By Andrew Lo, President & CEO of Embark Student Corp.

By Andrew Lo, President & CEO of Embark Student Corp.

(Sponsored Post)

The pursuit of higher education is a cornerstone of personal and professional growth for many young Canadians. However, this pursuit often comes at a hefty price, with student loans being a significant barrier to financial independence. The burden of student debt can haunt graduates for years, affecting their ability to save, invest, and achieve financial stability. But there’s good news: opening a Registered Educations Savings Plan (RESP) can lighten the burden of student loans and help you help your children start their adult life debt-free by encouraging regular and early savings, offering valuable government grants, and harnessing the power of compound interest.

The Student Loan Conundrum

Canada is home to a world-class education system, but the cost of pursuing post-secondary education can be daunting. Tuition fees, books, accommodation, and other expenses can quickly add up, leaving many students with no choice but to turn to the most common method of affording post-secondary: student loans.

What some students don’t fully understand when they use student loans is that they come with interest rates that accrue after graduation. For many young Canadians, this means they start their careers with substantial debt, and few resources to help them repay their loans.

In a recent poll of Canadian students, 79% admitted that the amount of debt taken on to afford post-secondary can be debilitating. This burden of student debt can have a profound impact on a young graduate’s financial journey, with 57% of students surveyed agreeing that graduating with student debt will make it harder for them to become financially independent from their parents.

Unfortunately, the constant struggle to make loan payments often hampers their ability to save and invest in their futures. Despite this, student loans are still the most normalized way of paying for education in Canada.

There’s a better way pay for post-secondary education

One effective way to combat the student loan conundrum is to start saving for education expenses early. It can be hard to think about university and college when a child is a few years old but by beginning to save as soon as possible, families can significantly reduce their need for student loans. You’re probably thinking, “accumulating savings to cover educational costs while managing the rising cost-of-living is no easy feat.” This is where a Registered Education Savings Plan [RESP] comes into play.

RESPs are powerful tools that Canadians can take advantage of to fit the post-secondary bill. They can be opened by the parents or guardians of a child, other family members, or friends, to save over a total period of 35 years. By contributing regularly to an RESP, families can build substantial savings to cover tuition and related expenses. Starting early allows for smaller, manageable contributions over time, reducing the financial stress associated with higher education. The most valuable part of this savings tool is that it opens your savings up to a world of government grants that you can qualify for.

Unlocking “Free Money” with Grants

One of the most compelling features of RESPs is the opportunity to acquire “free money” in the form of grants. The Canadian government provides a generous grant called the Canada Education Savings Grant (CESG) as a reward for saving, allowing you to collect up to $7200.

This grant matches 20% of your contributions on the first $2,500 saved annually. Over the years, if you contribute $2500 annually to an RESP, this works out to an additional 20% being added to your first $36,000 saved without even considering investment gains. By maximizing these grant opportunities, families can alleviate the financial strain of higher education and better prepare for the future.

Another great grant is the Canada Learning Bond (CLB). The CLB is a federal government grant designed to help lower-income families save for their children’s post-secondary education. It offers several benefits. First, it provides an initial grant of $500 to kickstart an RESP for eligible children born in 2004 or after, with an additional $100 each year the child remains eligible, up to a maximum of $2,000.

Compound Interest: The Power of Growth over Time

Another important element to remember when considering an RESP is the role of compound interest. Compound interest is like a magical force that accelerates your savings growth over time. With RESPs, your contributions don’t just sit idly; they earn interest, and that interest itself earns more interest.

Consider this: if you start saving in an RESP early, your money has more time to grow. Over the years, the initial contributions, government grants, and the interest all compound, giving your educational fund an extra push. Compound interest allows your savings to work for you, not against you. Starting to save as early, or as soon as possible gives you more time to witness these benefits.

Another great perk of an RESP is that the income that you generate within one grows tax-sheltered until withdrawn. When you do reach the withdrawal stage, it is then taxed in the hands of the beneficiary, which is typically at a far lower marginal tax rate, leaving them with more money to use for school.

The Embark Student Plan

For many young Canadians, the path to financial independence is fraught with the challenges of student loans. The burden of debt can be overwhelming, limiting the ability to save, invest, and secure a stable financial future. RESPs, such as the Embark Student Plan, offer a practical solution to this problem.

For many young Canadians, the path to financial independence is fraught with the challenges of student loans. The burden of debt can be overwhelming, limiting the ability to save, invest, and secure a stable financial future. RESPs, such as the Embark Student Plan, offer a practical solution to this problem.

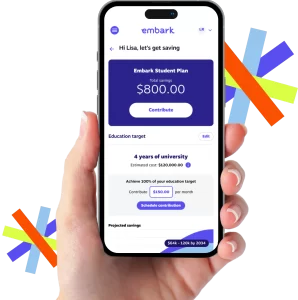

What sets Embark apart as an RESP provider is the technology that powers our plan. Our simple process allows you to sign up and start contributing in minutes directly from your bank account. You can track all your tax-sheltered earnings, government grants, and get tips on how to save more.

With the Embark Student Plan you can avoid the pitfalls of student loans and better position your future student for a brighter financial future. Our glidepath investment strategy is tailored your child’s age, the plan helps grow and protect your savings when needed, while automatically helping you capitalize on grants. It gives you tangible digital insights to track your savings and understand what you’ll need based on your child’s aspirations, while allowing you the flexibly to save whenever and however much you can. You can learn more about the Embark Student Plan and enroll at Embark.ca.

We take the hard work out of education savings so you can focus on what’s important: taking control of your financial independence.

This article is sponsored by Embark Student Corp. Visit our website and review the prospectus for more information. Start Savings with Embark Today

Andrew Lo is the CEO of Embark, Canada’s education savings and planning company. As a fintech leader for over 30 years, he’s focused on making the best financial services available to Canadians.

Andrew Lo is the CEO of Embark, Canada’s education savings and planning company. As a fintech leader for over 30 years, he’s focused on making the best financial services available to Canadians.