By Mark Seed, myownadvisor

Special to the Financial Independence Hub

The markets are down, inflation remains hot, and interest rates are moving higher.

Are you worried?

I’m really not that worried.

I’ve been preparing for higher interest rates for years, well before the pandemic.

Case in point: this post is literally from five years ago.

Where am I going???

Well, readers of this site will know I’m a big fan of companies that reward shareholders with dividends.

And why not love dividends?

Although I use a few indexed products in my investment portfolio, for extra diversification just in case, getting paid on a consistent, growing basis from Canadian and U.S. stocks: that’s a beautiful thing. I got another raise this week that I’ll link to below!

Digging deeper, I’m not that worried about the markets or inflation right now. There is a reason why dividends matter to me. Why do dividends really matter?

Beyond the Canadian dividend tax credit, beyond consistent payments and ever growing income I’ve experienced to date, dividends help me stick to my plan.

There is no financial advisor in my plan, nor fees paid to any advisor in my plan.

There is no day trading, there are no wasted fees or losses for trading.

There is no wild market speculation, I’m not trying to time anything.

I focus on my savings rate for investing and I invest more money when I have it. It’s that simple.

Recall that dividends paid is real money paid from real company profits. Buying and holding an established company that has paid dividends for decades is a good sign (at least from a historical perspective) that this company had enough cashflow to reward shareholders and stay in business.

Companies that don’t pay dividends tend to use their money for other means, grow their business; make acquisitions or buy back shares, pay down risky debt, therefore driving the stock price higher over time.

These are not poor management decisions by any means: far from it. There are lots of ways shareholder value is created and to be honest, acquisitions, share buybacks and other company reinvestments could be better company decisions in the long-run!!

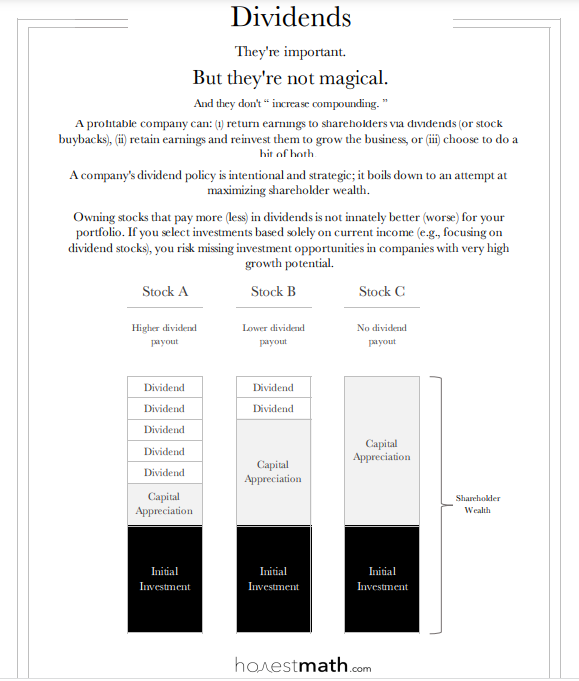

When it comes to the capital gains versus dividend income debate, there really isn’t a debate to be had, since every dollar you earn in capital gains from a stock is worth just as much as your dividend dollar paid. I love the graphic shown at the top of this blog.

These are some stocks to buy and hold, potentially forever!

But why dividends matter to me is beyond the growing income: although of course that’s the outcome I want!

Dividends matter since there is something rather beautiful about seeing money earned from your investments come into your account, and then seeing that money buy more investments, every month, every quarter and every year.

When your money starts making money and that money earns more money, you’ll well into the magical world of compounding.

This really isn’t magic as you know (see graphic at the top), and dividend-paying stocks aren’t the only investment vehicles that can participate in this wealth-building recipe. Yet consider the emotional benefits that dividends offer by sticking to a plan, reinvesting your money, motivated by saving for investment purposes, and striving to improve your financial literacy throughout.

That’s why dividends can really matter.

One of the best financial books I’ve read, The Investor’s Manifesto by William Bernstein, talked about the attributes of a successful investor:

- They must possess an interest in the process,

- They need more than a bit of math horsepower, far beyond simple arithmetic ,

- They need a firm grasp of financial history, and

- They need “the emotional discipline to execute their planned strategy faithfully, come hell, high water, or the apparent end of capitalism as we know it.”

So, read #4 carefully.

This is a world-famous neurologist, co-founder of a popular U.S. investment management firm, and author of several books on finance and economic history in one smart William Bernstein. He has contributed to Money Magazine and The Wall Street Journal several times. If he says what you need is emotional discipline to be succesful, then I listen.

Financial advisors, pricey money managers charging 1% or so for assets under management, and some various financial planners will continue to have some negativity towards dividend-paying stocks for a few reasons. They are entitled to their opinions.

I just know I’ll continue to invest in a way that works for me, that keeps more money in my pocket (away from others), in a way that aligns with my emotional discipline. I hope you consider making your investment plan personal too.

More Reading…

Thanks to Emera, one of my largest holdings, with a dividend increase this week. Not that dividends are magical of course.

My friend Mel Dorion isn’t all about dividends but she does practice a few things I don’t write about often enough on this site: mindfulness.

Do you want to reduce your spending to reach a specific financial goal or simply to have more room in your budget? Does such a change fill you with dread at the idea of depriving yourself or making sacrifices?

Consider Mel’s free course here.

A Wealth of Common Sense offered a guide to navigating your first bear market. From Ben:

“The more good decisions you can make ahead of time the easier it is to avoid the painful emotions that are brought about by the inevitable bear markets.”

Want to know how to retire earlier? Consider a side hustle as your golden ticket. You can shave years off your retirement date by having another income stream based on this Cashflows & Portfolios case study.

Dividend Growth Investor encouraged you to stay the investing course. From his post:

“The issue with stocks of course is that the amount and timing of future capital gains is largely unknown in advance. This is why people panic when prices start going down – they project the recent past onto the future indefinitely. They forget that stocks are not just some pieces of paper or blips on a computer screen, but real businesses that sell real goods and services to consumers who are willing to exchange the fruits of their labor for those goods and services. Over time, those businesses as group will likely learn ways to sell more, charge more, earn more and reward their shareholders. No matter the turbulence we will experience in the US and Global stock markets and economies in the short-run, I believe that things will be better for all of us ten years from now. And as investors, we invest for the long term, not for the next 5 years or 5 months.”

Good reminders for many!

Love this stuff from David from Filled With Money:

“Only after I read personal finance blogs and engaged with the personal finance community did my net worth start to take off. It still boggles my mind that there were total millionaire strangers providing all this advice for FREE. On top of it being free advice, it was the correct advice.”

Awesome, David. Kudos to your journey. Thanks for the long-time follow here.

Here are some recent Sunday Reads with thanks to the fine writing of Dale Roberts.

Happy investing,

Mark

Mark Seed is a passionate DIY investor who lives in Ottawa. He invests in Canadian and U.S. dividend paying stocks and low-cost Exchange Traded Funds on his quest to own a $1 million portfolio for an early retirement. You can follow Mark’s insights and perspectives on investing, and much more, by visiting My Own Advisor. This blog originally appeared on his site on Sept. 24, 2022 and is republished on the Hub with his permission.

Mark Seed is a passionate DIY investor who lives in Ottawa. He invests in Canadian and U.S. dividend paying stocks and low-cost Exchange Traded Funds on his quest to own a $1 million portfolio for an early retirement. You can follow Mark’s insights and perspectives on investing, and much more, by visiting My Own Advisor. This blog originally appeared on his site on Sept. 24, 2022 and is republished on the Hub with his permission.