By Bob Lai, Tawcan

Special to Financial Independence Hub

Lately, I have received many emails and questions on Twitter [now X] asking me about split-shares, or split-share corporations (split corp for short).

Specifically, are split-shares safe for building a dividend portfolio? Some readers also asked why I haven’t included split-shares like DFN.TO and LBS.TO in the best Canadian dividend stocks list or the best Canadian dividend ETF list.

With an initial look, these split-shares are extremely enticing and attractive due to the very high yields. Are there risks associated with these split-share corporations? Should one build an investment portfolio with them to generate dividend income?

Before we dive deeper into the details, here is a list of available Canadian split shares I can find, the share price, and the yield percentage. CanadianPreferredShares.ca keeps an updated list of all Canadian split-share corporations issued in the Canadian market.

| Ticker | Fund Name | Price | Yield % |

| BK.TO | Canadian Banc Corp. | $13.08 | 15.19% |

| DF.TO | Dividend 15 Split Corp. II | $4.03 | 0% (suspended) |

| DFN.TO | Dividend 15 Split Corp. | $6.43 | 17.94% |

| DGS.TO | Dividend Growth Split Corp. | $5.08 | 23.39% |

| ENS.TO | E Split Corp. | $14.59 | 10.60% |

| FFN.TO | North America Financial 15 Split Corp. | $4.00 | 0% (suspended) |

| FTN.TO | Financial 15 Split Corp. | $8.85 | 16.83% |

| GDV.TO | Global Dividend Growth Split Corp. | $9.50 | 12.45% |

| LBS.TO | Life & Banc Split Corp. | $8.70 | 13.59% |

| LCS.TO | Brompton Lifeco Split Corps. | $6.40 | 14.06% |

| LFE.TO | Canadian Life Companies Split Corp. | $3.70 | 0% (suspended) |

| OSP.TO | Brompton Oil Split Corp. | $4.19 | 0% (suspended) |

| PDV.TO | Prime Dividend Corp. | $5.76 | 12.63% |

| PIC.A | Premium Income Corporation | $4.90 | 16.59% |

| PRM.TO | Big Pharma Split Corp. | $14.50 | 8.50% |

| PWI.TO | Sustainable Power & Infrastructure Split Corp. | $6.28 | 12.74% |

| RS.TO | Real Estate Split Corp. | $14.25 | 10.96% |

| SBC.TO | Brompton Split Banc Corp. | $9.87 | 12.12% |

| SBN.TO | S Split Corp. | $2.78 | 0% (suspended) |

| TXT.UN | Top 10 Split Trust | $2.70 | 0% (suspended) |

| WFS.TO | World Financial Split Corp. | $1.40 | 0% (suspended) |

| XTD.TO | TDb Split Corp. | $4.05 | 0% (suspended) |

| YCM.TO | Commerce Split Corp. | $1.39 | 0% (suspended) |

As you can see from the table, most of these split-shares provide a 10% or higher distribution yield. This is extremely attractive if you’re seeking regular investment income.

You will also notice that some split-shares have suspended their distributions. This is due to how split-shares are structured, distributions will only get paid out if the Unit Net Asset Value (NAV) is over a certain threshold. More on that later …

So what are split-shares or split corps? Unfortunately, not many investors are familiar with them, due to how they are set up. I certainly had to do a bit of research to understand the details.

Within the split-share corporations, two classes of shares are available: Preferred Shares and Class A or capital shares. Investors can choose to hold both types of shares or just one. These two different kinds of shares are traded on the stock exchanges and can be purchased from online brokers like Questrade or National Bank Discount Brokerage.

Preferred Shares are designed for the more conservative investors who seek regular monthly distributions. Preferred shares typically have a finite term (e.g. 5 years but usually get renewed) and have a claim on fund distributions first. No capital gains or losses from the underlying holdings will impact preferred shares. In other words, the preferred shares are structured like a fixed-income vehicle.

Similar to how other preferred share stocks work, while distributions are quite safe, there’s usually a limited capital appreciation potential. There’s no management expense ratio (MER) associated with these split share preferred shares as fees are paid by the Class A shares.

Class A shares are created to provide high yields. The Class A shareholders receive all the gains (and losses) on the entire portfolio and any additional dividends or income generated from the underlying holdings (i.e. leftover dividends/income after preferred shares distributions are paid). Since preferred shares do not pay MER, all MER associated with the split-share structure is paid by Class A Share.

In DFN.TO’s case, the fund has a yield of 17.94%. If you look at the underlying holdings, collectively, none of the individual stocks can produce this kind of high yield. So how do DFN.TO and other Class A split shares generate such high yields?

Remember, one can’t arbitrarily manufacture additional yields unless one takes on additional risks. So to generate the additional yields, split-share funds use leverage and covered calls. As many readers would know, leveraging and covered calls increase overall risk. In other words, there’s no free lunch. Holding Class A shares is certainly not for the faint of heart.

As mentioned, preferred shares will get the split-share distributions first, followed by Class A shares. What’s important to keep in mind is that Class A shares will only get distributions if the Unit NAV is over a specific threshold, determined and set by the individual fund.

The Unit NAV is determined by the performance of the underlying holdings and the performance of leveraging and covered calls. Class A shareholders need to pay close attention to the Unit NAV.

For example, if the market is doing well and the underlying holdings see a price appreciation, there’s no worry regarding the safety of split-share preferred shares. However, if the market is not doing well, this will cause the Unit NAV to fall below the distribution threshold, causing distributions to potentially get suspended. The Financial Post has a really good illustration of how market performance affects split-share funds.

A suspension in the monthly distributions is something many split-share funds experienced during the early days of the global pandemic.

As you can see, split-share corporations aren’t like traditional dividend growth stocks or ETFs. Hence I have excluded them from any of my best-of lists.

Here are some important characteristics you should be aware of if you’re considering investing in split-shares.

- Income, income, income. Split-share funds are designed from the ground up to provide investors with income.

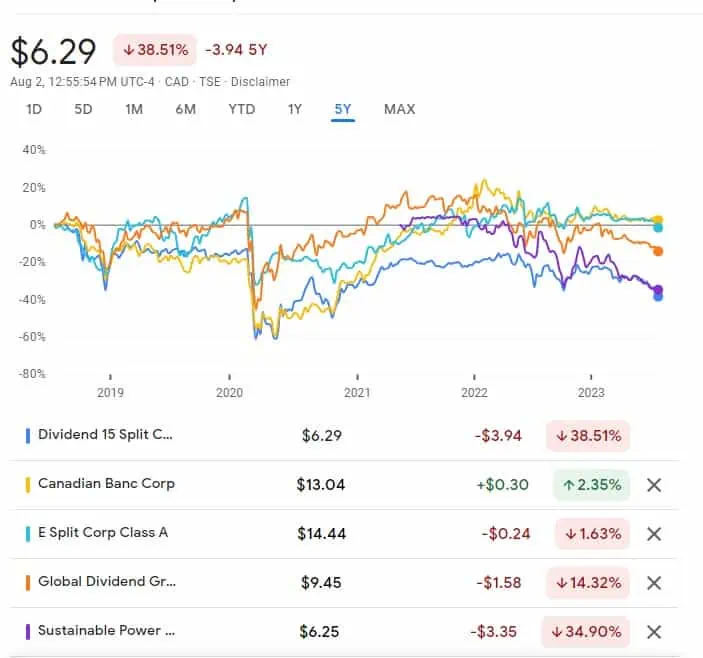

- Limited capital appreciation. Since split-share funds are income-focused, there’s very limited capital appreciation potential, both on preferred shares and Class A shares. You can see the share price performance for DFN.PR.A (Preferred shares) and DFN (Class A shares) below:

DFN.PR.A 5 year price performance

- Interest rates. The price of the preferred shares is tied directly to interest rates, just like most fixed-income investments.

- Distributions can get suspended. If Unit NAV falls below the threshold, especially during poor market conditions, you won’t get any distributions. This has happened multiple times in the past with many of these split-shares. Be careful!

- No distribution payout increases. Unlike many dividend growth stocks, split-share fund distributions do not go up and will stay flat forever.

Out of the two different share classes, the preferred shares are definitely the safer and more conservative option. Preferred shares usually mature after 5 years, so you can hold the shares and get your money back at the end of the term.

Investors looking for stable monthly income may be inclined to invest in preferred shares since it’s moderately low risk. However, while the staple monthly income is nice, you won’t get any capital appreciation.

Given that Class A shares are highly leveraged, you need to ask yourself: Is the yield worth the higher risk? Personally, I would not recommend investing in split-share Class A shares at all.

Just don’t touch them.

Furthermore, if you look at the price performance of many Class A shares, you’ll notice that you end up losing your capital in the long run, despite the high yield. You will encounter a lot of day-to-day, month-to-month volatilities by holding Class A shares.

Personally, I consider these Class A shares a little like annuities (but not as well structured). You’re basically investing money and paying yourself with your own money monthly. Unfortunately, more often than not, you will end up losing your capital with these Class A shares.

Essentially you get a super-high yield, but you most likely will be in the red with your investments over the long run.

Since we are focused on total return, not just purely on dividend income, we do not build our dividend portfolio on split-shares. I don’t believe the risks are worth it. I’d rather see our dividend income grow organically and see the value of our investment portfolio grow every year than get monthly distributions that may not be sustainable in the long run.

For us, we would never consider utilizing Class A split-shares. We believe there are other investments that are better suited for our long term goals.

So, are split-shares safe for building a dividend portfolio? Well, if you’re exclusively seeking income, I think the preferred shares may have a place in your portfolio.

It’s a different story with the Class A shares. For Class A shares, I personally wouldn’t touch them with a 100-foot pole. The risks are simply too high and the distributions often aren’t sustainable. Even if the distributions are sustainable, you may end up with a capital loss, so you are not better off in the long run anyway.

Put it this way, if you have a dividend portfolio that yields over 10%, do you believe this income can be sustained in the long run? More likely than not, such a high yield is simply not sustainable. To make matters worse, you probably will experience a drastic capital loss as a result of the high yield. So definitely be cautious whenever people promote these Class A shares as a way to generate dividend income.

Do you invest in split-shares? What’s your view on them?

This blog originally appeared on the Tawcan site on Nov. 27, 2023 and is republished on the Hub with the permission of Bob Lai. Hi there, I’m Bob from Vancouver Canada. My wife & I started dividend investing in 2011 with the dream of living off dividends in our 40s. Today our portfolio generates over $4,000 in dividends per month.

This blog originally appeared on the Tawcan site on Nov. 27, 2023 and is republished on the Hub with the permission of Bob Lai. Hi there, I’m Bob from Vancouver Canada. My wife & I started dividend investing in 2011 with the dream of living off dividends in our 40s. Today our portfolio generates over $4,000 in dividends per month.

I noticed that the Partners Value split preferreds were not included. These are essentially a Brookfield product. Only the preferred side is available to public. The difference between these and the other splits, is that they have a maturity date. The yields may look low today, but if yield to maturity is considered they have better total return than many alternatives.