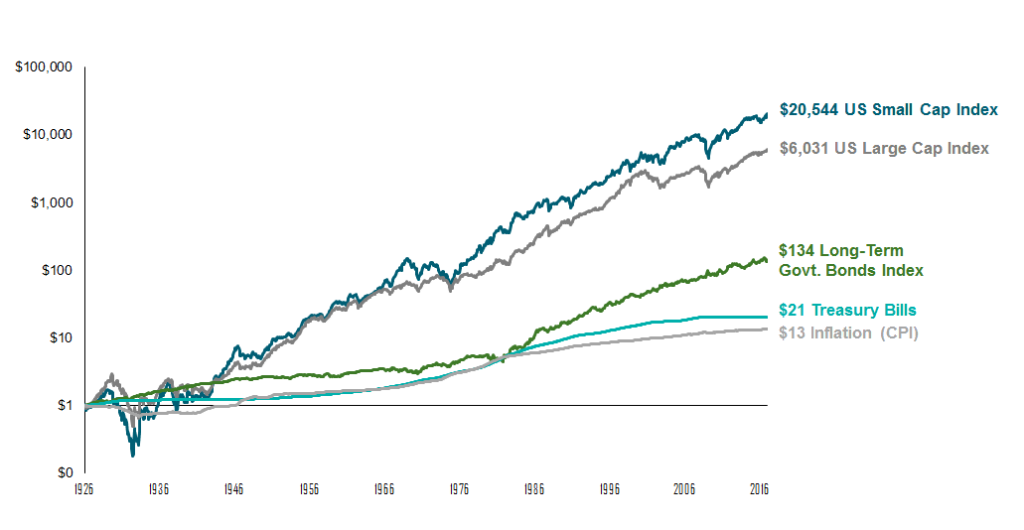

We recommend that investors follow an “evidence-based approach” with their investments. What does the evidence tell us? Investors should maintain globally diversified portfolios, keep costs low and select a mix of risky and safe investments that is suitable for their risk tolerance and financial goals.

We recommend that investors follow an “evidence-based approach” with their investments. What does the evidence tell us? Investors should maintain globally diversified portfolios, keep costs low and select a mix of risky and safe investments that is suitable for their risk tolerance and financial goals.

Once a sensible portfolio is in place, holding on through the roller coaster ride of the market’s ups and downs is key to having a positive long-term investment experience. One of the biggest reasons investors underperform market benchmarks or even the funds in which they invest is their inability to control the emotional urges which can easily lead to bad investment decisions which knock them off course.

Too good to be true

One temptation to which we often see investors succumbing is the “too good to be true” investment product pitch. For example, many investments are sold as “equity-like returns with bond-like safety.” Upon closer examination a better explanation for such products is often “equity-like or higher risk with very uncertain returns.”

There are four key criteria that you can use to assess every investment opportunity that comes across your path:

- Expected Return

- Costs and Fees

- Risks

- Liquidity (how quickly you can get your money back when you want it)

The only reason we invest is to earn a rate of return. The rate of return compensates us for letting someone else have use of our capital rather than just leaving it in a high-interest savings account in the bank. What type of return is reasonable? Well, you shouldn’t be surprised to hear that the answer is “it depends!” And what it depends on is the other three criteria: the more risk, the higher the costs and fees and the more locked-up your money is, the higher rate of return you should expect. Continue Reading…