By Dale Roberts

Special to the Financial Independence Hub

When I was an advisor at Tangerine Investments I would have many more-than-interesting conversations with clients about short-term economic and political events; especially over Donald Trump. For those of you who do not live under a rock, Donald Trump is the more than controversial President of The United States. Mr. Trump went from real estate magnate and reality TV show host to the most important chair in the world. Many will write and say that the President who resides over the world’s largest and most influential economy and the world’s most powerful armed forces (by many times over) is the most ‘powerful person’ in the world.

So as investors, and for those who manage money, we should pay attention to what the most powerful person on earth does and says, right?

Nope.

As investors, we don’t invest in Presidents or Prime Ministers, we invest in economies and the companies that help drive those economies. With respect to investing in the U.S. the world’s greatest investor, Warren Buffett, often writes …

Never bet against America.

And heading into the Presidential elections of 2016 Mr. Buffett (a vocal Democrat and Hillary Clinton supporter) offered in a Nasdaq interview …

“America works … I’ve said this before, it’ll work wonderfully under Hillary Clinton, and I think it’ll work fine under Donald Trump … For 240 years it’s been a terrible mistake to bet against America, and now is no time to start.”

Ahhh, and there’s the very powerful and destructive key phrase tucked into that sentience; the two words “bet against.” If you make a short-term move, make a guess on a short term event, you’ve just turned investing into betting/gambling. You’ve turned investing into trading. As the saying goes, on the list of the world’s most successful investors you won’t find any traders.

Successful investors have a long-term outlook and a long-term holding period. Boring works. Excitement is for the casino. When asked what is his favourite holding period for a stock or investment Mr. Buffett will reply “forever.”

So don’t listen to me, but you might listen to the word’s greatest investor: who often states that he has never invested based on a short-term economic event or economic prediction or political event or political commentary.

An investor with a well-balanced portfolio will likely invest in US and International markets. When we invest in America we often own market-leading companies such as Apple, Microsoft, Johnson & Johnson, Walmart, Home Depot, McDonald’s, Coke and Pepsico, Costco, Amazon, Google, Netflix, AT &T, Exxon Mobil, Clorox, Facebook, Colgate-Palmolive, Goldman Sachs, and even Mr. Buffett’s conglomerate Berkshire Hathaway.

You’re not investing in Donald Trump, you’re investing in McDonald’s.

Investors can ignore the midterm elections

If you now understand that you don’t need to pay attention to the current President of the United States, you also do not need to pay attention to the next President of the United States, nor do you need to pay attention to the next group of Congresswomen and Congressmen and Senators who will fill the seats of The House of Representatives. You can ignore the midterm elections on Tuesday November 6th, 2018. You can ignore the Presidential election that will follow two years later.

But you might shoot back with the ‘truth’ that The President and the House of Representatives as lawmakers will set the stage for these businesses and they can affect the economy and the performance of your Home Depot’s and Microsoft’s.

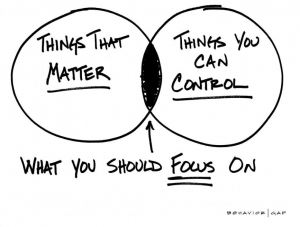

I’ll answer that challenge with a wonderful chart courtesy of Carl Richards who wrote the must-read book, The Behaviour Gap.

So it’s true that President’s and lawmakers Matter when it comes the running of economies, but guess what? That’s out of your control. You can’t control the outcome of the elections. You can’t control the actions of the folks who get elected. You can’t count on politicians to actually do what they say they will do.

So it’s true that President’s and lawmakers Matter when it comes the running of economies, but guess what? That’s out of your control. You can’t control the outcome of the elections. You can’t control the actions of the folks who get elected. You can’t count on politicians to actually do what they say they will do.

And on things that matter, here’s an example of what Mr. Trump was able ‘to do.’ President Trump was able to convince The House of Representatives to pass laws that lowered taxes for businesses and individuals. That’s a positive event, right? Sure many of the financial analysts and economists certainly measured the positive impact. Lower taxes can enable greater profits, and long-term more free cash flow that companies can use to invest in their businesses. The stock markets rewarded patient investors with higher stock prices and an event they called The Trump Rally.

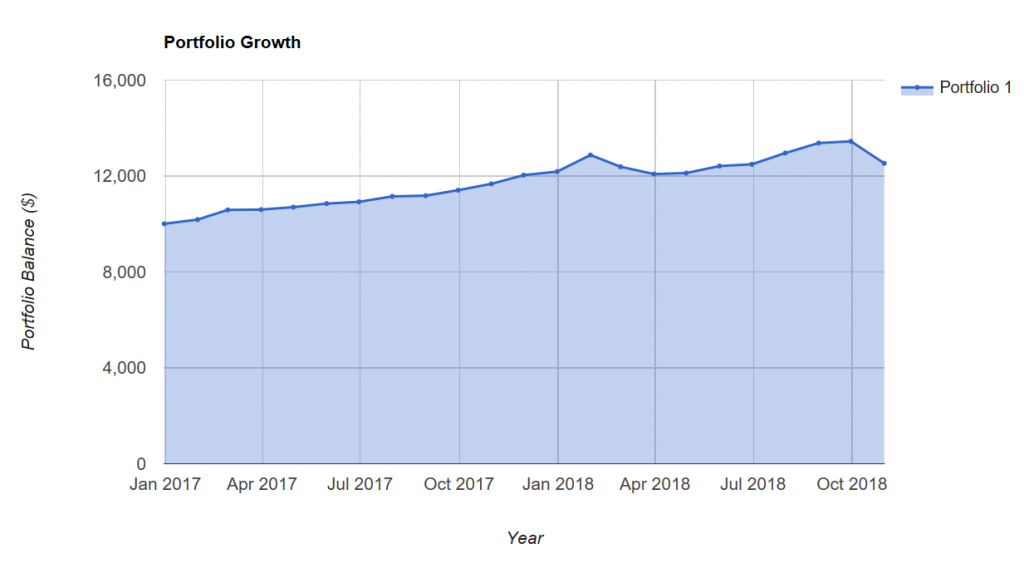

Here’s the US stock market returns represented by the US Dollar S&P 500 ETF – IVV. The chart is courtesy of portfoliovisualizer.com. The period is January of 2017 to end of October 2018. Mr. Trump took office on January 20, 2017.

During this period the US stock market delivered a 13.06% annual return (CAGR).

If you thought Mr. Trump was going to make a terrible President and you moved your monies out of US stocks or funds, well, you missed out. Your Behaviour just created an investment returns Gap. US stocks beat the pants off of International developed markets that offered a 7% annual returns and for Canadian markets (gulp) the period only delivered less than 2% annual.

We should also remember that in the runup to the Presidential elections the market-makers got it wrong, wrong and wrong again. First they loved Hillary, then they didn’t want her elected. When Mr. Trump was elected the futures markets took a tumble. Mr. Trump was supposed to be terrible for markets and ‘everything.’ We now know that US companies and stock markets survived and thrived. These were all wonderful opportunities or invitations to make a short-term guess, and potentially lose monies or lose out on long-term gains.

What about the Trump Rally?

But now they say the Trump Rally is over. All of that good news is already priced into the stocks. You’ve been rewarded. The market and the analysts have already moved on. Already? That was quick. But that’s not surprising to those of us who have observed stock market behaviour for decades.

Also Can President Trump Really Take Credit for the Stock Market Rally? In that article Barbara Friedberg offers some wonderful insights. There are so many moving parts to an economy and stock market. And many US companies earn a significant portfolio of their profits overseas. US Presidents can control effect and control only ‘so much.’

There’s simply too many things outside of their control. There’s too many things outside of your control to make these short-term events ‘investable.’

Let’s end on that black-shaded area from the Behavior Gap image: What You Should Focus On. A few of the most important things that we can control are the fees that we pay, our asset allocation (our mix of stocks and bonds), how much and when we invest. I also hope you can also control yourself, your behaviour. Successful investing can usually be found by way of doing less, not more. Find your investment mix at the appropriate level of risk. Set it and forget it. Wind it up and let it go.

Get some advice from a fee-for-service planner

If your personal scenario is getting more complicated I’d suggest you might seek some advice by way of a fee-for-service financial planner.

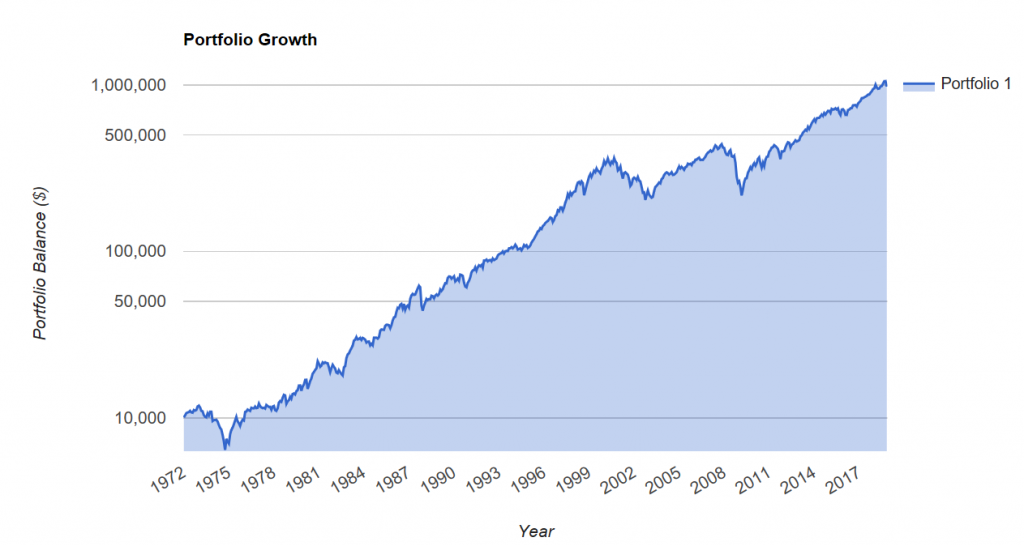

An investor needs to be a long-term optimist. Logically, we would not invest if we did not believe that the economies of the developed world will not continue to grow. The US and developed stock markets have delivered wonderful growth and returns over the decades.

The only bet worth making is the likelihood that this long-term trend will continue. Here’s the US markets from 1972. Along that route that turned $10,000 into $1,000,000 there have been a million events, all fit to ignore.

Thanks for reading.

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. He can be reached at cutthecrapinvesting@gmail.com

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. He can be reached at cutthecrapinvesting@gmail.com