Special to the Financial Independence Hub

Financial institutions play an important role in Canada’s economic well-being. They support growth in personal wealth, job creation and impact the country’s prosperity overall. It is my firm belief that when it comes to the household debt burden of Canadians, there is an even greater role for financial service providers to play. We have a duty to act in the best interest of our clients and proactively contribute to the financial wellbeing of Canadians.

On Wednesday (Jan 15) DUCA Impact Lab released the results of a first-of-its-kind Canadian study to capture the perceptions of Canadian borrowers and lenders, ultimately shining a light on disparities between the two groups. The research uncovers interesting new details about how Canadian borrower and lenders interact with each other and explains how borrowers are impacted by debt. You can find the full report here.

The mounting stress of debt on Canadians

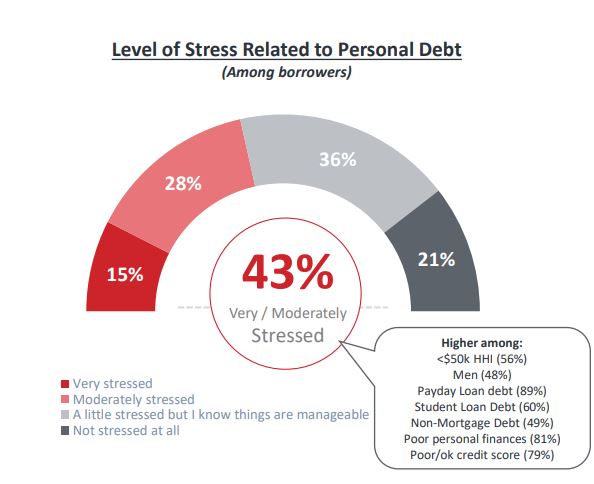

We talked to over 2,000 Canadian borrowers, nearly half of which reported that personal debt has impacted their ability to save and build wealth. It’s concerning that over one-third of borrowers surveyed report avoiding interactions with their financial advisor, despite recent Statistics Canada research which shows Canadians are spending more money than ever on debt payments.

The household debt-service ratio, which represents the percentage of after-tax income used for debt payments, rose to a record 14.96 per cent in the second quarter of 2019. This underscores the increasing need for better understanding among Canadians on how to manage existing debt. Canadians need help but they simply aren’t asking for it.

Our survey also shows debt affects access to healthcare and quality of life. Those surveyed report anxiety, trouble sleeping and poor lifestyle choices like skipping meals, eating unhealthy foods and spending more time alone.

A quarter of borrowers surveyed say they don’t trust their financial institution to guide them through their debt issues and 37 per cent report avoiding their financial services representatives due to perceived pressures to manage their finances in a way they do not feel comfortable with or because they are recommended products they do not understand. At the same time, 42 per cent of lenders surveyed report they don’t believe their clients fully understand the products they are purchasing.

This demonstrated lack of trust in financial services professionals and gaps in understanding of financial products can lead to a cycle of debt and a missed opportunity to set or prioritize financial goals.

How borrowers can take steps toward financial wellbeing

Our findings show 46 per cent of Canadian borrowers report that they feel the advice given to them by their financial institution doesn’t meet their needs or is not clearly explained. 42 per cent of lenders report that their institutions are sales-oriented as opposed to customer-oriented. The apparent communication breakdown demonstrated through our study shows borrowers can take steps towards better understanding the products they purchase. When selecting the financial institution for you, pay attention to how financial advice is positioned and whether the financial advisor is asking questions tailored to your unique financial needs and goals.

Finally, one third of lenders reported that the final product price and interest rate of financial products are dependent on whether the borrower negotiates successfully. Meanwhile, most borrowers believe prices are either dictated by the market (35 per cent) or the rates are standardized (31 per cent), demonstrating there are opportunities for borrowers to advocate on their own behalf with the right knowledge.

At DUCA our purpose is to help people do more, be more, and achieve more and our members are the owners, who sit at the center of every decision we make. We believe that should be the case across all financial institutions. This starts with providing the tools and information to guide clients effectively on their lifelong journey towards financial well-being.

As President & CEO of DUCA Credit Union and Chair of the DUCA Impact Lab, Doug Conick believes that banking can benefit everyone and he is passionate about DUCA’s mighty purpose of helping people and businesses do more, be more and achieve more. Doug is proud to play his role at DUCA in caring for our Members, our Employees, and our Community. Trained as a CPA-CA, Doug has a background in banking, insurance, investments and capital markets, and previously served as the CEO of Manulife Bank, Head of Canadian Investment Fund products at Manulife, and CFO of Manulife Japan Division.

As President & CEO of DUCA Credit Union and Chair of the DUCA Impact Lab, Doug Conick believes that banking can benefit everyone and he is passionate about DUCA’s mighty purpose of helping people and businesses do more, be more and achieve more. Doug is proud to play his role at DUCA in caring for our Members, our Employees, and our Community. Trained as a CPA-CA, Doug has a background in banking, insurance, investments and capital markets, and previously served as the CEO of Manulife Bank, Head of Canadian Investment Fund products at Manulife, and CFO of Manulife Japan Division.