By Tyler Mordy, Forstrong Global Asset Management

By Tyler Mordy, Forstrong Global Asset Management

Special to the Financial Independence Hub

An old Japanese proverb states “many a false step was made by standing still.”

So it is with currency exposures in investor portfolios. Consider the recent experience of Brazilian, Russian and even Canadian investors — to name a few countries with steeply depreciating exchange rates. By electing to remain invested in their domestic currency, they have all experienced a steep “loss” in their own global purchasing power (even if nominal values held up). An ostensibly conservative position has cost them dearly.

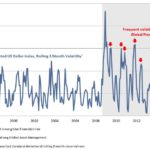

Welcome to the new, hyper-globalized world. Since the financial crisis, unorthodox policies — with central banks trying to outdo the effects of one another by plunging into a subterranean universe of quantitative easing and negative interest rates — have driven currency volatility much higher. Now, capital has a way of swiftly seeking out safe harbours and penalizing others who are not safeguarding their national currencies. Who would have thought the once-august Swiss franc would lose its safe haven status?

Indeed, currency exposures are having an outsized impact on portfolio returns. Currency-focused ETF vehicles could not have arrived at a better time, introducing yet another evolution in the portfolio management process. Today, gaining global currency exposures is as easy as buying stocks.

Beyond the academic view

Should investors respond or simply stand still? After all, the academic view has treated active currency management with an almost mythical disdain. Traditional thinking teaches that, rather than dive into the ethereal world of currency analysis, one should recognize that currency changes “wash out” over time and not try to actively manage them.

That’s true. Currencies do mean-revert to their fair values over very, very long periods — in many cases, on a 20-year or longer time horizon. But most investors don’t have the luxury of such lengthy time horizons.

That said, can investors penetrate these mysteries and do better than this? To leapfrog over 750 or so well-chosen words, we suggest the answer is a strong “yes.”

The case for active Currency management

Now begins a voyage of discovery where we arm the reader with facts, dispensing with the predictable academic narrative. For those with practical proclivities, rest assured that the destination is concrete, with a definitive arrival point: that currencies are overlooked and can produce significant amounts of that return-enhancing force called “alpha.”

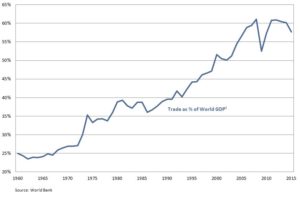

Our first consideration is that currency is the largest and most liquid asset class in the world, dwarfing the daily turnover of bond and stock markets. The reason is the explosion in cross-border trading since the onset of a flexible exchange rate regime in the early 1970s.

Given the sheer size and depth of liquidity, many would be tempted to conclude that currencies are very efficient in terms of pricing. Actually they aren’t. Identifying the key participants in global currency markets shows why. The majority are multinational corporations simply hedging the foreign exchange exposure of their revenues and costs in their international business activities. In other words, they are passive investors with no profit motive.

Conversely, those participants trying to actively manage and benefit from exchange rate fluctuations are a clear minority. The net result is an inefficiently priced market with persistent opportunities.

Secondly, currencies bring that increasingly elusive property to portfolios called “low correlation.” This is important in a progressively synchronized and interconnected financial system. The recent global financial crisis has underscored one of the limitations of Modern Portfolio Theory: correlations among different asset classes are not always stable.

During recent periods of market panics, the performance of many asset classes were much more highly correlated to equities than most had expected. Conversely, currencies had a very stable low correlation. During the period from 2007 – 2009, every asset class correlation increased significantly relative to US and global equities. The one exception was currency returns.

Factors driving Currency Returns

So the case for active currency management is strong based on inefficiency and low correlation. But how best to make active decisions?

To be sure, currency analysis is a tricky business. Currency moves, once they begin, rarely proceed as policymakers intend. Often countries lose control of their currency. Other times currency adjustments produce unintended effects in unexpected places.

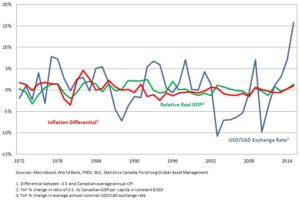

However, investors should recognize that exchange rates tend to be long-trending markets, regularly entering different regimes but consistently varying more than their underlying fundamentals. This is often related to the particular macro regime a country enters. In the case of Canada, the recent commodity boom created a steady wave of capital inflows, driving down yields and boosting the currency — a self-reinforcing cycle that drove the currency to lofty levels. Now all this is heading in reverse. However, the key point is that swings in the currencies are almost always far wider than differences in output and inflation.

A variety of underlying factors drive these moves. In simple terms, currencies can be looked at as the “stock” of a particular country. A firm currency reflects a confident view in the quality of its fiscal situation. In practice, currency forecasting methodologies and models vary widely. Some approaches focus on the concept of purchasing power parity (the level at which two countries are broadly competitive with each other given prevailing inflation rates). Others concentrate on measures of relative economic strength and resulting portfolio flows (i.e. a more attractive country growth profile will attract greater investment flows, creating demand for the currency and driving it upwards). Still others examine trade flows and attempt to determine the “equilibrium” exchange rate which brings a country’s current account into balance.

All of those are important factors. However, currencies can and do become wildly overvalued and undervalued — just like stocks. Why shouldn’t investors view this opportunistically?

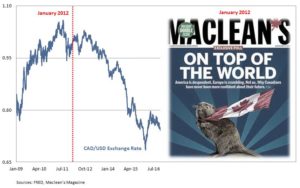

Examining investor sentiment is also critical. In financial markets, public opinion is usually unified and dead wrong at major inflection points, becoming too exuberant after prices have risen and too gloomy after they have fallen. Currencies are no different. Extremes in opinion often register shortly before major changes in trend.

Consider the recent experience of the Canadian dollar. From 2002 – 2012, the “loonie” (Canada’s colloquial name for its currency) soared by approximately 55% versus the USD dollar. At the end of that run, CAD bears were nearing extinction. Even the cover of Maclean’s magazine confidently announced that Canada was unstoppable. In hindsight, that was a clear contrarian opportunity and the Canadian dollar promptly entered a steady downward path.

While most investors understand the role that stocks, bonds and even commodities play in a portfolio, currencies remain opaque. So thick is the fog, that few investors are willing to confess any visibility at all. Yet, that presents significant opportunities for intrepid investors.

Putting it all together, investors should generally hedge currencies with high valuations and exuberant sentiment, and un-hedge currencies with low valuations and demoralized psychology. Policy is crucial too. It has been key to own currency-hedged equities in economies that are successfully devaluing their currency (like Japan and the Eurozone) or bonds in economies allowing currency appreciation (like India and the US).

With experimental monetary policy now widely accepted as standard operating procedure in today’s post-crisis era, the opportunities to add value through active currency management are enormous. Conversely, standing still carries significant risk.

Tyler Mordy is president and Chief Investment Officer for Toronto-based Forstrong Global Asset Management. Since joining in 2003, Tyler has become a recognized innovator in the design and application of “global macro” ETF portfolios. He is widely quoted and interviewed by the financial media for his views on global investment strategy and ETF trends. Recently, ETF.com profiled Tyler as one of the “best and brightest” working in the ETF Strategist industry and described him as “a money manager for the modern era.” CNBC has also called Tyler one of the “best independent ETF experts.”

Tyler Mordy is president and Chief Investment Officer for Toronto-based Forstrong Global Asset Management. Since joining in 2003, Tyler has become a recognized innovator in the design and application of “global macro” ETF portfolios. He is widely quoted and interviewed by the financial media for his views on global investment strategy and ETF trends. Recently, ETF.com profiled Tyler as one of the “best and brightest” working in the ETF Strategist industry and described him as “a money manager for the modern era.” CNBC has also called Tyler one of the “best independent ETF experts.”