As I consider some form of semi-retirement in the coming years, I’m learning there is a host of factors to consider in the decision to semi-retire or retire.

For today’s post, I’m going to take a recent quiz of sorts published on Financial Independence Hub with Fritz Gilbert, the founder and mastermind of a popular U.S. blog: The Retirement Manifesto.

After 30+ years in Corporate America, Fritz retired (as planned) in June 2018 at Age 55.

In running a respected U.S. personal finance blog, Fritz has written about pretty much everything on his site, including on retirement, and still does. A few years ago, as he was working through his own decision to retire, he admits some obsession about the transition. After doing his homework and analysis, he successfully made the leap and hasn’t looked back since.

As Fritz puts it when it comes to transitioning to retirement: some folks do well, and some don’t.

I hope to be in the former camp (!) and I hope this post (and answers to Fritz’s quiz factors) helps you too!

Here are 5 important factors to consider in your decision to retire including what Fritz wants to share about the transition process …

5 Important Factors to Consider In Your Decision to Retire

Fritz factor #1: Do you have enough money?

I hope so!?

Fritz comments in his article that having enough is “a necessary factor, but far from sufficient.”

I agree witih Fritz that retirement or even semi-retirement starts with a math problem to solve.

To understand how much you need, you need a process, a formula to outline as many unknowns as possible before you pull the trigger. One of the biggest unknowns in any retirement plan is your potential retirement spending.

You need to consider what you will spend to determine your “enough number.”

After that, you need to consider how to build your retirement paycheque per se to fund that lifestyle.

I’m intending to use a modified bucket strategy to deliver my income in semi-retirement.

Your mileage may vary.

Bucket 1 is cash savings. It’s simply a large emergency fund we don’t have to use but it’s there if we need it.

Bucket 2 is earning income from dividend-paying stocks. Income will be earned inside some key accounts (such as our non-registered account(s), TFSA(s), and RRSPs) to pay for living expenses.

Bucket 3 is earning income from equity ETFs. This income will come from mainly our RRSPs, as we intend to “live off dividends and distributions” and withdraw capital from our RRSPs/RRIFs over time as we work part-time.

The purpose of having buckets is simple but effective: this retirement bucket strategy is an investment approach that segregates your sources of cash or income into three buckets. Each of these buckets has a defined purpose based on what or when the money is for: now, (short-term), intermediate (near-term) or long-term (multi-year or decade).

My bucket approach, while maybe not perfect, helps for a few reasons:

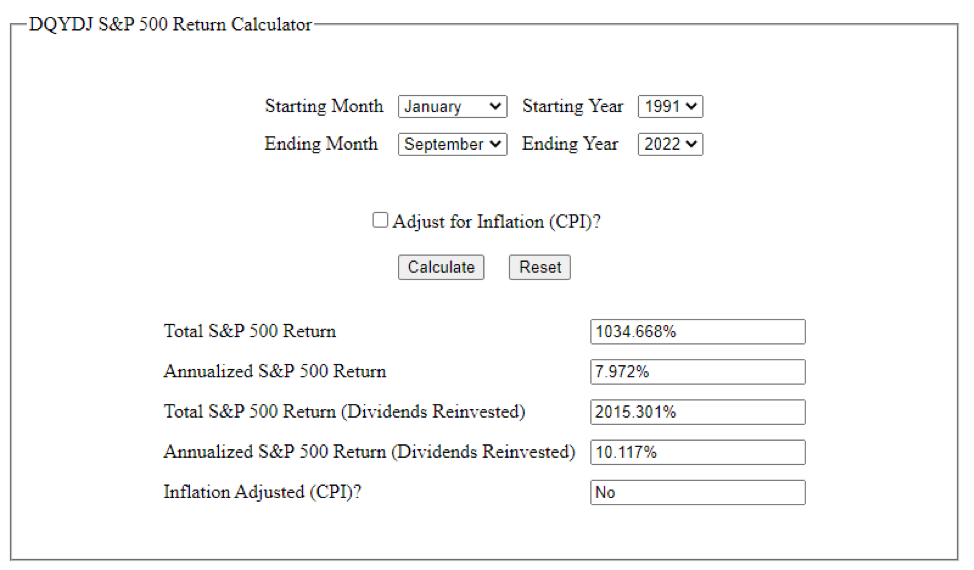

- It can help ensure I stay within a reasonable withdrawal plan, starting off retirement or semi-retirement with a low withdrawal rate of 3% or 4%.

- It can help avoid sequence of returns risk (especially in the early years of retirement)* *Review these graphs below from BlackRock for an example.

- It can help “smooth out taxation” over time by liquidating accounts, slowly and methodically.

- It can help offset longevity risk, thanks to preserving capital early in retirement and letting assets compound away.

This is our more detailed bucket approach to earning retirement income.

*On sequence of returns risk

Exhibit A – pre-retirement:

Exhibit B – during retirement:

Source: https://www.blackrock.com/us/individual/literature/investor-education/sequence-of-returns-one-pager-va-us.pdf

Fritz factor #2: Are you mentally prepared for retirement?

Yes, getting there, but it’s more semi-retirement for me/us.

As Fritz puts it in his post on Jon’s site:

“Almost everyone thinks about money when they’re making the decision to retire, but far too few consider the non-financial factors. If I were to choose one point to make from all the things I’ve learned in the 7 years of writing this blog, it’s that the non-financial factors are the most important for putting yourself on track for a great retirement. Important enough that I wrote an entire book on the topic.”

Instead of just focusing on the financial-side of things, I’m really ramping up my mental-game.

I’ve given quite a bit of thought about what semi-retirement might look like, including answering many of these Frtiz-factor questions and more:

How much do you want to travel? (A bit, not all the time.)

Where do you want to live? (In Ottawa, as a home base.)

Are you going to downsize? (Already done!)

Are you going to do more entertainment with that increased free time? (Yes, but also more volunteer work.)

So, to Fritz’s points and recommendations: we dream a bit, we talk a lot, and we keep our mind open to new opportunites. I think everyone should consider the same.

Fritz factor #3: Have you made a realistic spending estimate?

You bet!

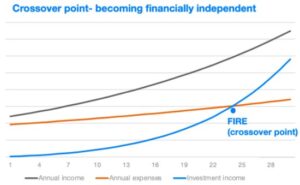

As we enter semi-retirement, we essentially intend to “live off dividends.”

Meaning, we will live off dividends from our non-registered accounts as we make some slow, methodical withdrawals from our RRSPs, while working part-time. We won’t touch TFSA assets at all and we’ll be far too young to tap any government benefits.

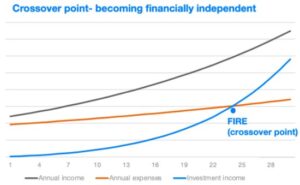

In a few years, we will be at this Crossover Point [also shown at the top of this version of the blog]:

In a few years, we will be at this Crossover Point [also shown at the top of this version of the blog]:

The income via dividends and distributions, from our entire portfolio, will cover all basic living expenses without touching/withdrawing any of the capital. This excludes future government benefits.

Including some cash buffer, we figure that’s a good starting point for semi-retirement to begin. Continue Reading…