By Noah Solomon

Special to Financial Independence Hub

When cash, high quality bonds, and other safe assets offer little yield, investors get caught between a rock and a hard place. They can either (1) accept lower returns and maintain their allocation to safe assets or (2) liquidate safe assets and invest the proceeds in riskier assets such as equities, high yield bonds, private equity, etc.

Using history as a guide, when faced with this dilemma many people choose the second option. This decision initially produces favorable results as the increase in demand for stocks pushes prices up. However, as this reallocation progresses, prices reach levels which are unreasonable from a valuation perspective, and the likely returns from risk assets do not compensate investors for their associated risk. At this juncture, committing additional capital to risk assets becomes akin to picking up pennies in front of a steam roller. For the most part, this narrative is what played out across markets following the global financial crisis of 2008.

Following the global financial crisis, near-zero rates pushed investors to take more risk than they would have in a normal rate environment, which entailed making outsized allocations to stocks and other risk assets.

Unable to bear the thought of receiving negligible returns on safe assets, people continued to pile into risk assets even as their valuations became unsustainable.

Had central banks not begun raising rates aggressively in 2022 to combat inflation, it is entirely possible (and perhaps even likely) that stocks would have continued their ascent, valuations be damned!

Instead, rising rates provided risk assets with some worthy competition for the first time in over a decade, which in turn caused investors to rethink their asset mix and shed equity exposure.

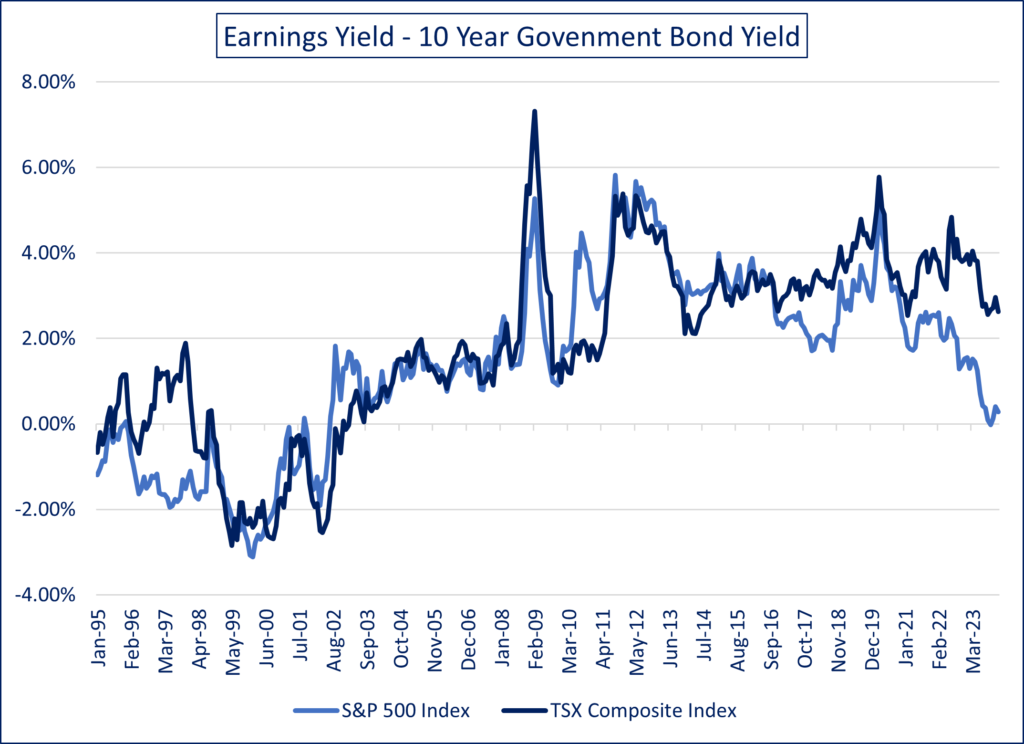

The Equity Risk Premium: A Stocks vs Bond Beauty Contest

The equity risk premium (ERP) can be loosely defined as the enticement which investors receive in exchange for leaving the safety of Uncle Sam to take their chances in the stock market. More specifically it is calculated by subtracting the 10-year Treasury yield from the earnings yield on stocks. For example, if the P/E of the S&P 500 is 20 (i.e. earnings yield of 5%) and the yield on 10-year Treasuries is 3%, the ERP would be 2%.

Historically, stocks tend to produce higher than average returns following elevated ERP levels. Intuitively this makes sense. When valuations are cheap relative to the yields on safe assets, investors are getting well compensated for bearing risk, which tends to portend strong equity markets. Conversely, at times when stock valuations are rich relative to yields on safe assets and investors are getting scantily compensated for taking risk, lower than average returns from stocks have tended to ensue.

- At the end of 2020, the S&P 500 Index’s PE ratio stood at 20 (i.e. an earnings yield of 5%), which by no means can be considered a bargain. However, stocks were nonetheless rendered attractive by ultra-low rates on cash and high-quality bonds. It’s easy to look good when you have little competition!

- By the end of 2021, the Index’s PE ratio was above 24 (i.e. an earnings yield of 4.2%). Stocks were even less enticing than valuations suggested, given that 10-year Treasury yields had risen from 0.9% to 1.5%. This set the stage for a decline in both prices and valuations in 2022.

- From an ERP perspective, 2022’s decline in valuations did not make stocks less stretched vs. bonds. The contraction in multiples (i.e. increase in earnings yield) was more than offset by a rise in bonds yields, thereby causing the ERP to be lower at the end of 2022 than it was at the start of the year.

- In 2023, the S&P 500’s PE ratio expanded from approx. 18 to 23, which was not accompanied by any significant change in 10-year Treasury yields. By the end of the year, U.S. stock multiples had nearly regained the lofty levels of late 2021, despite the fact that Treasury yields had actually increased by over 2% during the two-year period.

- In contrast, the relative valuation of Canadian stocks vs. bonds currently lies at levels that are neither high nor low relative to recent history.

Low Rates: The Growth Stock amphetamine

Growth companies, as the term implies, are those that are projected to have rapidly growing earnings for many years. Whereas an “old economy” stock such as Clorox or General Mills might be expected to grow its profits by 2%-10% per year, a juggernaut like NVIDIA could be expected to double its profits every year for the foreseeable future. Continue Reading…