By Noah Solomon

Special to Financial Independence Hub

A change, it had to come

We knew it all along

We were liberated from the fold, that’s all

And the world looks just the same

And history ain’t changed

‘Cause the banners, they all flown in the last war

Won’t Get Fooled Again. The Who; © Abkco Music Inc., Spirit Music Group

As inflation rapidly accelerated towards the end of 2021, bond yields woke up from their decade plus slumber breathing fire and brimstone. Subsequently, bonds have once again become a worthwhile asset class for the first time since the global financial crisis.

I will explore the historical behaviour and characteristics of bonds. Importantly, I will also discuss how they have reclaimed some of their status as a valuable part of investors’ portfolios.

Riding the Roller-Coaster for the Long Term

Notwithstanding that stocks have periodically caused investors some severe nausea during bear markets, those who have been willing to tolerate such dizzy spells have been well-compensated. In Stocks for the Long Run, Wharton Professor Jeremy Siegel states “over long periods of time, the returns on equities not only surpassed those of all other financial assets but were far safer and more predictable than bond returns when inflation was taken into account.”

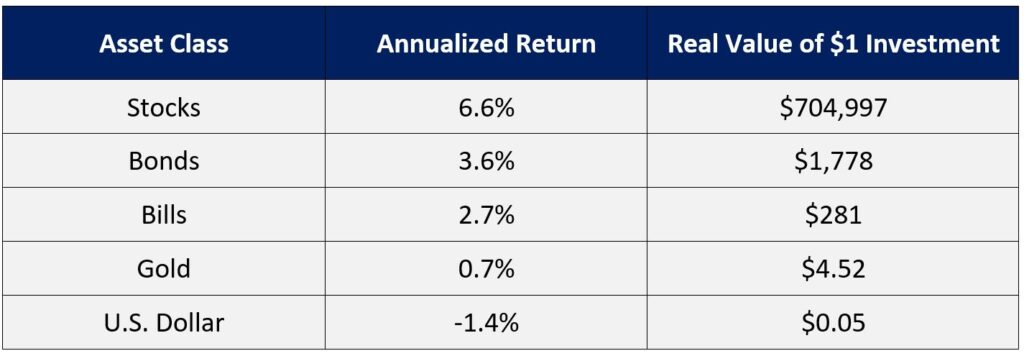

As the following table demonstrates, not only have stocks outperformed bonds, but have also trounced other major asset classes. The effect of this outperformance cannot be understated in terms of its contribution to cumulative returns over the long term. Over extended holding periods, any diversification away from stocks has resulted in vastly inferior performance.

Real Returns: Stocks, Bonds, Bills, Gold and the U.S. Dollar: 1802-2012

With respect to stocks’ main competitor, which are bonds, Warren Buffett stated in his 2012 annual letter to Berkshire Hathaway shareholders:“Bonds are among the most dangerous of assets. Over the past century these instruments have destroyed the purchasing power of investors in many countries, even as these holders continued to receive timely payments of interest and principal … Right now, bonds should come with a warning label.”

The Case for Bonds

Notwithstanding that past performance is not a guarantee of future returns, the preceding table begs the question of why investors don’t simply hold all-stock portfolios. However, there are valid reasons, both psychological and financial, that render such a strategy less than ideal for many people.

The buy-and-hold, 100% stock portfolio is a double-edged sword. If (1) you can stick with it through stomach-churning bear market losses, and (2) have a long-term horizon during which the need to liquidate assets will not arise, then strapping yourself into the roller-coaster of an all-stock portfolio may indeed be the optimal solution. Conversely, it would be difficult to identify a worse alternative for those who do not meet these criteria.

Even for those who have the emotional fortitude to stay the course through bear markets, there may be other reasons that compel investors to liquidate stocks, whether it be to fund living expenses or invest in other opportunities. Unfortunately, the markets pay no heed to the convenience of mortals. If you are lucky, the need for cash will materialize at market peaks. Conversely, if you need liquidity near market troughs, then the damage to your compounding rate and resulting negative wealth effect can be nothing short of devastating.

The Magic Elixir

For those investors who, for whatever reasons, are unable or unwilling to hold all-stock portfolios, bonds have at times proven to be a magic elixir from a portfolio perspective. The foundation of this magic is bonds’ potential to:

- Provide a reasonable return.

- Provide effective diversification from stocks during bear markets, thereby limiting overall portfolio losses.

By any measure, the bond market’s one-two punch of healthy returns and portfolio insurance over the past few decades has been impressive. The 4.71% annualized real (after inflation) return of 10-year U.S. Treasuries over the 40 years from 1981 to 2020 is nothing to sneeze at. As indicated in the table below, bonds have also provided significant diversification benefits during recent bear markets.

Recency Bias & The Jekyll and Hyde Problem

Importantly, the benefits of holding bonds over the past few decades are anomalous from a long-term historical perspective.

The 4.71% annualized real return of 10-year U.S. Treasuries over the 40 years from 1981 to 2020 stands in sharp contrast to the corresponding number of 1.36% for the 80 years from 1941 to 2020 and compares even more favourably to the -1.89% annualized real return for the 40 years from 1941 to 1980.

History also cautions against relying on bonds to diversify portfolios and mitigate losses when stocks decline. Notwithstanding that bonds provided much needed gains during the tech-wreck, the global financial crisis, and the Covid-crash, they have historically exhibited Jekyll and Hyde behaviour with respect to their correlation to stocks. The two asset classes have been positively correlated in 55% of the 93 years from 1928 to 2020, and 50% of the time since 1973.

Investors whose recency bias led them to believe that bonds are an ironclad hedge to stocks were sorely reminded of this fact in 2021, when stocks and bonds both suffered severe losses as central banks aggressively raised rates to combat inflation. Putting inflation aside, the simple fact is that when short-term rates were zero and 10-year Treasuries were yielding less than 1%, there was only so much room for bonds to provide capital gains in the event of a bear market – the math just didn’t work!

The Good News: Decent Yields & Renewed Diversification Value

The first piece of good news is that central banks’ battle against inflation has pushed rates back up to levels whereby high-quality bonds provide yields that exceed the rate of inflation for the first time in recent memory. Investors no longer need to reach out the risk curve and buy lower quality, high yield issues to avoid losing money in real terms.

The second piece of good news is that bonds have regained some diversification value. Given that (1) yields are currently at levels far above 2008-2021 levels, and that (2) central banks have been largely successful in reining in inflation, there is renewed potential for bonds to experience meaningful capital appreciation in the event of a cyclical downturn and/or bear market. This development has already played out during recent equity market hiccups. When global stocks declined 8.9% from mid-July to early August, global bonds provided much needed relief, rising 3.1%. Similarly, when equities fell 3.9% from the end of August through early September, bonds once again came to the rescue with a 1.2% gain.

The (Sort of) Bad News: We’re Not in Elysium … But We’re Not in Dystopia Either

As I have previously written, there are a multitude of factors that collectively render it highly unlikely that bonds will enjoy the tailwinds of the 1990-2020 era. The ongoing transition to renewable energy will spur demand and price increases for minerals such as nickel, lithium, and copper, which may flow through into more broad-based inflation. Perhaps more importantly, politics, populism, trade tensions, and military conflict (either potential or real) will stymie, if not reverse the explosion in global commerce that kept inflation firmly in check.

The upshot is that although bonds’ diversification potential has come a long way since late 2021, it may nonetheless be lower than has been the case over the past few decades. Fixed income markets will probably not return to the capital loss ridden dystopia of 2022, nor is it likely that they will revisit the Elysium of capital appreciation and hyper-diversification of 1990-2021. For the foreseeable future, bonds are likely to be what they have been in “normal” times throughout history – a valuable, if unspectacular asset class, providing portfolios with reasonable returns and diversification.

Noah Solomon is Chief Investment Officer of Outcome Metric Asset Management Limited Partnership.. From 2008 to 2016, Noah was CEO and CIO of GenFund Management Inc. (formerly Genuity Fund Management), where he designed and managed data-driven, statistically-based equity funds.

Noah Solomon is Chief Investment Officer of Outcome Metric Asset Management Limited Partnership.. From 2008 to 2016, Noah was CEO and CIO of GenFund Management Inc. (formerly Genuity Fund Management), where he designed and managed data-driven, statistically-based equity funds.

Between 2002 and 2008, Noah was a proprietary trader in the equities division of Goldman Sachs, where he deployed the firm’s capital in several quantitatively-driven investment strategies. rior to joining Goldman, Noah worked at Citibank and Lehman Brothers.

Noah holds an MBA from the Wharton School of Business at the University of Pennsylvania, where he graduated as a Palmer Scholar (top 5% of graduating class). He also holds a BA from McGill University (magna cum laude). Noah is frequently featured in the media including a regular column in the Financial Post and appearances on BNN.

This blog originally appeared in the September 2024 issue of the Outcome newsletter and is republished with permission.