By Zayla Saunders, BMO ETFs

(Sponsor Blog)

Markets are noisy right now. Between trade talks, shifting rate expectations and recession whispers, there’s no shortage of turbulence. That’s why low-volatility strategies are back in focus: and BMO’s lineup is standing out.

Not all low-vol ETFs are created equal. In fact, BMO’s low-volatility ETFs have been quietly dominating their corner of the market. Here’s what’s working with the approach and the key differentiators of the methodology.

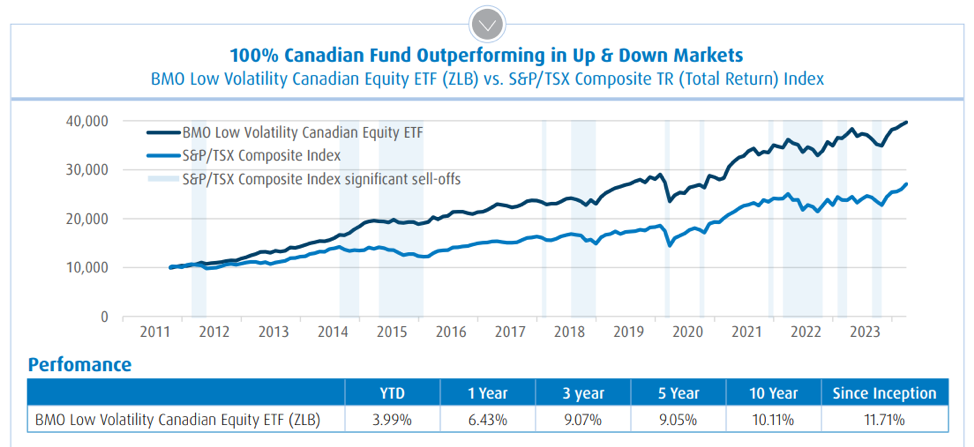

Source: Morningstar as of March 31, 2024 2

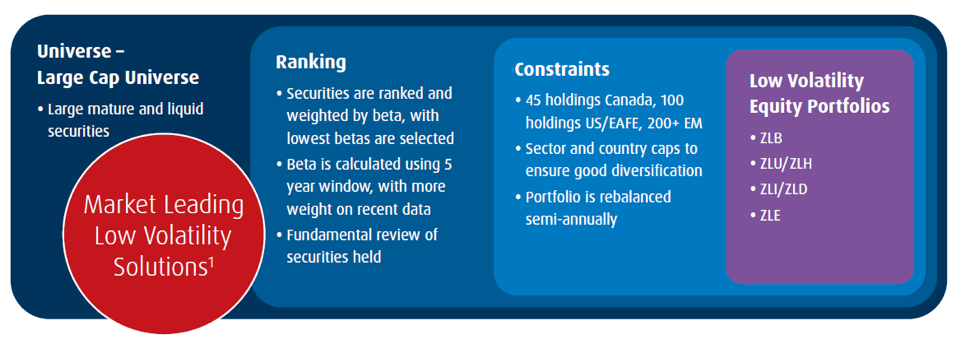

Smart, Targeted Methodology

BMO doesn’t just take the market and strip out the riskiest names. Its methodology is precise, practical, and time tested

Step 1: The Starting Point

BMO begins with a broad universe of stocks that are the largest and most liquid from a particular region — say, Canada or the U.S. — and then ranks them based on historical return volatility (also known as beta). Lower is better here.

Step 2: Ranking

Next, the securities are ranked and selected based on their beta, with lowest betas carrying the highest weight in the portfolio. Beta is calculated using 5-year window, with more weight on recent data. Then the team engages in a fundamental review of securities held.

Step 3: Sector Constraints

Unlike some low-vol strategies that end up extremely overweight in defensive sectors (hello, utilities and consumer staples), BMO imposes sector caps. Why? To ensure diversification and avoid concentration risk. That means that while there will be a tilt towards defensive sectors, you’re building a balanced, resilient portfolio.

The Burning Question: Why ‘Beta’?

Beta and Standard deviation are two of the most common ways to measure a fund’s volatility. The key difference is that beta measures a stock’s volatility relative to the market as a whole, while standard deviation measures the risk of individual stocks.

This is where BMO ETFs stands apart in their strategy: The BMO ETF Low Volatility Strategy uses beta as the primary investment selection and weighting criteria. By constructing ETFs with lower beta securities, the BMO ETF Low Volatility Strategy gives investors access to portfolios that are designed to provide growth while reducing exposure to market risk. Over the long term, low beta stocks may benefit from smaller declines during market corrections and still increase during advancing markets. Additionally, they tend to be more mature and provide higher dividend yield than the broad market.

Beta is a risk metric that measures an investment’s sensitivity to fluctuations in the broad market (market sensitivity). The broad market is assigned a beta value of 1.00, an investment with a beta less than 1.00 indicates the investment is less risky relative to the broad market.

So why now?

Low volatility has always had its place: particularly for long-term investors looking to stay invested through all market cycles, or those who tend to be more emotional around volatility in their portfolio. But right now, the case is even stronger:

- Sticky inflation and rate sensitivity: With interest rates still uncertain and growth slowing, investors are increasingly looking for defensive equity exposure.

- Volatility is back: Markets have been more reactive to headlines, earnings, and macro data. Low-vol strategies are designed to smooth the ride without giving up on equity upside.

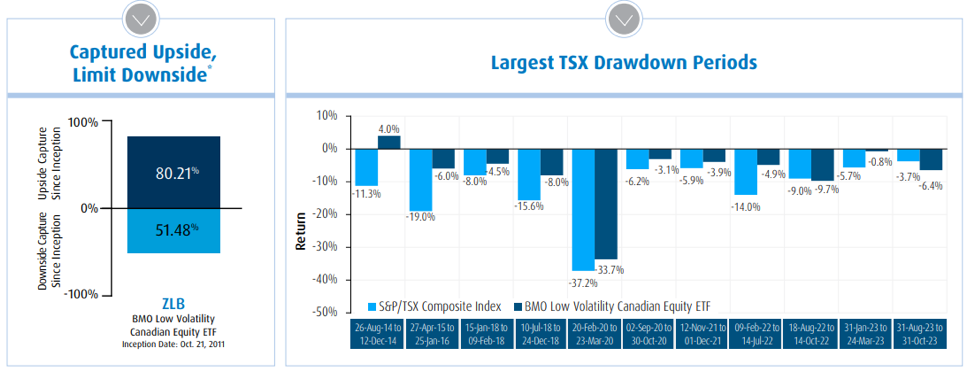

- Strong long-term track record: BMO’s low-volatility ETFs, like ZLB — BMO Low Volatility Canadian Equity ETF (Canada) and ZLU (BMO Low Volatility US Equity ETF) —have shown lower drawdowns in tough markets, while capturing most of the upside when things turn around.

Source: Morningstar data as of March 28, 2024 3

The Bottom Line

Low-volatility ETFs aren’t just for the ultra-conservative. They’re a smart solution for anyone looking to navigate uncertainty with confidence. With BMO’s thoughtful approach it’s clear why their lineup is so well-positioned right now.

If you’re looking to stay in the market, protect your downside and sleep a little better at night, BMO’s low-volatility ETFs are worth a look.

Want to learn more about ZLB, ZLU, or other defensive strategies in BMO’s lineup? Check out Factor ETFs | BMO Global Asset Management

1 Source: Bloomberg, December 31st, 2023.

2 Inception of ZLB as of October 21, 2011. Inception of BMO Low Volatility Canadian Equity ETF Fund as of May 2019. The chart illustrates the impact to an initial investment of $10,000 dollars from October 21, 2011 to March 31, 2024 in the BMO Low Volatility Canadian Equity ETF (ZLB). It is not intended to reflect future returns on investments in the BMO Low Volatility Canadian Equity ETF. The listed holdings represent the Fund’s exposure as a result of the ETF holding – BMO Low Volatility Canadian Equity ETF (ZLB) and the returns presented maybe different than the mutual fund wrapper. Index returns do not reflect transactions costs or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results

3. Based on monthly returns. ZLB as compared to the S&P/TSX Composite TR Index. Index returns do not reflect transactions costs or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results. *Upside capture measures the strategy’s performance in up market’s relative to the benchmark. Downside capture measures a strategy’s performance in down markets relative to the benchmark.

Zayla Saunders is Senior Associate, Online Distribution for BMO Exchanged Traded Funds. As a member of BMO Global Asset Management’s ETF Direct Distribution Team, Zayla brings more than a decade of experience in finance. She holds the Chartered Investment Manager (CIM) designation is a graduate of the University of Manitoba. Since joining BMO in 2020, Zayla has focused on making ETF investing accessible through strategic partnerships content creation, and industry collaborations. Know for her client-focused expertise and investment knowledge, she empowers investors to make informed, confident decisions.

Zayla Saunders is Senior Associate, Online Distribution for BMO Exchanged Traded Funds. As a member of BMO Global Asset Management’s ETF Direct Distribution Team, Zayla brings more than a decade of experience in finance. She holds the Chartered Investment Manager (CIM) designation is a graduate of the University of Manitoba. Since joining BMO in 2020, Zayla has focused on making ETF investing accessible through strategic partnerships content creation, and industry collaborations. Know for her client-focused expertise and investment knowledge, she empowers investors to make informed, confident decisions.

Disclaimers

This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance. The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only. Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus. Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated. For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination. BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. "BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.