By Penelope Graham, Zoocasa

By Penelope Graham, Zoocasa

Special to the Financial Independence Hub

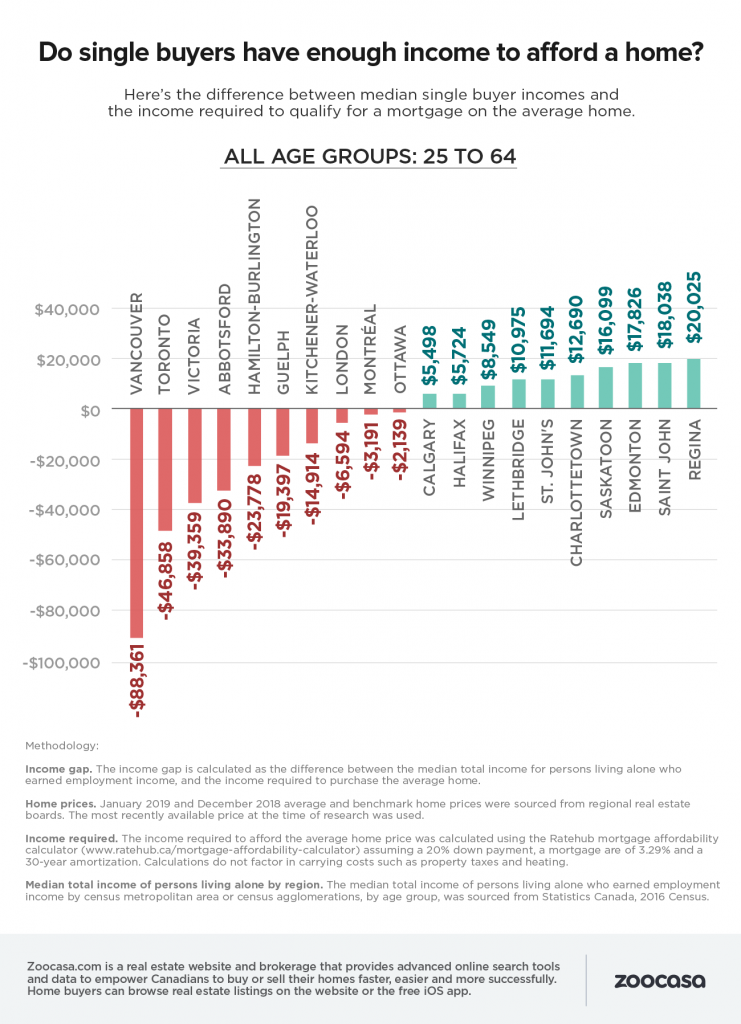

Despite recent reports that home prices in Canada’s tightest markets are starting to cool, skyrocketing values over the last five years mean purchasing real estate is still financially unfeasible for many prospective buyers – especially those trying to do so on their own.

However, while this certainly is the case in the Vancouver and Toronto markets – where average home prices rose 35 and 58% between 2014 – 2019, respectively – a new study from Zoocasa reveals homeownership isn’t out of the cards for buyers willing to expand their search.

Where can single purchasers afford a home?

To find which markets can be considered affordable on a solo budget, the study sourced average home prices for 20 cities across the nation. It then calculated, assuming a 20% down payment, mortgage rate of 3.29%, and a 30-year amortization, the minimum income required to purchase the average home in each market. That amount was then compared to actual median income data of “persons living alone who earned employment income” as reported by Statistics Canada.

The numbers reveal that for single purchasers earning the median income, 10 markets can still be considered affordable: and all are located within the Prairie and Eastern Canadian provinces.

Regina takes the top spot for single buyer affordability; there, an earner bringing in$58,823 would qualify to purchase a home at the average price of $284,424, and have an “income surplus” of $20,025. This surplus indicates the buyer is not purchasing at the top of their affordability, an important consideration when interest rates are on the rise.

The other most affordable cities include Saint John, where the average home priced at $181,576 could be purchased on an income of $42,888 with $18,038 left over, and homes on the Edmonton MLS, where earning $64,036 would net a $17,826 surplus on the average home price of $338,760. Calgary, Lethbridge, Winnipeg, and Halifax can also be considered to be affordable markets based on the study’s criteria.

Vancouver, Toronto, still well out of financial range for solo buyers

On the least affordable end of the scale is Vancouver, where the average home costs $1,109,600: out of the range of the local median single income of $50,721 to the tune of $88,361.

Affordability also remains steep for single buyers in the Toronto market, despite overall higher earnings and lower average home price: there, an income of $55,221 would fall $46,858 on the average home price of $748,328. Victoria rounds out the top three with an average home price of $633,386, $39,359 below what the median income of $86,400 can afford.

Other markets not considered affordable for single buyers include Guelph real estate, Kitchener-Waterloo, London, Montreal, and Ottawa.

Single Gen-Xers have best affordability

The research also compared how earnings ranged by age group per location, and which demographic enjoyed the greatest affordability when purchasing a home. Across every market, Gen Xers (35 – 44 and 45 – 54 age brackets) enjoy the greatest earnings and purchasing power, with 11 markets considered within affordable reach (compared to 10 markets across all age groups). Millennials (aged 25 – 34) had the least earning power in each city, behind Boomers (aged 55 – 64).

Overall, single home buyers aged 35 – 44 purchasing a home in Regina enjoyed the greatest affordability of all, with an income surplus of $24,215. A millennial purchasing in Vancouver had the least, facing a gap of $92,774.

Check out the infographics to see how affordability ranges for single home buyers by location and age.

Penelope Graham is the Managing Editor of Zoocasa.com, a leading real estate resource that uses full brokerage service and online tools to empower Canadians to buy or sell their home faster, easier, and more successfully.

Penelope Graham is the Managing Editor of Zoocasa.com, a leading real estate resource that uses full brokerage service and online tools to empower Canadians to buy or sell their home faster, easier, and more successfully.