By Winnie Jiang, Vice President, Portfolio Manager, BMO ETFs

(Sponsor Content)

Little about the current economic cycle has conformed to historical norms. With divergence in employment data and leading economic indicators, recent data released sent mixed signals that left investors perplexed about the near-term economic outlook.

On one hand, the job market remains overwhelmingly strong, with ISM (Institute for Supply Management) Services bouncing back from extreme lows in December and retail sales also rebounding. The re-opening of the Chinese economy will likely provide a breather on global supply chain issues while boosting demand. Consumer credit remains well retained as default rates stay low with no warning signs of near-term upticks.

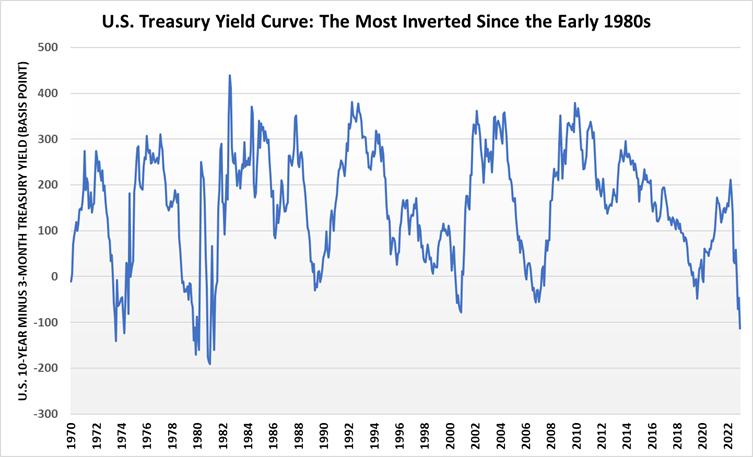

On the other hand, yield curve inversions, a precedent of most recessions, continue to worsen. 3-month U.S. Treasury yields are pushed above 10-year yields by the widest margin since the early 1980s. ISM Manufacturing PMI (purchasing managers’ index) and housing data also point to a gloomy outlook. Corporate sentiment and capital expenditure showed little signs of recovery, and housing permits have rolled back to pre-pandemic levels after surging strongly during Covid.

Source: Bloomberg, January 31st, 2023

The Outlook

While robust job markets and consumer data keep inflation well above the Fed’s long-term target, recent CPI (Consumer Price Index) announcements indicate things are steadily, albeit slowly, moving towards the right direction. The inversion of the yield curve caps the magnitude of further rate increases that could be absorbed by the economy before it slips into a recession.

Central bankers are well aware of the long and variable lag between interest rate hikes and their impact on the real economy. It is fair to expect the Fed (Federal Reserve) and BoC (Bank of Canada) to take a pause on hiking interest rates in 2023, while they patiently monitor macro trends as disinflationary forces, such as loosening supply chain shocks and lower home prices work their way through the economy.

The Opportunity

As markets and economies continue to recalibrate, investors are wondering how to position defensively. With higher yields and persistently wider credit spreads going into 2023, short term investment grade bonds may let investors benefit from those higher yields of the short end of the curve, while better managing duration and credit risks. BMO Short-Term US IG Corporate Bond Hedged to CAD Index ETF (ticker: ZSU) and BMO Short Corporate Bond Index ETF (ticker ZCS) are two examples providing this exposure.

BMO High Quality Corporate Bond Index ETF (ticker: ZQB), composed of A+ rated corporate bonds, is another solution for investors who may want better quality exposure. BMO Ultra Short-Term Bond ETF (ticker: ZST), and BMO Ultra Short-Term US Bond ETF (ticker: ZUS.U) can complement an investors’ fixed income portfolio, providing liquidity and yields above 4%. These ETFs can be used as an alternative to savings-account ETFs as investors can take advantage of wide credit spreads while staying nimble in this fast-moving market environment.

Winnie Jiang is a portfolio manager and trader who joined the BMO ETF team in June 2021. Winnie is responsible for managing and trading both Canadian and international passive fixed income mandates, including government bonds, investment-grade and high-yield corporate bonds, real return bonds, etc. Winnie has over 10 years of experience in the investment industry covering both active and passive mandates. Winnie holds a Bachelor of Commerce degree from the University of Toronto and is a CFA charter holder.

Winnie Jiang is a portfolio manager and trader who joined the BMO ETF team in June 2021. Winnie is responsible for managing and trading both Canadian and international passive fixed income mandates, including government bonds, investment-grade and high-yield corporate bonds, real return bonds, etc. Winnie has over 10 years of experience in the investment industry covering both active and passive mandates. Winnie holds a Bachelor of Commerce degree from the University of Toronto and is a CFA charter holder.

Disclaimer: Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus. This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax, or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance. Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently, and past performance may not be repeated. For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination. BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. ®/™Registered trademarks/trademark of Bank of Montreal, used under license.