Special to the Financial Independence Hub

Post-secondary education is a necessity to get ahead in the new economy, but for many Canadians, attending university is out of reach due to rising tuition costs.

This why it’s now more important than ever for parents to start saving for their child’s education. Thankfully the Government of Canada offers one of the best ways to save for your child’s future through a Registered Education Savings Plan (RESP).

Rising Tuition Costs

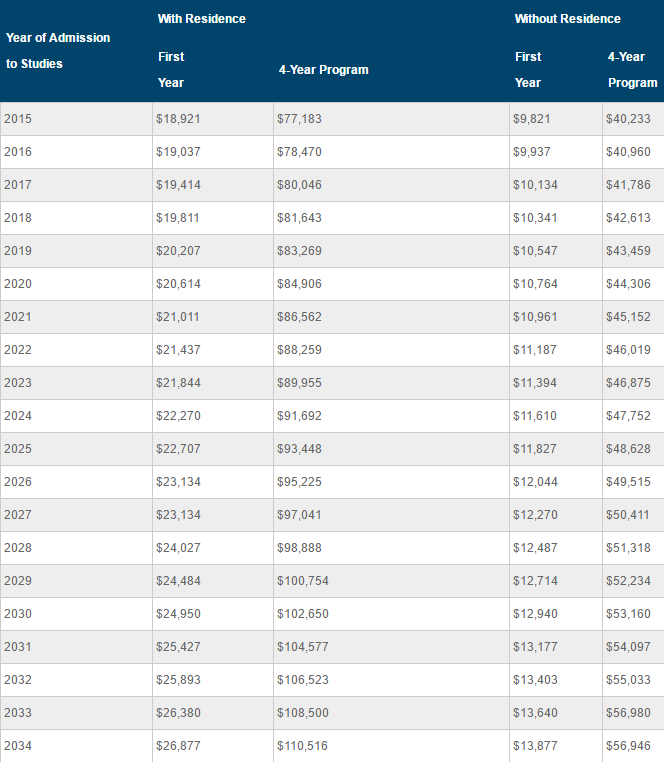

According to Statistics Canada, tuition costs have increased by 40 per cent in the last ten years, and between 2014-2015 and 2015-2016 school years it rose by almost three per cent. The news is worse for parents in Ontario where the average cost of tuition is $8,114: the highest in Canada. If your child chooses to study out-of-province or overseas, fees will be significantly higher. Knowledge First Financial’s Guide to Education Costs in Canada projected that tuition could climb to over $14,000 by 2034. These figures do not account for living expenses. For example, four years of tuition, room and board could add up to $90,000 at the University of British Columbia.

The cost of tuition has been rising steadily over the last ten years and continues to outpace inflation. Compared to last year, students paid on average 3.2% more in tuition compared with the previous year, while the Consumer Price Index was 1.3%. According to Statistics Canada, the national average for university costs in 2015/2016 was approximately $19,500 for students in residence, and $10,000 for Guide to Education Costs in Canada projects that first year tuition could climb to over $14,000 by 2034. These figures do not account for living expenses, students who lived at home or did not have to pay for residence and meals. Students in Ontario have the greatest challenge, where tuition is the highest in the country.

These high costs have resulted in a record-high number of students applying for loans, which is putting them in debt. According to the 2015 survey of 18,000+ graduating university students conducted by the Canadian University Survey Consortium, the average student owed $26,819. Costs are not limited to university degrees, with 37 per cent of Canadians with student loan debt being non-degree students, attending vocational schools or other certificate programs, says Stats Canada.

RESP from Ottawa

The Government of Canada provides the RESP to benefit those planning to pursue a post-secondary education. The biggest advantage of an RESP is that the any interest accumulated is tax-free and by investing in an RESP, your child will have access to federal grants.

Since the RESP is tax-exempt, it’s one of the few ways to grow investments without having to pay interest. The maximum lifetime contribution you are allowed to make is $50,000 (principal) and any amount you invest on top of that will be subject to a one per cent monthly tax. Depending on your financial standing, even if you over-contribute to your RESP, it will still pay off in the long term.

The government will also contribute 20 per cent of whatever you invest up to a maximum of $7,200. This is basically free money that accumulates interest. These contributions come from the Canada Education Savings Grants (CESG) and must be used towards your child’s education. This means if they do not end up going to university, the money has to be returned to the government.

Start planning for the future, today

As with any large expense, it’s best to start planning early. The government of Canada extends funds to those that wouldn’t otherwise be able to afford postsecondary without an RESP, such as the BCTESG. However, a financial advisor may recommend you look at your family’s budget so you don’t sacrifice RRSP contributions over those to the RESP: the reason being your child can still take out substantial interest-free student loans (for the duration of their studies) but you cannot do the same for retirement. Parents can also take out equity loans for their child’s education, but this will likely not be the case for retirement.

When it comes to government-run savings plans, there are rules and regulations that not everyone will easily decipher, but there is help. That’s why you should consider consulting with a professional to learn how you too can open an RESP.

Jo-Anne Wong is a writer and advisor for Knowledge First Financial. For more information about education savings plans from the company please visit its website or refer to its prospectus. As of April 30, 2016, Knowledge First Financial manages $3.62 billion in assets on behalf of more than 250,000 customers.

Jo-Anne Wong is a writer and advisor for Knowledge First Financial. For more information about education savings plans from the company please visit its website or refer to its prospectus. As of April 30, 2016, Knowledge First Financial manages $3.62 billion in assets on behalf of more than 250,000 customers.