By Ian Moyer

(Sponsor Content)

A Canadian couple living in Nova Scotia are approaching retirement. Carlos is 64 and his wife Arlene is 61. They have one adult adopted child who lives on their own with the couple’s three grandchildren. Carlos and Arlene live close to their daughter and help with the grandchildren often, so being able to stay in their home is important.

After two extended careers in the public sector with a combined annual income of $180,000, Carlos and his wife Arlene decided it was time to retire beginning March of the following year.

Managing the family finances Carlos and Arlene were able to save the following for retirement:

Carlos

- $250,000 Registered Retirement Savings Plan (RRSP), contributing $5500 annually until retirement

- $31,500 annually from a Defined benefit pension

- $ 21,000 in A Tax-Free Savings Account (TFSA), contributing $1500 annually

Arlene

- $290,000 Registered Retirement Savings Plan (RRSP), contributing $5500 annually until retirement

- $33,600 annually from a Defined benefit pension

- $ 30,000 in A Tax-Free Savings Account (TFSA), contributing $1500 annually

Carlos and Arlene dream of traveling to various countries and plan to take 3 trips a year and assume they would need a total of $15,000 annually to do so for 8 years. After traveling they would like to contribute to Registered Education Savings Plans (RESP) for each of their grandchildren totalling $3000 a year.

More recently, when the market experienced volatility, Carlos’ portfolio took a big hit. Making adjustments to spending, Carlos was able to recuperate most of his losses and is now back on track with his goals.

“The more you learn, the more you earn.”

— Warren Buffett

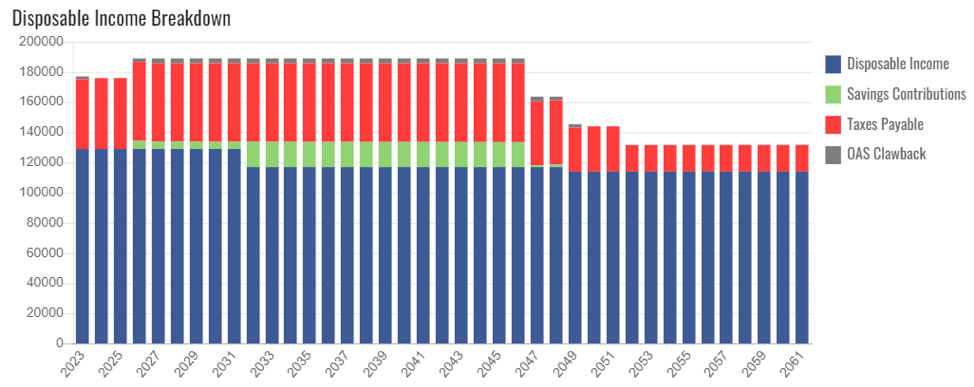

A key consideration in Cascades is to take a look at the retirement budget: using their employment income as a starting point to determine how much retirement income they require. It is well known and generally accepted that you will require less income in your retirement years, but how much less? In making this determination the couple can consider they no longer have employment income deductions like CPP and employment insurance, retirement savings, costs related to traveling to work, retirement income tax credits, etc. Carlos used their employment income after these deductions, taxes, and employment expenses and compare that with the projected retirement income. Carlos assumes he would need approximately $120,000 annually.

Carlos believes he has a good understanding of financial planning strategies, but he finds decumulation a bit overwhelming and wanted to learn more to personalize his retirement income based on their needs: using Cascades Financial Solutions retirement Income planning software and to plan for his retirement.

After entering his data into Cascades Financial Solutions Carlos’ report determined the best retirement decumulation strategy would only allow him to receive an after-tax amount of $116,945 per year.

The couple has a few options to offset the$3,055 retirement income shortage.

Life Annuity option: The couple can consider allocating some of their savings to a life annuity that could help achieve a higher sustainable retirement income. These vehicles are a great way the shift the burden of making their money last forever and can often have attractive capital payout ratios throughout the retirement years due to their “mortality credits.” Continue Reading…