(Sponsor Content)

Individuals who are following conventional retirement-planning may be in disbelief as they approach retirement and discover that they cannot afford to retire just yet or are likely to outlive their retirement funds.

The 70% Rule

Common practice is to save enough so that your annual retirement income equals about 70% or more of your current income. Of course, many Canadians are not aware of such information entirely and have saved little or not enough for their retirement.

With this being said, there are still some fundamental issues with this understanding. One, few people have a complete understanding of their retirement resources or a realistic view of their retirement funds. In some cases, 70% retirement pay usually isn’t enough to sustain them in retirement.

Example

We’ll use the fictitious name Tom for this example. Tom is making $60,000 annually living a modest lifestyle. Tom will qualify for CPP and OAS. Tom only contributes through his employer-directed contribution program, which is $2500 a year.

Tom also saves $13,000 in a regular checking account, an additional $3,000 in non-registered savings and $12,000. Tom is a conservative investor and he thought he was doing pretty well saving what he can and living a modest lifestyle.

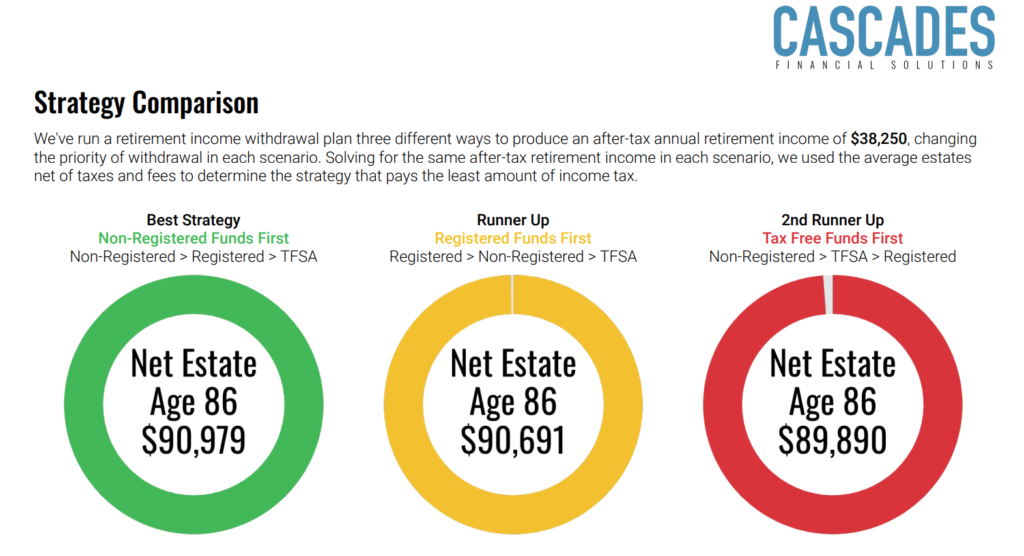

Using Cascades to do retirement planning at the age of 54 using the above figures. Tom discovers his annual income will only be approximately $38,250. After taxes per year. Going back to the common practice of 70% Tom needed minimum $42,000 per year as retirement income. This leaves Tom needing to find a way to make an additional $3750 a year. Tom would need a part-time job, choose not to retire or drastically change his lifestyle in retirement.

For a lot of individuals, they will have to work longer than they planned or seek part-time employment during retirement. This could be a problem for retirees and employers. In order to navigate this issue before it starts employers need to assist their employees with retirement planning.

How can we change this?

The first step would be for employers to become more effective at helping employees realistically prepare for and manage their retirement. For example, this could include a process or program to build up wealth accumulation prior to retirement, which could be a mix of LIRA, Capital Gains or RRSP just to name a few.

A second step would be for employees to change their behaviours and thoughts around retirement savings. Employees can make changes by becoming more proactive when it comes to saving. When some individuals think about saving for retirement after they attend school, buy a home, raise children and send them to college sometimes it can be too late.

Why ‘buildup’ is not enough

Furthermore, employees are aware that they need to save but they are focussed on the “buildup” of retirement funds; for example, creating a large group of money but not necessarily the knowledge or understanding of how much they need, how and when to invest or how to manage the money they do have invested. A small percentage of employees know how much they need for retirement, however; that rate can change with inflation.

Reasons for not having enough money

Frequent job moves are a reality of today’s gig economy: it’s a fact that few employees spend their entire careers with one or even two employers. Coupled with buying a home, having a family, and lifestyle there could have been very little essentially set aside for retirement.

Higher life expectancies could lead to running out of money. If you only save enough to last you 20 years and you live 25 years beyond retirement you could find yourself in a dire financial situation.

Why employers should ‘do the right thing’

Though workplace management, employers could start to see a decline in work productivity for people who want to retire and cannot. Financial implications can fall back on employers who need to offer larger benefit packages to these employees who should have been retired. Feelings of hostility may occur when employees that need to work longer could be blocking career paths for other individuals.

Traditionally, employers would participate in Group Registered Retirement Savings Plans (GRSPs) with their full-time permanent employees: by matching employees’ contributions dollar for dollar allowing individuals to put aside more for retirement. Retirement income planning is not a major responsibility of employers but with the right retirement planning software tools employers can assist their employees through group benefits, strategically plan retirement and with the right tools individuals can plan a better retirement future.

If you’d like more information on how Cascades can help you sort through this complicated process, contact info@cascadesfs.com or visit cascadesfs.com. (You can also click on the banner ad on the top right of the Hub’s home page.)

Ian Moyer is a 40 year veteran of the financial services industry. He is a long term member of the MDRT, as well as Court and Top of the Table. In 2013 he started developing Cascadesfs.com with his business partner Jonathan Kestle. Cascades’ focus is to illustrate the value of advice, by revealing the tax difference of comparing withdrawal strategies.

Ian Moyer is a 40 year veteran of the financial services industry. He is a long term member of the MDRT, as well as Court and Top of the Table. In 2013 he started developing Cascadesfs.com with his business partner Jonathan Kestle. Cascades’ focus is to illustrate the value of advice, by revealing the tax difference of comparing withdrawal strategies.

It appears that the order of asset harvesting did not change the outcome very much in this case. I find that surprising. Wondering why that is the case, in this case.

‘Agreed Dale. Minimal differentiation between best and worst.

In the end, how many people earning $60,000 annually are saving $18,500 or more as depicted in the example? I’d say this is completely unrealistic.

Also, the solution appears to lean heavily on employers to shoulder more responsibility for their employees’ retirements. Once again, completely unrealistic.

Come on Cascades, surely you can do better than this?