By Noah Solomon

Special to Financial Independence Hub

I see the bad moon a-risin’

I see trouble on the way

I see earthquakes and lightnin’

I see bad times today

Don’t go around tonight

Well it’s bound to take your life

There’s a bad moon on the rise

- Creedence Clearwater Revival

The Curious Case of Missing Inflation

Prior to the global financial crisis of 2008, if you had asked me what would happen if the Fed and other central banks slashed rates to zero and then left them there for over a decade, I would have told you that it wouldn’t be long before the world faced a serious inflation problem. I would have been dead wrong!

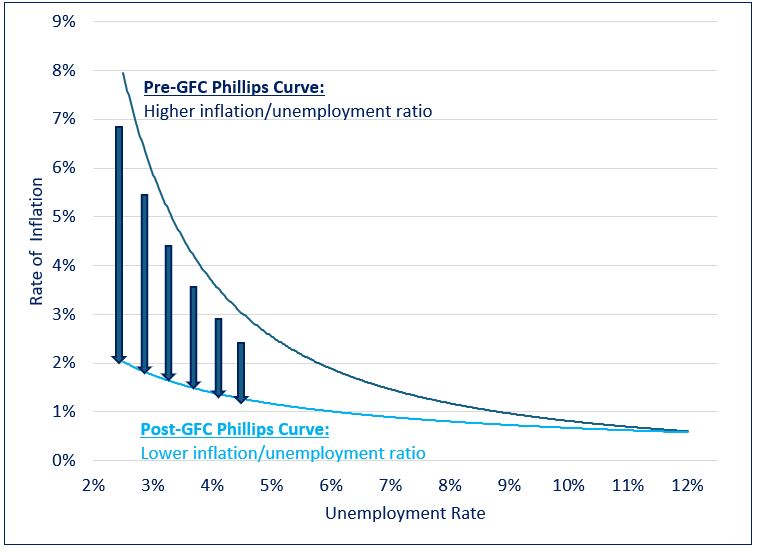

The Phillips curve is an economic concept developed by A. W. Phillips that describes the relationship between inflation and unemployment. The theory holds that there is an inverse tradeoff between the two variables. All else being equal, lower unemployment leads to higher inflation, while higher unemployment is associated with lower inflation.

Phillips’ theory proved largely resilient for most of the postwar era. However, a notable exception occurred in the years following the global financial crisis (GFC). From 2009 to 2021, despite unprecedented amounts of monetary and fiscal stimulus and record low unemployment, global prices remained unexpectedly subdued.

The Evolution of the Phillips Curve

As the chart above illustrates, in the years following the GFC the Phillips curve seemed to have shifted downward. This change allowed global economies to sustain low levels of unemployment that historically would have been accompanied by runaway inflation.

The classic unemployment vs. inflation tradeoff seemed to have vanished, leaving central bankers in the enviable position of being able to leave rates at uber stimulative levels for an extended period without spurring runaway inflation. This dynamic remained in place until 2021, when the rubber of unprecedented quantities of monetary and fiscal stimulus met the road of Covid-related supply-chain disruptions. This combination brought an abrupt end to the disinflation party of the past decade, causing central banks to raise rates at a blistering pace the likes of which had not been seen since the Volcker era of the 1980s.

Declining Interest Rates: How do love thee?

The long-term effects of low inflation and record low rates on asset prices cannot be overstated. On the earnings front, low rates make it easier for consumers to borrow money for purchases, thereby increasing companies’ sales volumes and revenues. They also enhance companies’ profitability by lowering their cost of capital and making it easier for them to invest in facilities, equipment, and inventory. Lastly, higher asset prices create a virtuous cycle: they cause a wealth effect where people feel richer and more willing to spend, thereby further spurring company profits and even higher asset prices.

Declining rates also exert a huge influence on valuations. Lower rates result in higher multiples, from elevated P/E ratios on stocks to higher multiples on operating income from assets like real estate.

According to Buffett:

“Interest rates power everything in the economic universe. They are like gravity in valuations. If interest rates are nothing, values can be almost infinite. If interest rates are extremely high, that’s a huge gravitational pull on values.”

The effects of the one-two punch of higher earnings and higher valuations unleashed by low inflation and rock bottom rates cannot be overestimated. Using monthly data, the S&P 500 posted an annualized return of 18% from the GFC low at the end of February 2009 through the end of 2021, which is roughly double the index’s long-term historical rate of return. For private equity and other levered strategies whose vintages and exits corresponded with this window, the macroeconomic backdrop was even more hospitable, resulting in windfall profits.

The China Effect giveth, and the China Effect taketh away

Given the outsized effects that inflation and rates have on markets, it is essential to consider their future trajectories. In making this determination, it is important to identify the factors which contributed to unexpectedly subdued inflation in the post-GFC era.

Perhaps the single most important factor that enabled the extended Goldilocks environment of strong growth, low unemployment, and scant inflation was a dramatic increase in global integration and international trade. In the 30 years from 1991 through 2021, total international trade rose from roughly 37% to 57% of global GDP, propelled largely by the consistently rapid growth of the Chinese economy coupled with its rapid integration into the global economy. China’s outsized contribution to global productive capacity kept inflation under wraps in circumstances which previously would have caused it to be unacceptably high.

To be sure, there are other factors that kept a lid on inflation. Productivity gains, limited military conflict, and advances in technology in particular undoubtedly played their parts. These contributions notwithstanding, the aforementioned “China effect” has been a significant contributor to disinflation in the post GFC era. However, the deflationary influence of globalization and the China effect in particular is either slowing or reversing outright.

Populism, Politics, & the Reversal of Globalization

Anti-trade rhetoric has become increasingly prevalent. Populism and economic protectionism have intensified around the globe, most notably between the U.S. and China. Whereas Democrats and Republicans seem unable to agree on whether the earth is round or flat, there is nonetheless bipartisan support for tariffs and other restrictions on trade.

The likelihood of greater global economic integration for the foreseeable future has also been reduced by a rash of geopolitical conflicts, which have caused companies to reevaluate supply chains and explore nearshoring opportunities. “Just in case” is replacing “just in time” as the guiding principle for firms seeking to fortify their supply chains.

The Aging of the World’s Factory

China is facing a rapidly aging population and a growing labor shortage. Its most recent census found that its working population actually shrunk by 38 million over the 10 years ending in 2020. By contrast, the number of those aged 65 and older increased by 60%. Relatedly, Chinese wages have doubled since the GFC, and labor shortages will only accelerate the trend. Given that China lies at the heart of global production and accounts for roughly 20% of the world’s working-age population, rising wages in “the world’s factory” will not only hinder its historical disinflationary influence, but could in fact could push up price levels globally.

Importantly, China is not alone in this regard. Most major economies are also experiencing a deterioration in the ratio of their working-age populations to retirees. In The Great Demographic Reversal, LSE Professor Charles Goodhart argues that aging populations will spur inflation. Specifically, Goodhart states that older people will continue to consume goods and services even as their retirement contributes to labor shortages.

The Green Transition & Greenflation

The “green transition” to renewable energy is expected to create what has been dubbed “greenflation.” Estimates suggest that meeting the Paris Agreement will entail a quadrupling of minerals required for clean-energy technologies by 2040. This surge in demand will inevitably exert upward pressure on prices for minerals such as nickel, lithium and copper, which in turn will contribute to broad-based inflation.

While these developments do not mean that rates cannot decline from current levels, they do suggest that the neutral setting for monetary policy (i.e. the rate which is neither inflationary nor restrictive) may be higher than what markets have grown accustomed to. It is likely that markets will have to tolerate some combination of higher rates, higher inflation, and slower growth that has been the case for most of the post-GFC era.

Investment Implications & Portfolio Positioning

A long-term shift towards a lower growth/higher inflation/higher rate regime carries significant implications for markets and portfolio positioning. In particular, such a change would usher in an interruption or outright reversal of many of the longstanding investment themes and outperformers that have characterized markets over the past several years.

The darlings of yesteryear, which include private equity, venture capital, tech stocks, and other long-duration growth assets, are unsurprisingly the very same asset classes that benefitted the most from an unusually favourable mix of strong growth and low rates. By the same token, their future prospects will be most affected by a reversion to a more normal macroeconomic environment. Consequently, investors might be well-served to reduce their exposure to PE, venture capital, and growth stocks in favour of value stocks and high-quality bonds.

From 2008 to 2016, Noah was CEO and CIO of GenFund Management Inc. (formerly Genuity Fund Management), where he designed and managed data-driven, statistically-based equity funds.

From 2008 to 2016, Noah was CEO and CIO of GenFund Management Inc. (formerly Genuity Fund Management), where he designed and managed data-driven, statistically-based equity funds.

Between 2002 and 2008, Noah was a proprietary trader in the equities division of Goldman Sachs, where he deployed the firm’s capital in several quantitatively-driven investment strategies.

Prior to joining Goldman, Noah worked at Citibank and Lehman Brothers.

Noah holds an MBA from the Wharton School of Business at the University of Pennsylvania, where he graduated as a Palmer Scholar (top 5% of graduating class). He also holds a BA from McGill University (magna cum laude).

Noah is frequently featured in the media including a regular column in the Financial Post and appearances on BNN. This article first appeared in the July 2024 issue of the Outcome newsletter and is republished here with permission.