By Robb Engen, Boomer & Echo

Special to the Financial Independence Hub

Earlier this year, the Financial Planning Standards Council (FPSC) updated the numbers it uses for projected investment returns and inflation. Financial planners use these numbers as guidelines when projecting retirement needs and income for their clients.

The FPSC’s latest guidelines for 2015 peg annual inflation at 2 per cent and make the following assumptions for investments returns (nominal returns, not adjusted for inflation):

- Short term: 2.90 per cent

- Fixed income: 3.90 per cent

- Canadian equities: 6.30 per cent

Portfolio return assumptions

Planners (and investors) need to consider inflation in their retirement projections, so these numbers should be adjusted down by 2 per cent.

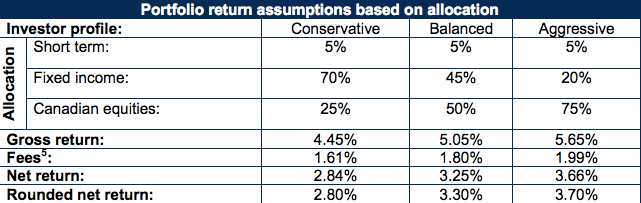

We also need to account for investment fees and expenses in order to calculate the net portfolio returns. The FPSC assumes the majority of Canadians are invested in mutual funds and therefore use a management expense ratio of up to 2.25 per cent for Canadian equity investments and 1.50 per cent for the fixed-income security portion.

This chart shows net portfolio returns (after fees, but before inflation) for three types of investors: conservative, balanced, and aggressive:

Once adjusted for inflation these returns range from 0.80 per cent annually for the conservative investor to 1.70 per cent for the aggressive investor.

Do those numbers sound realistic? Conservative?

According to data collected by the Million Dollar Journey blog (and pulled from online financial resource, Money Chimp), the compound annual growth rate after inflation for the S&P 500 during any 30-year period dating back to 1950 was between 4.32 per cent and 8.42 per cent.

It appears as though the new FPSC guidelines are being cautious with future investment returns; although keep in mind they’re using Canadian equity markets in their assumptions, not U.S. or international markets. These guidelines also use the highest average investment expenses – which is unfortunately true for most Canadian investors – to calculate net portfolio returns.

Projecting returns for my clients

When projecting investment returns for my clients I use 5 percent annual growth for investments and a 2.5 percent annual target for inflation. That leaves a net return of 2.5 per cent annually: after inflation, but before investment costs.

Now keep in mind that most of my clients have switched from expensive bank mutual funds into low cost index funds or ETFs, so their investment fees and expenses are a fraction of what the FPSC uses in its guidelines.

For example, a portfolio of TD e-Series funds with 25 per cent allocated to each of the Canadian index, U.S. index, International index, and Canadian bond funds has an average MER of just 0.42 per cent. If we use those costs for the aggressive investor in the FPSC guidelines then the net portfolio return now equals 5.2 per cent after costs and 3.2 per cent when adjusted for inflation. Not bad.

Assumptions for my own portfolio

For my personal retirement planning assumptions I use an 8 per cent nominal return on my investments (remember, I’m 100 per cent in equities – both domestic and international – with my two-ETF solution).

The total costs for my portfolio each year is just 0.29 per cent, which leaves a net portfolio return of 7.71 per cent. I peg inflation at 2.50 per cent annually. That leaves inflation adjusted investment returns of 5.21 per cent for my retirement portfolio.

Why costs matter

The main takeaway from looking at these guidelines shouldn’t be which number to arbitrarily attach to your projected investment returns in order to boost your retirement income. Even inflation, although real, is largely out of your control.

What you can control is your investment costs. Fees matter; and the difference between a low-cost portfolio of index funds and a smattering of expensive bank mutual funds could mean the difference between your portfolio handily beating inflation over time or just treading water and barely keeping up.

What assumptions do you use when projecting investment returns and inflation?

In addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on his site on July 26th and is republished here with his permission

In addition to running the Boomer & Echo website, Robb Engen is a fee-only financial planner. This article originally ran on his site on July 26th and is republished here with his permission