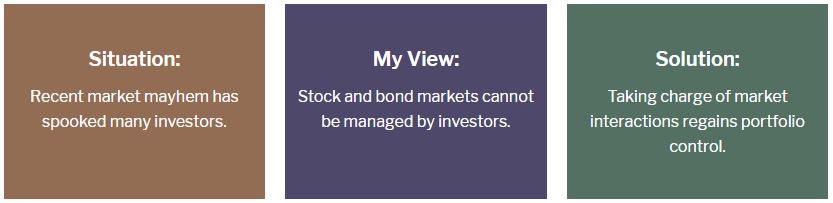

Suddenly a raft of market fears have sprung up in the past few days.

All North American markets have been affected: the Dow, S&P500, Nasdaq and TSX. Labels ranged from corrections to market routs. Some indices were shaved in excess of -10%. In reality, this mayhem may not yet be finished.

I recall the October 87 rout when the Dow dropped -22.6% in one day. Ouch! The good news part of the story is that the loss was substantially gone by a year later.

This brings me to dust off a previous commentary dealing with the same topic.

Remember that markets are logical, while investors are emotional. This combination is a non-starter for investors.

Success will come to those who quickly ditch emotional attachments. Don’t waste precious time on strategies that keep failing.

“To conquer fear is the beginning of wisdom.”

—Bertrand Russell (1872–1970), British philosopher

As we noted in this blog on the Hub almost exactly two years ago, investors have been enjoying the fruits of rising markets. A 11-year upside since the March 2009 lows, to be more precise. Conventional wisdom expected that stocks continue to deliver as economic conditions are likely to remain healthy.

Suddenly, everyone is wallowing in fears. Worries about global economies, recurring volatility and market jitters are back on stage. Investors are wondering what to do with the nest egg amid the crazy mayhem.

“Markets can’t be managed, so focus on your interaction with the markets.”

I recommend that you act wisely. Move slowly. Don’t give up. Don’t throw in your towels. The solution is simpler than you think.

Repeat after me: “I am not in control of my nest egg – the stock and bond markets are.” This is your first and most important admission.

Expect market corrections and surprises any time. Market mayhem is a normal occurrence, in both directions. You’ll be afforded little time, if any, to react. Fretting and worrying about the volatility does not help anyone. Your task is to regain as much control as possible.

Recent market haircuts are graphic reminders of the curve balls of investing. Zeroing in on simple practices reduces the hazards of stepping in a sink hole along your investing roadway.

Adopted Wisdom

I have adopted these timeless steps. You should too:

- What matters most is how the portfolio fares, not the market outcomes.

- Markets can’t be managed, so focus on your interactions with the markets. Continue Reading…