Special to the Financial Independence Hub

We all know that location plays some kind of role in car insurance, and it’s a controversial topic in Ontario. There have been discussions about banning territorial ratings for a while now.

However, it’s been difficult to get a bead on exactly how much location affects those rates. Thanks to a study of 2,800 car insurance policies we now have some facts and figures to work with.

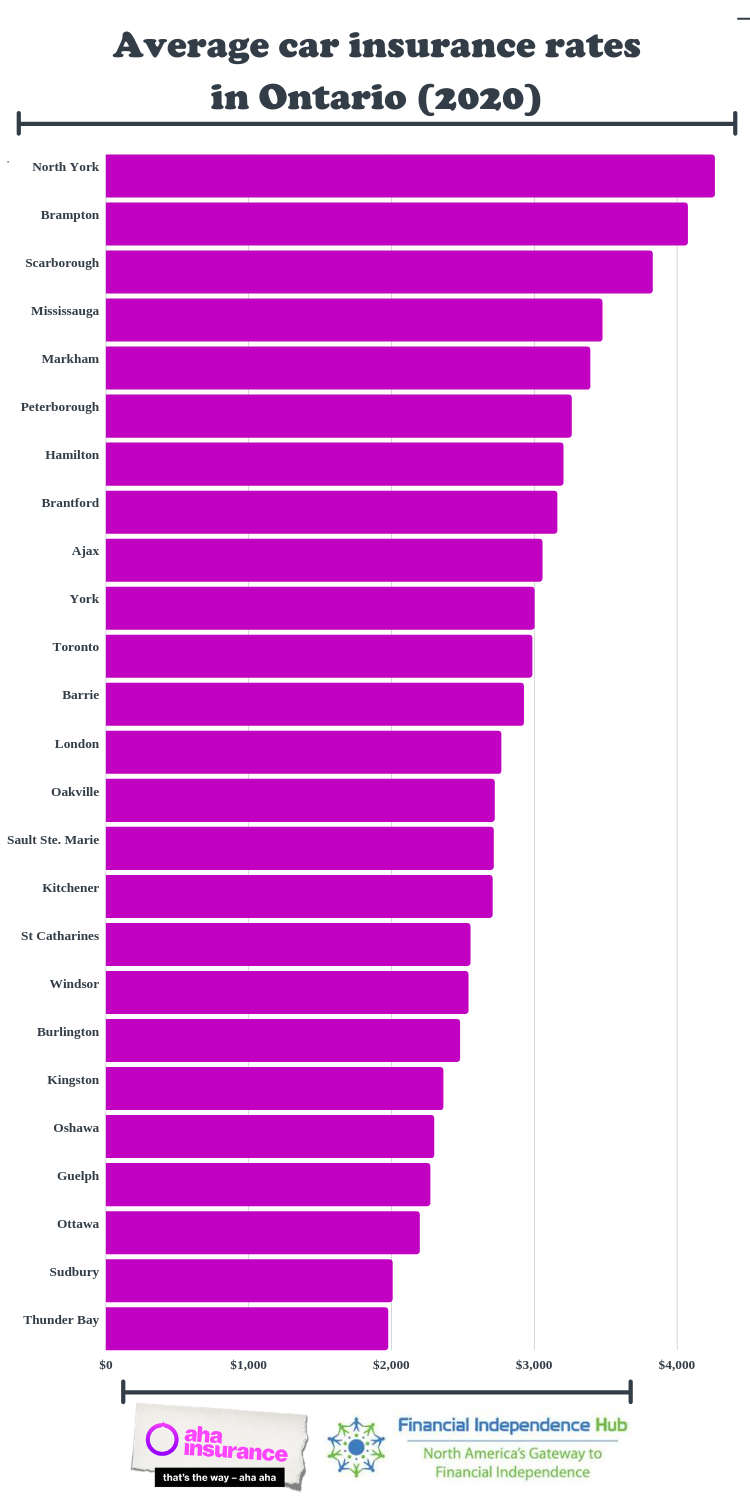

This study reports the average annual cost of auto policies for major towns and cities, so it’s not a substitute for a proper, personalized quote. With that said, the numbers are telling. Location does have a strong correlation to the average rate that Ontarians pay, and that number can vary by more than $2,000 between the most and least expensive cities.

Quantifying average car insurance rates by city

Wasaga Beach comes in with the lowest rate in the study at $1,958, while North York features the highest average rate at $4,261 per year.

That’s a difference of more than $2,000 per year depending on where you live in Ontario. You could pay for a week-long trip to Europe with that money, airfare included.

Here are the numbers, ranked from most to least expensive city:

It’s also worth noting that all of these average prices are higher than the official average price of auto insurance in Ontario as reported by the Insurance Bureau of Canada.

Why do cities have different rates?

Insurance underwriting takes many factors into account, but we forget many of them. For instance, we can see that many of the most expensive cities are in the Greater Toronto Area.

Those communities don’t have inherently higher collision rates (aside from Brampton), but what they do share is a heavy commuter population. It’s quite common for more than 50% of the workforce to commute outside the municipal region for work among these cities.

It’s possible that the extra risk associated with driving long distances, long hours, and on crowded highways correlates to higher car insurance rates.

Averages aren’t everything

It’s important to stress that these are city-wide averages. Every city has a range of geographic areas that are all rated differently by insurance underwriters, and even then, location is just one of many factors that affect auto insurance rates.

Lowering one’s insurance rates should start with bundling policies and maintaining (or working toward) a clean driving record, but it pays to know the cost of your location, too: it could seriously affect your financial plans.

Andrew Webb is the Content Strategist at aha insurance, a digital home and auto brokerage based in Waterloo, Ontario. He’s trying to show Canadians how to save their hard-earned money on all kinds of insurance. He runs the Employed Historian blog in his spare time.

Andrew Webb is the Content Strategist at aha insurance, a digital home and auto brokerage based in Waterloo, Ontario. He’s trying to show Canadians how to save their hard-earned money on all kinds of insurance. He runs the Employed Historian blog in his spare time.

Just another case of auto insurers screwing drivers – they could just as easily base it on individuals driving records.