By Ambrose O’Callaghan, Harvest ETFs

(Sponsor Blog)

On Wednesday, August 21, 2024, Harvest ETFs introduced another innovative product in its growing lineup: Harvest High Income Shares ETFs.

These single-stock ETFs invest in top, well-favoured U.S. stocks, with a focus to provide high income every month from covered call writing.

The Top U.S. Stocks in Scope

Eli Lilly. A dominant global pharmaceutical manufacturer and distributor.

Amazon. A global e-commerce giant that has established a massive logistics network and an innovator in enterprise cloud computing.

Microsoft. A global leader in software services and solutions, as well as hardware technology.

NVIDIA. Established as a huge force in the semiconductor industry, with its graphics processing units (GPUs) at the forefront of the AI revolution.

These U.S. stocks are well known and sought after. They are four of the largest and most widely held stocks in today’s market. They offer a significant building block for covered call writing strategy, in that the shares of these massive companies have very deep and liquid option markets. Further, the level of volatility that accompanies the share prices is high. That makes these great stocks for Harvest’s active and flexible covered call writing strategy.

The Harvest Process: Strong focus on High and Reliable Income every month

Record matters, and Harvest has it. For 15 years and counting, Harvest has pursued an active covered call writing strategy focused on generating high income, every month for investors in its Income ETFs lineup. Supported by its proven covered call strategy, Harvest has delivered nearly $1 billion in total monthly cash distributions over its 15-year history to investors.

This new, innovative product line, focuses on investing in shares of a single company targeting the largest, most widely held U.S. stocks. Harvest’s investment team — with a combined six decades of investment experience — will use Harvest’s well-established covered call writing strategy to provide high monthly income to investors while delivering on what sets Harvest apart; that is, ensuring that investors enjoy not just high, but consistent, stable, predictable, and reliable income each month.

The premium income from covered call writing can be treated as capital gains. That means the high income that the Harvest High Income Shares ETFs seek to provide can be regarded as being among most tax-efficient income. The Harvest High Income Shares ETFs are organized as Canadian Trust Units and are available in Canadian and U.S.-dollar-denominated Units. As open-end mutual funds listed on an exchange (“ETFs”), on the TSX, they provide trading and reporting flexibility for Canadian investors.

Innovation, High Monthly Income, and Upside

The covered calls strategy used in the Harvest High Income Shares ETFs will operate with up to 50% write level. Harvest’s portfolio management team has stress tested these equities with an average 2-year implied volatility. It found they can produce high levels of income at much lower write levels. Therefore, a 50% write level, in their view, provides a conservative floor to ensure unitholders will be able have reliable high-income generation every month.

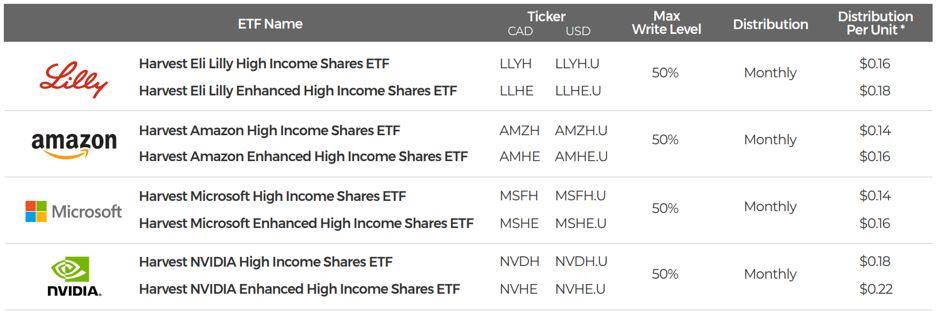

For investors who want higher income and growth potential, Harvest has also introduced the Enhanced series. The Enhanced Series uses modest leverage at around 25% to provide greater income every month and greater growth potential. With the use of leverage, the Enhanced series have a higher risk rating of medium to high. The Harvest High Income Shares ETFs will have initial distributions in the range of CAD $0.14 to $0.22 per unit (see Chart below). Each ETF was launched at a NAV price of $12.00 per unit offering investors an affordable way to gain exposure to these highly priced stocks.

Summary

Each Harvest High Income Shares ETF invests in a single top U.S. stock and overlays an active and flexible covered call strategy on the portfolio holdings of up to 50%. Investors have four widely held stocks to which they can get exposure at a lower price point relative to owning the stocks directly: Eli Lilly, Amazon, Microsoft, and NVIDIA.

Moreover, each ETF is focused on generating high monthly income that’s tax efficient while providing exposure to the upside of the individual stock. The Harvest High Income Shares ETFs are listed on the TSX, each as a Canadian trust, and their units are available in CAD or USD.

As well, each comes in a non-levered and levered/enhanced series for investors to explore. Harvest ETFs is pleased to bring these products to market. Products that align with its investment philosophy which includes investing in strong companies that are leaders in their respective industries. With all its income products, Harvest is known to deliver consistent, reliable and predictable cash distributions to investors each month.

Learn more about these new innovative products and get crucial market insights by subscribing to our newsletter.

Ambrose O’Callaghan is Senior Copy Writer at Harvest ETFs. Ambrose brings over a decade of experience in the financial services industry to the Content Editor role. He is responsible for providing context to current trends, developments, and analyses to help make sense of the ETF market and emerging themes. With a strong knowledge of the Canadian equity markets and Harvest products, Ambrose regularly provides commentary on a broad array of market topics.

Ambrose O’Callaghan is Senior Copy Writer at Harvest ETFs. Ambrose brings over a decade of experience in the financial services industry to the Content Editor role. He is responsible for providing context to current trends, developments, and analyses to help make sense of the ETF market and emerging themes. With a strong knowledge of the Canadian equity markets and Harvest products, Ambrose regularly provides commentary on a broad array of market topics.

Disclaimer Commissions, management fees and expenses all may be associated with investing in Harvest High Income Shares ETFs (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. The content of this article is to inform and educate and therefore should not be taken as investment, tax, or financial advice. Distributions are paid to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into Class A and Class U units of the Fund. If the Fund earns less than the amounts distributed, the difference is a return of capital.