Special to the Financial Independence Hub

“Life,” philosopher Albert Camus contended, “is the sum of all your choices.”

Do you think otherwise?

Good or bad. Easy or hard. Right or wrong. Every choice you make will impact your life to some degree.

Choices with little impact are often made without much thought and the trouble is this casual approach to decision making tends to be deployed on bigger and more impactful choices.

In my profession, as a retirement income specialist, I see poorly made choices all the time. They, unfortunately, tend to be life altering, irreversible and totally avoidable. Like a doctor passing along a gloomy prognosis, I am heartbroken to see the look on peoples’ faces when I tell them how a choice they made will put them at a disadvantage for the rest of their lives.

And, as I said, many of these damaging financial choices are often avoidable.

The Retirement Risk Zone Years (TRRZY)

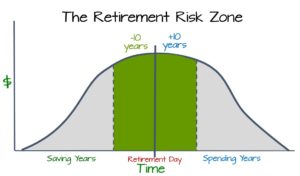

The years leading up to, and the early years of retirement are packed with important choices that can create turning points in your life. We call this period of your life ‘The Retirement Risk Zone Years’ (TRRZY).

TRRZY has aptly earned this acronym because this phase of life contains the highest concentration of high-impact choices that can lead to turning events, both good and bad, in people’s lives.

It is important to recognize that the number and frequency of tough and important choices increases during this time. In addition, the implications of choosing poorly intensify as both time and flexibility have turned from friend to foe. Successfully creating your best possible retirement years is directly linked to how well you navigate the challenging choices of TRRZY.

Over this nearly two-decade period we must adapt our thinking to a new reality. Strategies that served us well during our savings years can turn on their heads and start to work to our disadvantage as our flow of funds reverses from saving to spending. Those who fail to recognize and adapt to this new thinking have a high propensity for making poor choices, many of which they will regret in future years.

Turning Points during “TRRZY”

There is work involved in making wise choices in the year leading up to, and during, the early years of retirement. With the right tools it is not difficult work, but it does require attention, the right information, guidance and process.

Is it worth the effort? Absolutely. The alternative is the ongoing stress of wondering: Will I outlive my money?

There are significant choices that if made properly can lead to:

- Optimizing your recurring retirement incomes like CPP and OAS by wisely choosing your optimal start dates, you are rewarded with hundreds of thousands of incremental income dollars.

- Avoiding expensive tax traps. By selecting to actively and strategically shift where we choose to source each year’s required cash flow, we have the ability to pre-determine which marginal tax bracket we land, whether or not we take full advantage of income splitting and if we get clawed back on Old Age Security. The goal of better choices is to minimize the amount of taxes we pay over the balance of our lives.

- Putting pension like-disciplines in place as we choose to integrate the timing of future cash flows with our money management strategies. The goal of better choices is to mitigate our exposure to damaging market downturns.

Bottom line, the goal of better choices is to make your money work harder and last longer so you have the capacity to do more and worry less.

The tough choices during TRRZY can be broken into two distinct categories:

- The last 10 Years of Saving Prior to Relinquishing the Security of a Pay Cheque:

- How much longer should I choose to work?

- Should I choose to make work optional?

- How much more should I choose to save?

- When should I choose to stop contributing to my RRSP?

- Where should I choose to top up my final savings?

- Will I choose to downsize my home? If so, when?

- The first 10 Years of Drawing Down Upon Your Retirement Nest Egg

- When should I choose to start to collect my Canada Pension Plan / Old Age Security?

- How soon should I choose to convert my RRSP to a RRIF?

- Can I afford to financially support the lifestyle I have chosen or do I risk outliving my money?

- Where, from my various investment portfolios, will I choose to source the cash flow I require?

- Will my choices for draw down positively or negatively impact the financial future of my spouse, when I die?

- How much financial assistance can I choose to offer my children today (when they really need it) without risking putting my own financial future at risk?

- Do I choose to leave an estate to future generations? If so, how much?

As a Retirement Income specialist I see, first hand, how a little effort, the right tools and experienced guidance can help people make better choices. I have access to powerful tools that utilize state of the art technology to model your choices, compare the outcomes of each of your choices and ultimately prescribe the choice that best meets your specific situation.

Like A GPS

As baby boomers, we have come to rely on technology to make better choices. A GPS is probably the tool we are all most familiar with.

A GPS relies upon three key pieces of information – where you are now, your desired destination and your mode of transportation. Armed with this key information, your GPS identifies all possible routes (choices) you might follow to get to your desired destination. The GPS then rapidly computes millions upon millions of calculations as it measures the time it takes to travel the distance of each possible route.

The duration of travel times for each of the possible routes (choices) are compared to ultimately prescribe the route that will get you to your destination as quickly as possible. The whole process to a better choice takes milliseconds.

However, the value of a GPS does not end there. The GPS also:

- Monitors your progress along the chosen route and in a step by step fashion informs you of upcoming required actions.

- Looks ahead for the possibility of traffic congestion, construction etc. and recommends changes that improve upon the original recommendation.

Today, those who want it, have access to tools that operate on a similar basis to your GPS. They provide an elegantly simple solution to making better retirement choices.

As a pioneer in the specialized field of retirement income planning, Doug Dahmer is the founder of Emeritus Financial Strategies™ and the creator of the Designing My OK™ suite of retirement planning tools, which focus upon identifying and taking advantage of opportunities to optimize retirement income streams and minimize taxation for baby boomers transitioning from their saving years to their spending years. Visit the web site at www.EmeritusFinancial.com

As a pioneer in the specialized field of retirement income planning, Doug Dahmer is the founder of Emeritus Financial Strategies™ and the creator of the Designing My OK™ suite of retirement planning tools, which focus upon identifying and taking advantage of opportunities to optimize retirement income streams and minimize taxation for baby boomers transitioning from their saving years to their spending years. Visit the web site at www.EmeritusFinancial.com