By Lorne Marr, LSM Insurance

Disability Insurance and Critical Illness Insurance: Why the Choice Is Not Straightforward

Choosing between disability insurance and critical illness insurance is a decision filled with complexities and nuances that go beyond simply comparing premiums and payouts. One of the primary confusions arises from the overlap in coverages between disability insurance and critical illness insurance. Both types aim to provide financial support in the event of serious health issues, yet they serve different purposes.

Choosing between disability insurance and critical illness insurance is a decision filled with complexities and nuances that go beyond simply comparing premiums and payouts. One of the primary confusions arises from the overlap in coverages between disability insurance and critical illness insurance. Both types aim to provide financial support in the event of serious health issues, yet they serve different purposes.Disability insurance replaces a portion of your income if you’re unable to work due to an illness or injury. Critical illness insurance, on the other hand, provides a lump-sum payment upon diagnosis of specific conditions listed in the policy, such as cancer, heart attack, or stroke.

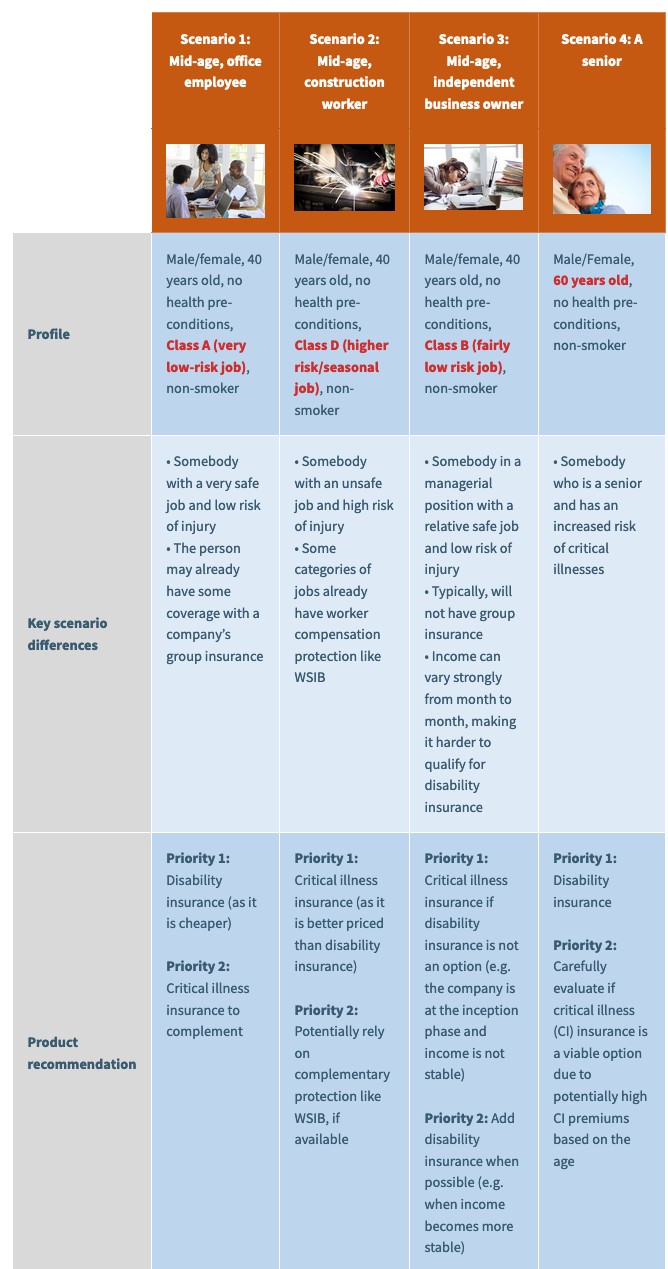

The cost of disability insurance is closely linked to one’s occupational class, with higher premiums for those in jobs deemed higher risk or seasonal. This categorization means that individuals in professions with greater physical demands or inherent risks — such as construction workers or miners — may face significantly higher costs for disability insurance. This aspect can make disability insurance less accessible or more expensive for those who potentially need it the most, complicating the decision-making process.

For freelancers, entrepreneurs, and others without a steady paychecque, obtaining disability insurance can be particularly challenging. Insurers often require proof of income to determine benefit levels, making the quoting and application process more complex for those with variable incomes.

Many people may already have some form of disability or critical illness coverage through group insurance plans provided by employers, unions, or associations. Additionally, government programs like the Workers’ Safety and Insurance Board (WSIB) in certain jurisdictions offer protection against work-related injuries and illnesses. Awareness of these coverages is essential to avoid unnecessary duplication and to identify any coverage gaps that private insurance could fill.

It is also important to note that your smoking status has a differing impact on disability insurance and critical illness insurance premiums and eligibility. Since many critical illnesses covered by these policies, such as heart disease and cancer, are directly linked to smoking, smokers may find critical illness insurance to be more expensive or harder to qualify for compared to disability insurance.

Before deciding on which one – or if both – are right for you, it’s crucial to understand these products on a deeper level. So, let’s dive in and learn more.

What are Disability Insurance and Critical Illness Products?

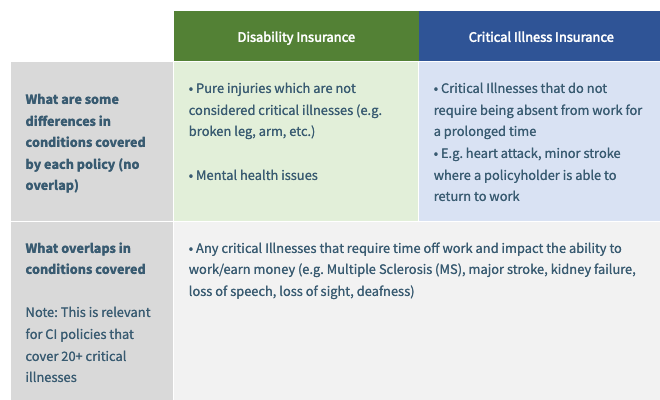

The table below provides a detailed comparison of disability insurance and critical illness insurance. Note that there are some areas of overlap between the two coverages.

Where Disability Insurance and Critical Illness Coverages Overlap

It is important to note that some health conditions are unique based on the type of policy selected, but there is still some crossover between what is covered on disability insurance, and what is covered by critical illness insurance.

If you are interested to read more about Disability insurance, here is a detailed overview of all long-term disability insurance components and all short-term disability insurance elements.

What Scenarios do we Compare and Why

We compare a few typical scenarios, which results in significant differences between critical illness and disability insurance quotes. For all the scenarios we use the following coverage values:

- Disability insurance: 70% of the current monthly salary of $7,500 = $5,250/month

- Critical illness Insurance: $300,000

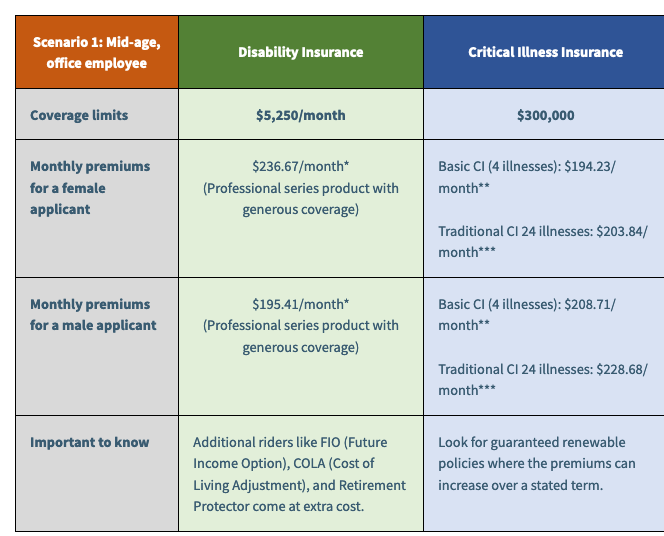

Scenario 1: Disability Insurance vs Critical Illness Insurance Premiums for An Office Employee (AKA “Safe Job”)

Job classes have a big impact on coverage, and also on the premium. See the table below for sample coverage limits. Remember, these are samples only.

Job classes have a big impact on coverage, and also on the premium. See the table below for sample coverage limits. Remember, these are samples only.

Work with a broker to get the best solution and rate for your unique situation.

*Quote as of April 2024 from RBC Insurance (w/o FIO, COLA, and Retirement Protector riders that come at additional costs)

**Quote as of March 2024 from Ivari

***Quote as of March 2024 from Manulife

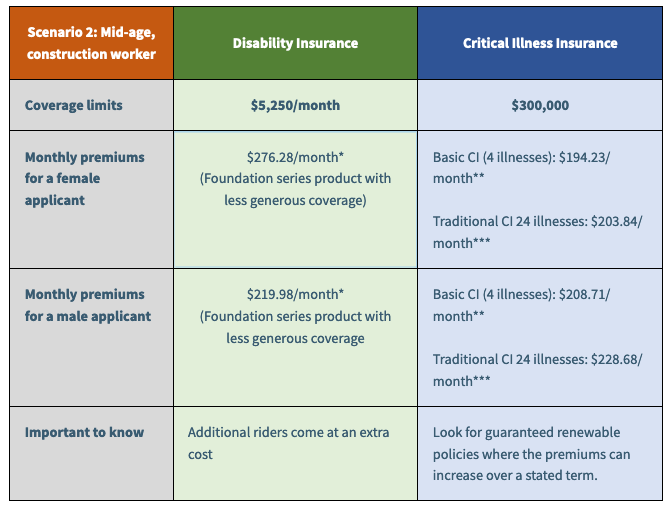

Scenario 2: Disability Insurance vs Critical Illness Insurance Premiums for a Construction Worker (AKA “Non-Safe Job”)

We just took a look at sample rates for an office worker. Let’s keep exploring how job class affects premiums. Remember, working with a broker will provide you with the best rate since your broker will compare policies and rates on your behalf.

We just took a look at sample rates for an office worker. Let’s keep exploring how job class affects premiums. Remember, working with a broker will provide you with the best rate since your broker will compare policies and rates on your behalf.

*Quote as of April 2024 from RBC Insurance

**Quote as of March 2024 from Ivari

***Quote as of March 2024 from Manulife

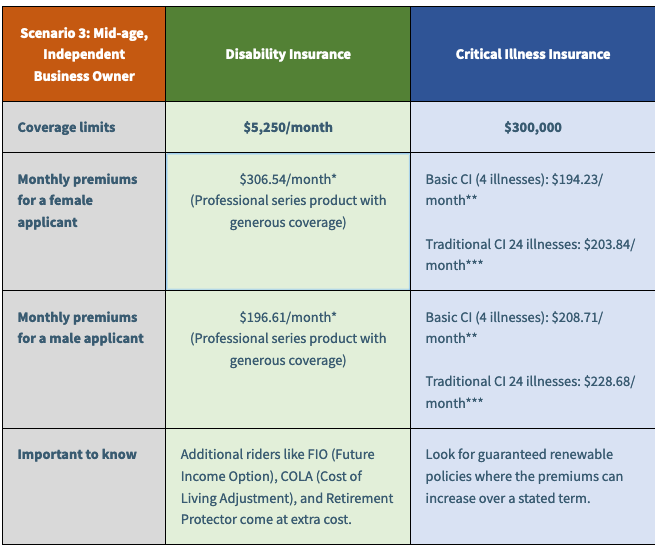

Scenario 3: Disability Insurance vs Critical Illness Insurance Premiums for a Business Owner

Unlike employees, business owners are in their own job class. Here are some sample rates based on generous coverage.

Unlike employees, business owners are in their own job class. Here are some sample rates based on generous coverage.

*Quote as of April 2024 from RBC Insurance (w/o FIO, COLA, and Retirement Protector riders that come at additional costs)

**Quote as of March 2024 from Ivari

***Quote as of March 2024 from Manulife

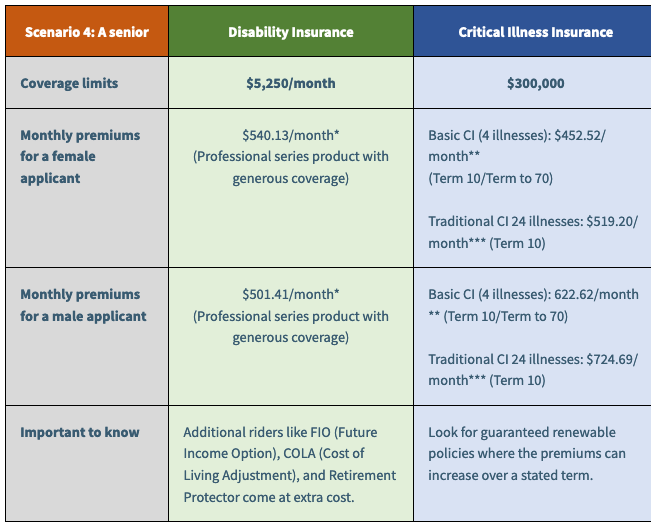

Scenario 4: Disability Insurance vs Critical Illness Insurance Premiums for a Senior Person

While not a business class, age does play a factor. Let’s look at the chart below to see how being a senior changes the premium.

While not a business class, age does play a factor. Let’s look at the chart below to see how being a senior changes the premium.

*Quote as of April 2024 from RBC Insurance (w/o FIO, COLA, and Retirement Protector riders that come at additional costs)

**Quote as of March 2024 from Ivari

***Quote as of March 2024 from Manulife

Disability and Critical Illness Insurance – Which to Choose: Summary

When considering insurance options to protect yourself and your loved ones from the financial impact of unforeseen health issues, disability insurance and critical illness insurance emerge as key components of a comprehensive insurance strategy. Both types of insurance provide essential coverage but serve different purposes, making them complementary in nature when tailored to an individual’s specific needs.

Disability insurance is designed to replace a portion of your income if you become unable to work due to a disability. This can be a lifeline, ensuring that you can continue to meet your financial obligations, from daily living expenses to mortgage payments, even if you’re unable to earn an income.

Critical illness insurance, on the other hand, provides a lump sum payment if you are diagnosed with one of the specific critical illnesses covered by the policy, such as cancer, heart attack, or stroke. This can help cover medical expenses not covered by your health insurance, or even be used for anything you choose, such as taking time off work to recover or making adjustments to your home to better accommodate your health needs.

While both types of insurance provide significant benefits, it’s important to note that they come at a cost higher than some other insurance products, like term life insurance. The premiums for disability insurance and critical illness insurance reflect the higher likelihood of a claim being made during the policy term. Therefore, deciding between these insurance products — or determining the right combination of coverage — should be made on a case-by-case basis, tailored to the individual’s occupation, health preconditions, and overall risk profile.

Working with an experienced insurance broker is crucial in navigating these complex decisions. A knowledgeable broker will have experience with both types of policies and access to products from multiple companies, allowing them to compare and contrast options to find the best fit for your situation.

At LSM Insurance, a division of Hub Financial, our brokers have these vital skills. With a deep understanding of both disability insurance and critical illness insurance, our team is equipped to offer guidance that aligns with your personal and financial needs. We pride ourselves on our ability to provide a personalized assessment, drawing from a wide range of products to ensure you receive the coverage that best suits your circumstances.

For those seeking to explore their insurance options further, we invite you to complete the quote form on this site a free assessment of your needs. This no-obligation chat with a broker is an opportunity to gain valuable insights and peace of mind, knowing that you’re making informed decisions about your insurance coverage.

Lorne Marr has been in the Life Insurance Industry for 30 years and is the Director of Business Development at Hub Financial as well as the Founder of FitInsure.ca. This blog originally appeared there and is republished here with permission.

Lorne Marr has been in the Life Insurance Industry for 30 years and is the Director of Business Development at Hub Financial as well as the Founder of FitInsure.ca. This blog originally appeared there and is republished here with permission.