By Billy and Akaisha Kaderli

Special to Financial Independence Hub

Recently, an interesting question was presented to us: How much is Enough?

We posed this same question to ourselves years ago when we were contemplating early retirement. But what about now, three decades later?

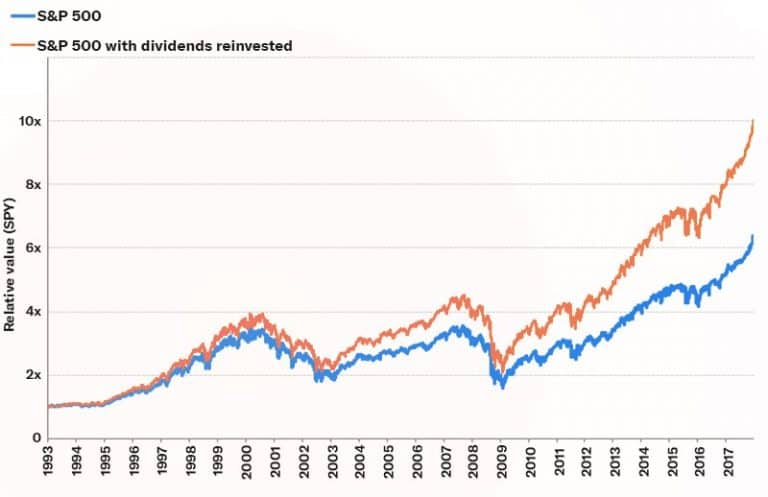

4% rule be damned

Years of capital appreciation due to decades of compounding and proper money management has paid handsomely in the growth of our net worth and financial wellbeing. Now, 33 years later, do we still need to be diligent in monitoring our spending and outflows, or is now the time to seize the day and go first class? Eat in trendy restaurants, be seen and show off our wealth?

This is definitely not our style …

Flying under the radar living a bohemian lifestyle is more like us, and we’re still here livin’ the dream.

In fact, some family members and friends consider us “poor” as compared to their consumer-based standards. That’s fine with us. We have not owned a car for years and we tend to live in foreign countries where we can geographically arbitrage value for money spent. We prefer experiencing cultures and cuisine as compared to a shiny new car, club membership and debt payments.

We are just trying to make it to Friday

There are many ways to live a life, and our choice is unique to us. It’s a lifestyle not a vacation and our approach is one that we created based on our personal values and interests.

But back to the question of when we might loosen the purse strings … Should we start living on more – or less – than the US$35,000 that we have done for years?

We now use more private drivers than chicken buses, stay in pricier hotels (not always a better choice), and we’ve set up a stable, semi-permanent home base in Chapala, Mexico.

We now use more private drivers than chicken buses, stay in pricier hotels (not always a better choice), and we’ve set up a stable, semi-permanent home base in Chapala, Mexico.

We donate freely, giving our time and money, helping others less fortunate, as well as teaching people better money management and life skills.

There are needs everywhere and we do our best to contribute. As always, we want results rather than throwing money at a problem to feel good and brag about it.

Checking back in with the 4% rule, we took a look at what that number would be for us today and both of us asked “How would increasing our spending to that amount change our lives?” Granted, it’s not Bill Gates’ level, but how much more can we eat, drink, travel, be merry and give away?

But that’s us.

What about you?

Is it time for you to flip the switch from saving and being frugal for your future – to enjoying a higher standard of living and giving back to the community?

Below are a couple of suggestions which might clarify this question for you.

Know where you are

Life circumstances change.

None of us know our exit date from this planet. As each day passes, we are one day closer to the end of our adventure. But you could check some actuarial tables to see where you stand in general. We are not saying throw caution to the wind and start “X-ing” out days on your calendar. Rather, utilize this bit of information to get a clearer picture of where you might be.

Imagine if you knew your Date of Death. Would that change your spending habits or the way you live?

Other thoughts

Have you or your spouse had an awakening in regards to health? Do you want to open a foundation that produces results and wealth? Begin a new business or leave a particularly handsome legacy for your grandchildren? Continue Reading…