1,500 for your retirement, what would YOU do? While the majority of Canadians stated they’re seeking lower fees and better returns, ironically, two thirds (66 per cent) of respondents chose a traditional higher-fee option (mutual funds) or a lower-return option (savings accounts).

What does this mean? Opportunities still exist for Canadians to be educated about new cost-efficient investment vehicles like ETFs and low-cost portfolios of ETFs.

Investors should closely examine their own goals and do a comparative study of higher-fee funds versus new lower-fee options that now exist, to see the difference. If your current choices are not maximizing your retirement savings, now is the time to consider a change. Fees, the false impression of a tax penalty and a potentially uncomfortable discussion to switch should not be obstacles; research and identify an institution or provider that offers the best RRSP for your retirement goals and then switch.

There is now an ever-increasing amount of choice and ease in RRSP alternative investments to help investors on the road to financial freedom. These lower-fee investment alternatives have the potential to significantly improve returns for Canadians.

To learn more about lower fee alternatives, we invite all Canadians to visit Questrade.com.

Edward Kholodenko is president and chief executive officer of Questrade Financial Group (www.questrade.com) an independent multi-service financial group. Questrade, Inc. is not just the largest (non-bank) online brokerage in Canada, it is also the fastest growing as ranked by Investor Economics for the last three years in a row.

Edward Kholodenko is president and chief executive officer of Questrade Financial Group (www.questrade.com) an independent multi-service financial group. Questrade, Inc. is not just the largest (non-bank) online brokerage in Canada, it is also the fastest growing as ranked by Investor Economics for the last three years in a row.

Edward was the recipient of the Entrepreneur of the Year Ontario 2014 services category award. In 2014 and 2018, DALBAR awarded Questrade its seal of excellence for client account reporting and customer service; it has also been designated one of Canada’s Best Managed Companies for the last seven years in a row.