By Alfred Lee, Director, BMO ETFs

(Sponsor Blog)

The 60/40 portfolio has been long considered the prototypical balanced portfolio. This strategy consists of the portfolio investing 60% of its capital to equities and the remaining allocation of 40% in fixed income.

The two segments in the portfolio each have its unique purpose: equities have provided growth and fixed income has historically provided stability and income. When combined, it allowed a portfolio to have stable growth, while generating steady income.

In the last decade, however, the 60/40 portfolio has been challenged on two fronts. The first has been due to the lack of yield available in the bond market, as interest rates have grinded to all-time lows. As a result, many looked to the equity market to generate higher dividends in order to make up for the yield shortfall left by fixed income.

The second shortcoming of the 60/40 portfolio has been the higher correlation between bonds and equities experienced in recent years, which has limited the ability for balanced portfolios to minimize volatility.

However, the resurgence of bond yields in the recent central bank tightening cycle has breathed new life into the 60/40 portfolio. Suddenly, bonds are generating yields not seen since the pre-Great Financial Crisis era. A higher sustained interest rate environment also means a slower growth environment; that means equity risk premiums (the expected excess returns, needed to compensate investors to take on additional risk above risk-free assets) will be lower. This means fixed income may look more attractive than equities on a risk-adjusted basis, which may mean more investors may allocate to bonds in the coming years. Fixed income as a result, will play a crucial role in building portfolios going forward and its resurgence has revived the balanced portfolio.

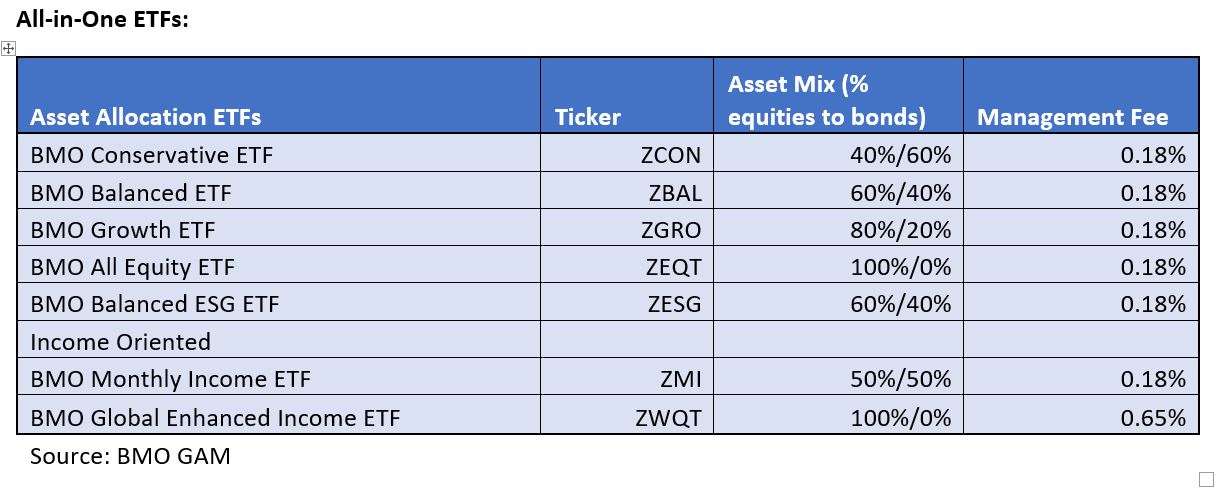

Investors can efficiently access balanced portfolios through one-ticket asset allocation ETFs. These solutions are based on various risk profiles. In addition to the asset allocation ETFs, we also have various all-in-one ETFs that are built to generate additional distribution yield for income/dividend-oriented investors. Investors in these portfolios only pay the overall management fee and not the fees to the underlying ETFs.

How to use All-in-One ETFs

- Standalone investment: All-in-one ETFs are designed by investment professionals and regularly rebalanced. Given these ETFs hold various underlying equity and fixed income ETFs, they are well diversified, and investors can regularly contribute to them over time. Continue Reading…