By Megan Sutherland, BMO Private Wealth

Special to Financial Independence Hub

The days are getting shorter, nights a bit cooler and with September now upon us, back to school is on the minds of parents nation-wide. Since 2007, the average cost of undergraduate tuition fees in Canada has increased 55% and, according to a 2023 poll, 81% of parents believe it’s their responsibility to help pay for post-secondary costs. Conversations I’m having with clients, friends and family certainly corroborate these numbers, making it timely to talk about the Registered Education Savings Plan (“RESP”).

For decades Canadians have been able to utilize the RESP, a program developed to incentivize savings with grant money (Canada Education Savings Grant, “CESG”), and preferential tax treatment. Who doesn’t love free money!

Okay, so what’s the deal?

- What is the maximum amount I can contribute per beneficiary?

- A lifetime contribution limit of $50,000 per beneficiary.

- How can I receive the maximum CESG?

- Contribute up to $2,500 per year to receive 20% in CESG.

- What if I’ve missed years of contributing?

- You can catch up one additional year of CESG per year.

- How much is the CESG grant?

- Maximum of $7,200.

- Is there an age limit on receiving CESG?

- The CESG is available until the calendar year in which the beneficiary turns 17. However, there are specific contribution requirements for beneficiaries aged 16 or 17.

- What is the tax treatment?

- Contributions are not deductible but can be withdrawn tax-free.

- Investment growth and CESG are taxed to the beneficiary when withdrawn for qualifying educational purposes.

- Do you have to be the beneficiary’s parent to open one?

- Any adult can open an RESP on behalf of a beneficiary – parents, guardians, grandparents, other relatives or friends – however, contribution across all plans must not exceed the maximum per beneficiary.

If you hope to have an aspiring doctor on your hands, consider harnessing the power of compounding to amp up your savings and open a plan as soon as possible!

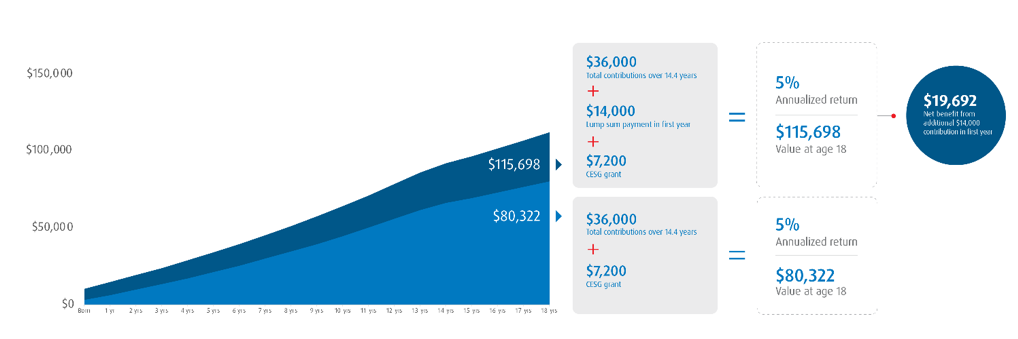

Compare:

- Contribute a total of $36,000 over 14.4 years and receive the maximum CESG

- Annualized return: 5%

- Value at age 18: ~$80,000

- Contribute a $14,000 lump-sum in year one, then $36,000 over 14.4 years, for a total of $50,000, and receive the maximum CESG

- Annualized return: 5%

- Value at age 18: ~$115,000

Net benefit from additional $14,000 contribution in year one: approximately $20,000.

Saving to Attract CESG Only vs. Saving to Maximize Growth and Attract CESG

Just like everything in life, make sure to read the fine print. Keep in mind the following tips and traps:

- Open a Family Plan. Growth can be shared by all beneficiaries and the CESG money may be used by any beneficiary to a maximum of $7,200.

- Be prepared if the funds aren’t depleted by school costs. Contributions can be withdrawn by the subscriber without penalty. However, remaining CESG is clawed back. Growth in the RESP can be contributed to your RRSP (up to $50,000 if you have available contribution room), otherwise it is taxed at your marginal tax rate upon withdrawal by the subscriber, and there is an additional penalty tax of 20%.

- Choose investments wisely. Taking too much risk could result in losses that may create hard feelings or regret. Make sure to plan for withdrawals, potentially transitioning assets to cash, laddered bonds or GICs to ensure funds are available to pay for education costs.

- Put it in your estate plan. If you are married, consider opening the RESP in joint name. If you aren’t married or open the RESP in your name only, name a successor subscriber in your Will.

- U.S. citizens beware! The U.S. does not recognize the RESP as an exempt account type. Therefore, any earned income in the account is reportable on your U.S. tax return and can result in double taxation.

There are certainly other ways to save for post-secondary expenses, but I like to start the conversation with the RESP. As long as the rules are followed, there is automatic growth of 20% on $36,000 of savings per beneficiary, less temptation to dip into the funds since they aren’t easily accessible and as long as the beneficiary uses the money for school, and no tax impact to the subscriber – wins all around!

Megan Sutherland is Senior Investment Advisor with BMO Private Wealth. Megan started in financial services in 2008 and has provided top-tier advice to high-net-worth families and ultra-affluent clients for over a decade. Drawing upon the full depth and breadth of a trusted team of BMO Private Wealth specialists, she offers unbiased, integrated and multi-disciplinary wealth management solutions to help clients achieve their financial goals, manage the complexities of significant wealth, enjoy a seamless cross-border experience, and increase their net worth over time. A few areas of particular focus and interest are developing retirement income strategies, mitigating risk, tax efficiencies before and in retirement and intergenerational wealth transfer and protection strategies.

Megan Sutherland is Senior Investment Advisor with BMO Private Wealth. Megan started in financial services in 2008 and has provided top-tier advice to high-net-worth families and ultra-affluent clients for over a decade. Drawing upon the full depth and breadth of a trusted team of BMO Private Wealth specialists, she offers unbiased, integrated and multi-disciplinary wealth management solutions to help clients achieve their financial goals, manage the complexities of significant wealth, enjoy a seamless cross-border experience, and increase their net worth over time. A few areas of particular focus and interest are developing retirement income strategies, mitigating risk, tax efficiencies before and in retirement and intergenerational wealth transfer and protection strategies.

https://www.statista.com/statistics/542989/canadian-undergraduate-tuition-fees/

https://www.bankofcanada.ca/rates/related/inflation-calculator/

https://www.canada.ca/en/services/benefits/education/education-savings.html