By Mike Brown

Special to the Financial Independence Hub

The devastating coronavirus pandemic has flipped every aspect of life on its head and caused great uncertainty, especially when it comes to higher education in North America.

In Canada, for example, higher education institutions can’t appear to get on the same page, as some colleges will be fully online, some will be a mix between in-person and virtual classes, and some just aren’t sure what they are going to do yet.

Then there are some colleges, like Brock University, that are implementing mandatory mask policies, while others like St. Francis Xavier University are requiring all students to sign a liability waiver by August 1 to protect the school against any loss or injury related to COVID-19.

In the United States, the situation is no different, and many students and parents have no idea what colleges are going to do come the Fall. Some institutions, like Yale and the California State University system, are gearing up for another virtual semester, while others like Rice plan to reopen with social distancing regulations in place.

Harvard released a confusing plan that will bring back 40% of students next semester, while the rest will take online classes, and all will somehow pay the exact same price.

LendEDU, a personal finance website, recently published a survey that highlighted how this uncertainty surrounding higher education in North America could change the college landscape for good.

Many students considering Online College or a Gap Year during Pandemic

LendEDU’s report surveyed 1,000 respondents that were either current college students from the graduating class of 2021 or later or graduated high school seniors from the class of 2020.

The results showed that many college students are considering nontraditional alternatives to college in light of the coronavirus pandemic.

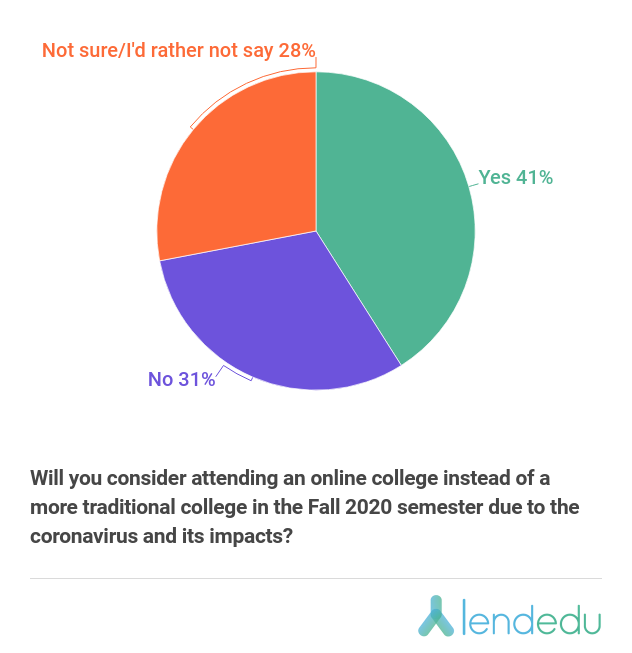

For example, 41% of undecided high school seniors are considering enrolling in online college for the Fall semester, while another 28% are not sure if they would do that yet, and 31% will not.

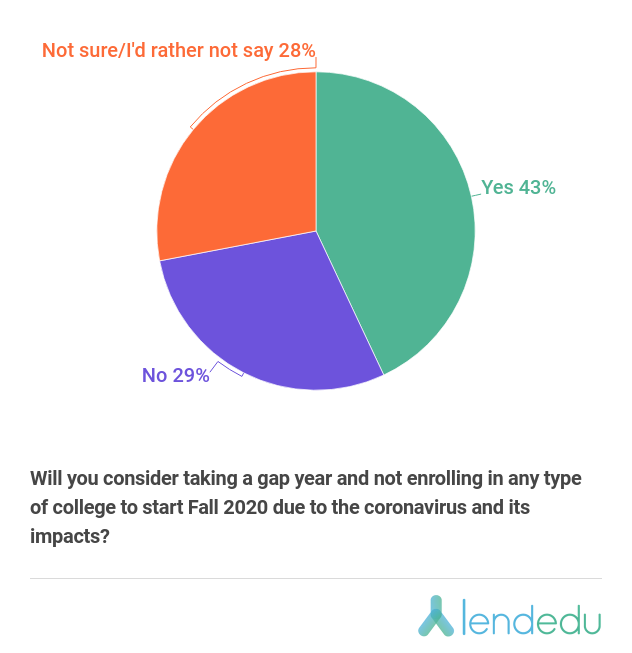

Another 43% of undecided high school seniors are thinking about just taking a gap year next year, while 28% are not sure either way, and 29% are not considering that.

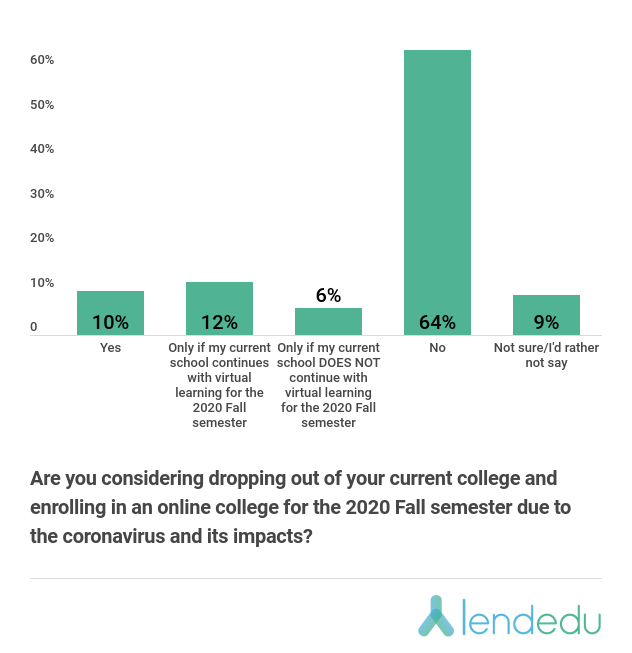

When it comes to current college students from the LendEDU report, a combined 28% are thinking about dropping out of their current school and enrolling in online college for next Fall.

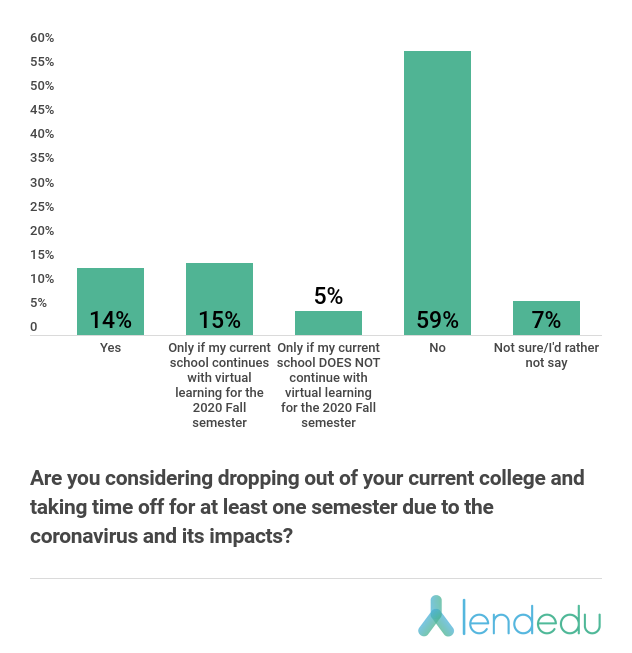

Finally, a combined 34% of current college students are weighing dropping out of their current institution and simply taking the year off next year.

The data from the LendEDU survey proves that higher education is already changing rapidly due to COVID-19, and there’s no reason to believe these changes won’t stick for good.

What Higher Education could look like in the long term

With alternatives like online college, community college, and even taking a gap year gaining popularity due to the coronavirus pandemic, traditional colleges and universities will experience a drop in demand that will force them to make changes.

One of these changes could include all colleges launching a permanent online program that all students will have the option of selecting. To keep such a virtual program competitive with actual online colleges, the higher education institutions will need to keep the tuition rate much lower compared to what they price the normal in-person higher education experience.

It is entirely possible that large tech companies, like Google and Microsoft, jump in on the online college business by launching their own programs or even by partnering with name-brand institutions like Stanford or McGill.

Another change could just be all higher education institutions finally dropping their tuition rates across-the-board to try to prevent future students from opting towards cheaper alternatives like online or community college. By dropping the cost of college, universities might also reduce the number of students that take gap years.

In summation, we will see a considerable drop in demand for traditional colleges and universities because the coronavirus pandemic has opened many eyes to cheaper alternatives like online college, and higher education institutions will need to finally adapt accordingly to remain competitive and stay alive.

In his role at LendEDU, Mike Brown uses data, usually from surveys and publicly-available resources, to identify emerging personal finance trends and tell unique stories. Mike’s work, featured in major outlets like The Wall Street Journal and The Washington Post, provides consumers with a personal finance measuring stick and can help them make informed finance decisions. You can follow LendEDU on Twitter @goLendEDU.

In his role at LendEDU, Mike Brown uses data, usually from surveys and publicly-available resources, to identify emerging personal finance trends and tell unique stories. Mike’s work, featured in major outlets like The Wall Street Journal and The Washington Post, provides consumers with a personal finance measuring stick and can help them make informed finance decisions. You can follow LendEDU on Twitter @goLendEDU.