By Mike Brown

Special to the Financial Independence Hub

In Canada, the debate over health care isn’t nearly as fiery as the one that is going on within the confines of its southern neighbor, the United States.

That is because Canadian citizens and permanent residents already have access to public health insurance that alleviates them from paying for health care services most of the time.

But in the U.S., the debate rages on, especially with 2020 being a presidential election year.

This election cycle is no different than any other one in recent memory because health care is once again a core issue amongst the candidates and constituents. Plans from both sides of the aisle range from maintaining the status quo to free universal health care.

What is different about this year’s presidential election is the much greater emphasis that is being placed on the student loan debt crisis and the growing cost of higher education.

Whereas before these joint-issues would have rarely been discussed at debates and rallies, they are now amongst the most discussed topics.

And it’s easy to understand why; in the U.S., the total outstanding student loan debt figure is now roughly $1.61 trillion, which makes it the second largest class of consumer debt in the country behind mortgage debt. There are 44.5 million student loan borrowers and recent ones owe $28,565 in student loan debt.

Student loan debt has gotten so out of hand in the U.S. in large part due to the ever-inflating cost of college tuition, which has outpaced the inflation rate by at least three times. Whereas the average cost of college in Canada for a Canadian citizen costs around $5,000 per year, it costs between $20,000 and $50,000 per year for an American attending college in the U.S.

So, both health care and student loan debt plus the cost of higher education will be issues that weigh heavily on the minds of American voters in the 2020 presidential election.

With this in mind, LendEDU, a personal finance company, conducted a survey of 1,000 Americans of voting age to gauge their preferences on the two topics.

60% of Americans prefer free Universal Health Care to complete Student Loan Debt Forgiveness

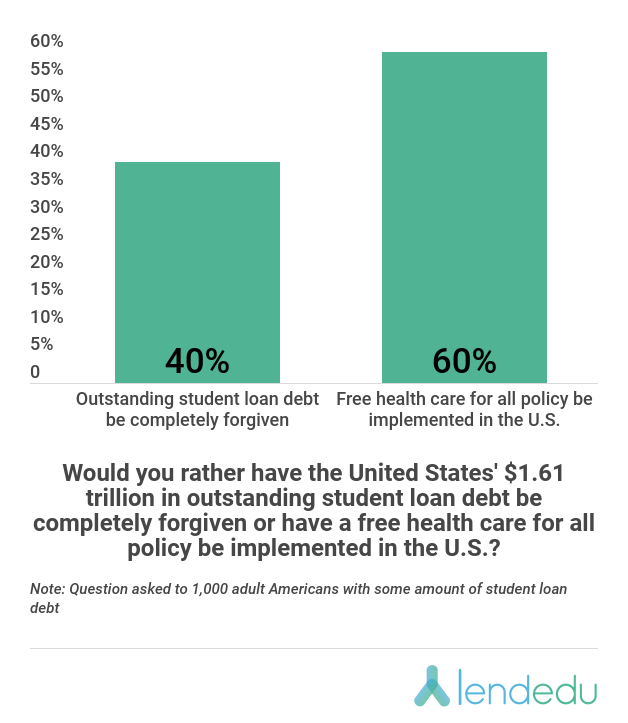

LendEDU’s survey first asked respondents the following: “Would you rather have the United States’ $1.61 trillion in outstanding student loan debt be completely forgiven or have a free health care for all policy be implemented in the U.S.?”

While 40% of poll participants opted for complete student loan forgiveness, the majority (60%) still wanted free universal health care instead.

In terms of cost, forgiving the nation’s student loan debt would cost somewhere around $1.61 trillion, while free universal health care would cost anywhere from $25 trillion to $36 trillion over 10 years. Further, while the average student loan debtor owes $28,565 in student loan debt, the average cost of health insurance was $18,764 for the average American family in 2017, with $5,714 of that coming from out of the pocket.

58% of Americans want Free Universal Health Care Over Free Four-Year College

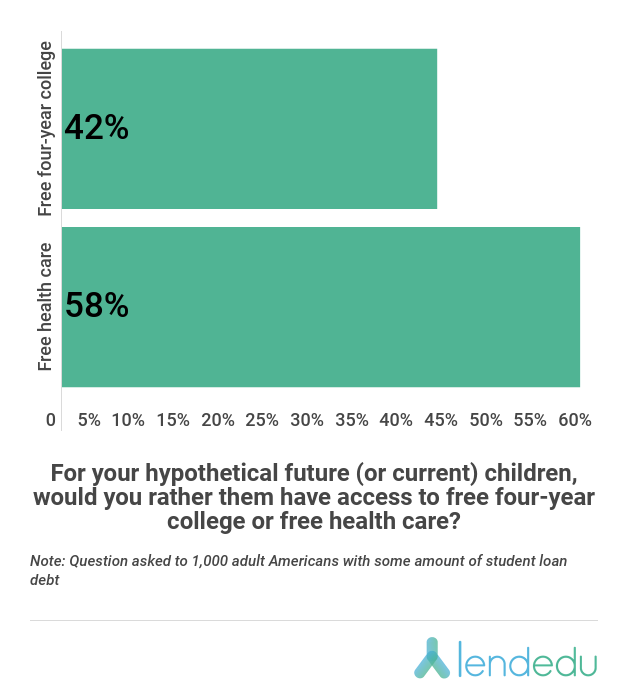

The second question of LendEDU’s report asked this: For your hypothetical future (or current) children, would you rather them have access to free four-year college or free health care?

This question proved to be a bit of a tighter race, but not by much; 58% of adult Americans still wanted free universal health care compared to the 42% that wanted free four-year college.

When it comes to what free four-year college would cost the U.S., Senator Bernie Sanders, a presidential hopeful, submitted a plan that estimated providing free four-year public college to all would cost around $70 billion per year. If one was to account for private institutions as well, this cost per year would likely cost well past $100 billion.

In his role at LendEDU, Mike Brown uses data, usually from surveys and publicly-available resources, to identify emerging personal finance trends and tell unique stories. Mike’s work, featured in major outlets like The Wall Street Journal and The Washington Post, provides consumers with a personal finance measuring stick and can help them make informed finance decisions.

In his role at LendEDU, Mike Brown uses data, usually from surveys and publicly-available resources, to identify emerging personal finance trends and tell unique stories. Mike’s work, featured in major outlets like The Wall Street Journal and The Washington Post, provides consumers with a personal finance measuring stick and can help them make informed finance decisions.