Questrade touched a nerve with financial advisors with a series of commercials highlighting how lower investment fees over time potentially means you can retire up to 30% wealthier.

Questrade touched a nerve with financial advisors with a series of commercials highlighting how lower investment fees over time potentially means you can retire up to 30% wealthier.

Financial advisor extraordinaire Jason Pereira acknowledged that Questrade was right to go after do-nothing advisors who collect fat commissions, but he claimed the 30% wealthier promise was unrealistic and borderline illegal.

Mr. Pereira’s argument is a good one. Advisors like him (and others who put a client’s best interests ahead of their own) can add tremendous value for clients, but not in the way you might think.

Mr. Pereira’s argument is a good one. Advisors like him (and others who put a client’s best interests ahead of their own) can add tremendous value for clients, but not in the way you might think.

The old school notion of a financial advisor is of someone who adds value through their stock-picking prowess. But that argument falls flat when you see the evidence that the vast majority of actively managed funds fail to beat their benchmarks.

Indeed, investors are better off buying the entire market as cheaply as possible using index funds or ETFs.

PWL Capital’s Ben Felix once told me, “investing has been solved … The way for advisors to add value is on planning, behaviour, and transformation.”

With that in mind, I can get behind the idea that financial advisors with this mindset do have a net positive impact for their clients, even after fees.

Which brings me to the point of this article. Canadians have $1.6 trillion invested in mutual funds, most of which are of the expensive, actively managed variety. Those actively managed funds aren’t adding value: the vast majority will underperform their benchmark. Furthermore, most bank-advised clients aren’t getting value in other ways: financial planning, goal setting and prioritization, behavioural coaching, etc.

Traditional advisors are still selling (and charging for) investment expertise, but failing miserably at delivering excess returns while offering little-to-no value for things that would truly make a difference for their clients.

The easy answer is to pair a fee-only advisor with a low-cost investment solution (either a self-directed portfolio of globally diversified ETFs, or through an automated portfolio with a robo advisor). This way, you get the planning, coaching, and behavioural nudges you need to succeed financially, plus the benefit of lowering your investment fees. Win-win.

But the sad reality is that financial inertia is powerful and it’s easier to keep your investments at your bank, along with your chequing, savings, and mortgage. I get it.

Retire up to 30% wealthier without moving your investments

What if I told you that you can still retire up to 30% wealthier without moving your investments to a robo advisor or a DIY investment solution? The answer is sitting right there on the product shelf at your bank: yet rarely if ever talked about by your financial advisor.

I’m talking about index funds. That’s right. Every big bank has a suite of index mutual funds available to investors. These funds charge between one-sixth to one-half the cost of the actively managed mutual funds that are typically sold to Canadian investors.

I’ve monitored and tracked the performance of big bank index funds and their actively managed mutual fund cousins for more than 10 years, and in every single case (when comparing to identical benchmarks), the lower cost index funds outperform the active funds.

So, all you need to do is walk into your bank branch, sit down with your advisor, and ask (no, demand) to move your portfolio from actively managed mutual funds to their index fund equivalents.

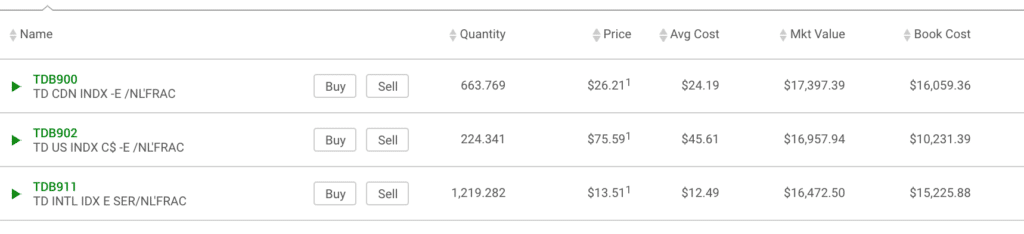

Below, I’ll show you the exact index funds to buy to build a 60/40 balanced, globally diversified portfolio of index funds at each of Canada’s five big banks. I’ll compare those index funds to the commonly sold actively managed “balanced” mutual fund.

RBC Index Funds

If you’re an RBC client, chances are you have the RBC Balanced Fund (RBF272) in your investment portfolio. The fund has nearly $5 billion in assets under management and comes with a fee (MER) of 2.16%. Returns have been decent, with a 10-year average annual return of 5.3%. Continue Reading…