By Erin Allen, CIM, VP Online ETF Distribution, BMO ETFs

(Sponsor Content)

It’s simple, innovation has the potential to create higher productivity: the same input generates higher output. As productivity moves higher, more goods and services are produced, and as such the company or the economy grows.

Innovative companies in turn will displace industry incumbents as they see an increase in efficiencies and productivity leading them to gain market share. The long-term growth potential of these innovative companies is what investors in this space are after.

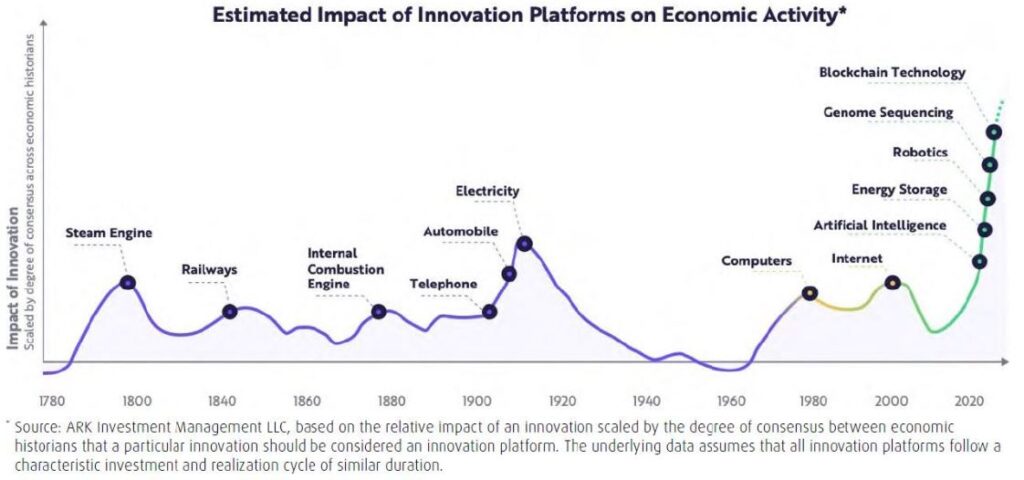

In the late nineteenth century, the introduction of the telephone, automobile, and electricity changed the way we communicated, travelled, transported, and powered our economy. The world’s productivity went through the roof as costs dropped, creating demand across sectors.

Source: BMO ETFs, Nov 2022

Today, the global economy is undergoing a technological transformation that will shape the future. Innovations in areas such as artificial intelligence, robotics, DNA sequencing, energy storage and blockchain technologies are evolving at a rapid rate and seeing cost declines that are expected to further lead this growth.

BMO Global Asset Management offers three ETF series in partnership with ARK Invest that focus on disruptive innovations. BMO ARK Innovation Fund ETF Series (ARKK), BMO ARK Genomic Revolution Fund ETF Series (ARKG), and BMO ARK Next Generation Internet Fund ETF Series (ARKW). ARK believes innovations should meet three criteria and invests accordingly in these unconstrained, high-conviction portfolios.

3 Criteria for Innovations

- Dramatic cost declines

- Cuts across sectors and geographies

- Serves as a platform for additional innovations.

For illustrative purposes only. Source: ARK Invest

Innovation ETFs can serve as a complement or a growth sleeve in a traditional well diversified portfolio. These innovation ETFs are for investors who have a longer time horizon and can serve as an effective complement to Canadian focused portfolios that are typically less exposed to technology. Below is an outline of two simple strategies for portfolio construction using BMO’s ARK ETF Series.

- Core Satellite Approach: Asset Allocation ETF & High Growth ARK ETFs

- For the core portfolio you can build your own or select an appropriate Asset Allocation ETF

- You can add a satellite position in an ARK ETF to add higher growth potential over the long term

- Barbell Approach: Low Volatility & High Growth ARK ETFs

- Pair a low volatility ETF such as BMO Low Volatility US Equity ETF (ZLU) with an ARK ETF to balance the higher risk growth solution with a lower volatility solution

To those visionaries who believe in the power of innovation to change the way we live BMO’s partnership with ARK brings investors in Canada the option to invest in these game-changers. DNA sequencing innovations are aiming to cure cancer and other diseases (not just treat them). Blockchain technology is shaping the future of the internet (web 3.0) and solving problems around data security. We have our share of problems in the world today, but innovation solves problems.

To Learn More Click Here

Erin Allen has been a part of the BMO ETFs team driving growth since the beginning, joining BMO Global Asset Management in 2010 and working her way through a variety of roles gaining experience in both sales and product development. For the past 5+ years, Ms. Allen has been working closely with capital markets desks, index providers, and portfolio managers to bring new ETFs to market. More recently, she is committed to helping empower investors to feel confident in their investment choices through ETF education. Ms. Allen hosts the weekly ETF Market Insights broadcast, delivering ETF education to DIY investors in a clear and concise manner. She has an honors degree from Laurier University and a CIM designation.

Erin Allen has been a part of the BMO ETFs team driving growth since the beginning, joining BMO Global Asset Management in 2010 and working her way through a variety of roles gaining experience in both sales and product development. For the past 5+ years, Ms. Allen has been working closely with capital markets desks, index providers, and portfolio managers to bring new ETFs to market. More recently, she is committed to helping empower investors to feel confident in their investment choices through ETF education. Ms. Allen hosts the weekly ETF Market Insights broadcast, delivering ETF education to DIY investors in a clear and concise manner. She has an honors degree from Laurier University and a CIM designation.

Disclosure:

This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

Commissions, management fees and expenses (if applicable) all may be associated with investments in mutual funds. Trailing commissions may be associated with investments in certain series of securities of mutual funds. Please read the fund facts, ETF facts or prospectus of the relevant mutual fund before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Distributions are not guaranteed and are subject to change and/or elimination.

For a summary of the risks of an investment in the BMO Mutual Funds, please see the specific risks set out in the prospectus. ETF Series of the BMO Mutual Funds trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

®/™Registered trademarks/trademark of Bank of Montreal, used under license.