(Sponsor Content)

With volatile markets, rising inflation and a potential economic slowdown, 2022 has proven to be a challenging year for investors. Exchange traded funds (ETFs) are effective tools for investors to help navigate these uncertain markets and can be used to help crystallize losses from a tax perspective. As 2022-year end approaches, this article provides trade ideas to help you harvest tax savings from under-performing securities.

What is Tax-Loss Harvesting?

By disposing of securities with accrued capital losses, investors can help offset taxes otherwise payable from securities that were sold at a capital gain. The proceeds from the sale of these securities can then be reinvested in different securities with similar exposures to the securities that were sold, in order to maintain market exposure.

- Realized capital gains from previous transactions can be offset by selling securities, which are trading at a lower price than their adjusted cost base.

- Investors can then use the proceeds from the security that is sold to invest in a different security, i.e. BMO Exchange Traded Funds (ETF).

- In addition to common shares, tax-loss harvesting can also be applied in respect of other financial instruments that are on capital account, such as bonds, preferred shares, ETFs, mutual funds, etc.

Considerations:

If capital gains are not available in the current year, the realized losses may be carried back for three years to shelter gains realized in those years or carried forward to reduce capital gains in upcoming years.

The ability to recognize a capital loss for tax purposes may be restricted in certain circumstances, including where the acquired security is identical to the security that is sold.

The disposed security (or an identical security) cannot be purchased during the period that begins 30 days before and ends 30 days after the disposition, otherwise the capital loss (from a tax loss harvesting perspective) is denied. Investors should consult their own tax advisor to ensure that restrictions do not apply when implementing a tax loss selling strategy

With the ETFs universe being so expansive, you have everything from broad-based ETFs all the way down to you extremely targeted ones that provide exposures to various sectors, industries, themes etc. Therefore, there are many options to serve as replacement vehicles for your securities trading at a loss.

In addition, ETFs are low cost, and since an ETF can also be well diversified (being a portfolio of securities), it allows for investors to minimize stock/ company specific risk.

ETFs are also transparent, investors will know exactly what is owned with the portfolio. Liquidity plays a critical role as well, ETFs can be traded at any time that the market is open, with intraday liquidity. This additional feature provides liquidity beyond some other investment vehicles (i.e., Mutual funds).

Considerations:

Watch for single-security risk with some ETFs that are not Equal Weighted.

Check for any potential capital gains distributions of ETFs and understand the implications of them with respect to the strategy.

For tax purposes, capital losses are based on the difference between price sold and book value.

Always consult with your tax advisor before implementing your tax-loss harvesting strategy!

Dates to Remember:

- December 28, 2022: Last day for Canadian and U.S. tax-loss selling (with T+2 settle). Please note the tables below are used for illustrative purposes only, where losses are calculated based on year-to-date.

Examples: Canadian and U.S Equites

The example below shows a number of Canadian listed companies with poor performance; we see the first company, Shopify, as once of the “biggest losers” year to date: down 79%. In this example for the purposes of tax loss harvesting, an investor may sell Shopify and buy a broad market ETF (since Shopify makes up a good percentage of the TSX) to maintain exposure to the entire market, i.e. ZCN – BMO S&P/TSX Capped Composite Index ETF. Or the investor could change the exposure entirely to something with a different exposure.

For Illustrative Purposes Only*

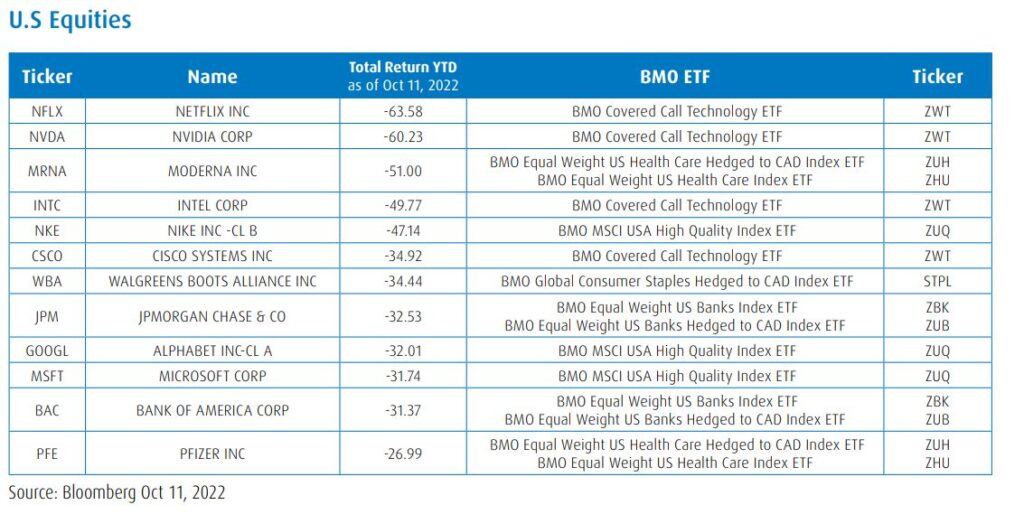

The U.S equities example below has the same thesis as the Canadian equities we covered. Ie. Netflix having a total return YTD as of Oct 11th, 2022 of -63.58% may be sold and ZWT – BMO Covered Call Technology ETF would provide a similar exposure but with more diversification.

For Illustrative Purposes Only*

Beware of “Superficial Losses”

While executing a tax loss strategy where the two securities (in this case, ETFs) are considered “identical properties” a capital loss on the sale of one followed by an immediate re-purchase (or re-purchase within 30 days) of the other would be considered a “superficial loss” for tax purposes. A best practice to avoid this is to ensure the two ETFs do not track the same index.

Sa’ad Rana has been in the financial services industry for the last 12 years in a variety of roles. In 2019 he joined the BMO ETFs sales team, supporting Portfolio Managers and Advisors in Central Canada. Sa’ad is an intrapreneur that is helping spearhead the development of BMO ETF’s Direct Channel segment. He is currently focusing working with investors and other partners to provide education, insights on ETFs within the Direct Channel segment and building relationships with key stakeholders.

Sa’ad Rana has been in the financial services industry for the last 12 years in a variety of roles. In 2019 he joined the BMO ETFs sales team, supporting Portfolio Managers and Advisors in Central Canada. Sa’ad is an intrapreneur that is helping spearhead the development of BMO ETF’s Direct Channel segment. He is currently focusing working with investors and other partners to provide education, insights on ETFs within the Direct Channel segment and building relationships with key stakeholders.

Disclaimer Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties, and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus. The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only. Commissions, management fees and expenses (if applicable) all may be associated with investments in BMO ETFs and ETF Series of the BMO Mutual Funds. Please read the ETF facts or prospectus of the relevant BMO ETF or ETF Series before investing. BMO ETFs and ETF Series are not guaranteed, their values change frequently, and past performance may not be repeated. NASDAQ®, and NASDAQ-100 Index® or NASDAQ-100 Index® Hedged to CAD, are registered trademarks of Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by the Manager. The ETF(s) have not been passed on by the Corporations as to their legality or suitability. The ETF(s) are not issued, endorsed, sold, or promoted by the Corporations. The Corporations make no warranties and bear no liability with respect to the ETF(s). Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently, and past performance may not be repeated. For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination. BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. ®/™Registered trademarks/trademark of Bank of Montreal, used under licence.