By Dale Roberts, Cutthecrapinvesting

Special to the Financial Independence Hub

You’ve worked for decades to build your retirement nest egg. You have invested smartly. The investment portfolio is required to fund a significant portion of your retirement years. In fact, you need those monies to last for many decades. Should you invest in an all-stock portfolio? That approach might deliver greater income than the traditional stock and bond portfolio.

Yup. More stocks might deliver more growth. No one can deny that stocks are the growth engine of a portfolio. When we own stocks we become business owners and we share in the success (or failure) of those companies. In the past, owning a big basket of market-leading companies has worked out more than well.

When stocks earn 8% we can spend 8%?

Retirement funding is tricky business. It’s much more complicated than the accumulation stage. The sequence of returns does not matter that much at all when we are building our portfolios, and we have decades until that retirement start date. We might see several good years that are followed by two or three bad years. Those bad years will not affect your retirement readiness when you have decades to recover. A savvy investor will even enjoy those bad years as the stocks go ‘on sale’.

But in retirement the order of stock market and portfolio returns do matter. That’s called sequence-of-returns risk. A bad year or a few bad years early in retirement can permanently impair your portfolio and your retirement. Even before that retirement start date we are already in the retirement risk zone.

But stocks beat the crap out of bonds

Most retirees and most financial planners will add some bonds to the portfolios of retirees. Those bonds work like shock absorbers. While there is no guarantee, good bonds have a habit of going up in price when stocks get hit hard. This is typical retirement planning ‘thinking’. And yes, there are other weapons besides bonds.

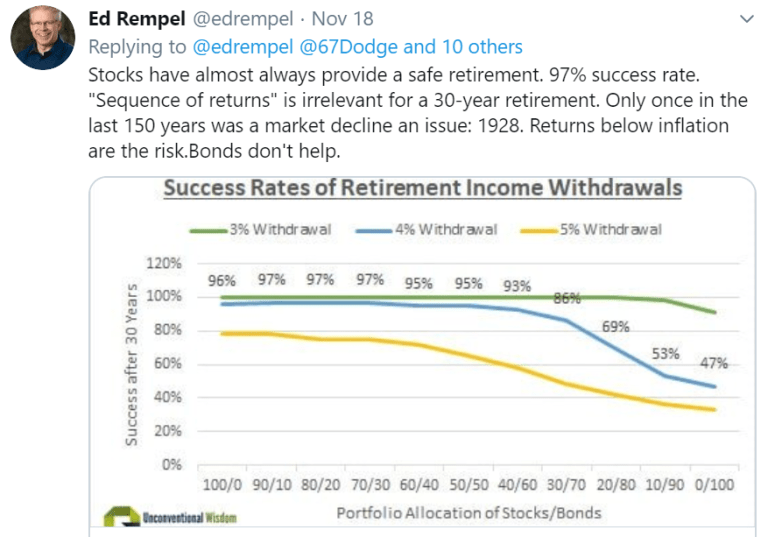

On Twitter we had a very robust discussion on retirement funding and risk. Financial Planner Ed Rempel defended the all-stock portfolio for retirees. And he provided some support with this chart:

According to Mr. Rempel, the success rate for an all equity portfolio is 97% for a period that spans over 100 years. Success is defined as the retiree being able to spend at 4% of the portfolio value, every year, with an adjustment equal to inflation. Of course that’s called the 4% rule. That’s a retirement planning benchmark that is useful, but is then usually disposed of for dozens of reasons. For Boomer and Echo I had asked if there was a new normal for Canadian retirees .

And here’s the full post from Ed Rempel: Is Typical Retirement Advice Good Advice?

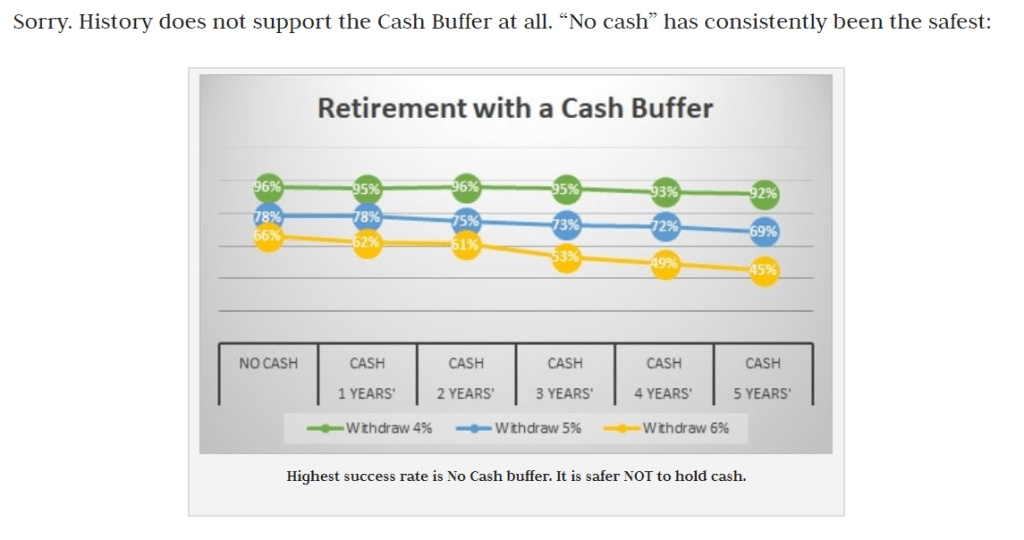

Conventional wisdom and typical advice states we should protect our assets. After all, our retirement and lifestyle is on the line. Ed begs to differ and he certainly takes an unconventional approach. Ed also suggests retirees do not hold that cash buffer.

But what about the correction in the early 2000s?

Of course any study that looks at 30-year periods does not include the last two major stock market corrections. We’d look to the 2000 to 2002 period and the 2008 financial crisis. Those are the two most severe market correction since the Great Depression of the late 1920s and through the 1930s. And it’s true that the typical market correction has not been ‘all that’ severe in the period in between the Depression and the tech meltdown of early 2000’s. An all-equity portfolio would not have been down for the count.

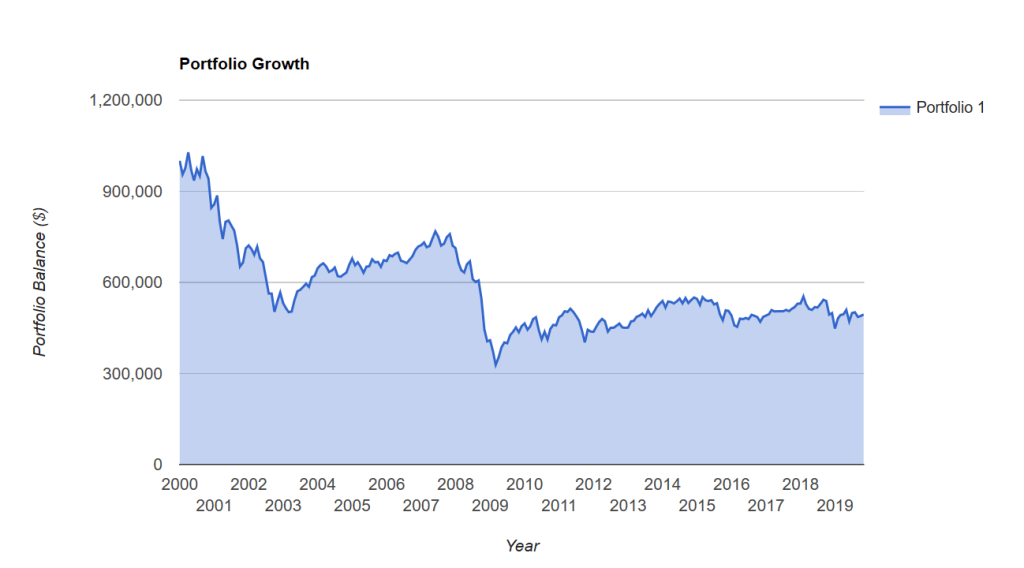

But that’s rolling the dice. That’s rolling the dice because that study does not include those two big corrections. Here’s how an all-stock portfolio would have fared from the year 2000. The retiree is spending at that 4% rate, annually, inflation adjusted. For this chart I am using US stocks. The chart is courtesy of portfoliovisualizer.com.

Dead portfolio walking

We see that from 2000 there is failure. The inflation-adjusted spend rate is too high. Dead portfolio walking, it has been cut in half. To give us a 30-year period to evaluate I went back to 2008 and then further back to restart the retirement funding process. The portfolio dies before a cumulative 30-year period. And perhaps a bigger question might be, who could watch their $1,000,000 portfolio (and life savings perhaps) fall to $330,000? Who has the stomach for that?

We see that from 2000 there is failure. The inflation-adjusted spend rate is too high. Dead portfolio walking, it has been cut in half. To give us a 30-year period to evaluate I went back to 2008 and then further back to restart the retirement funding process. The portfolio dies before a cumulative 30-year period. And perhaps a bigger question might be, who could watch their $1,000,000 portfolio (and life savings perhaps) fall to $330,000? Who has the stomach for that?

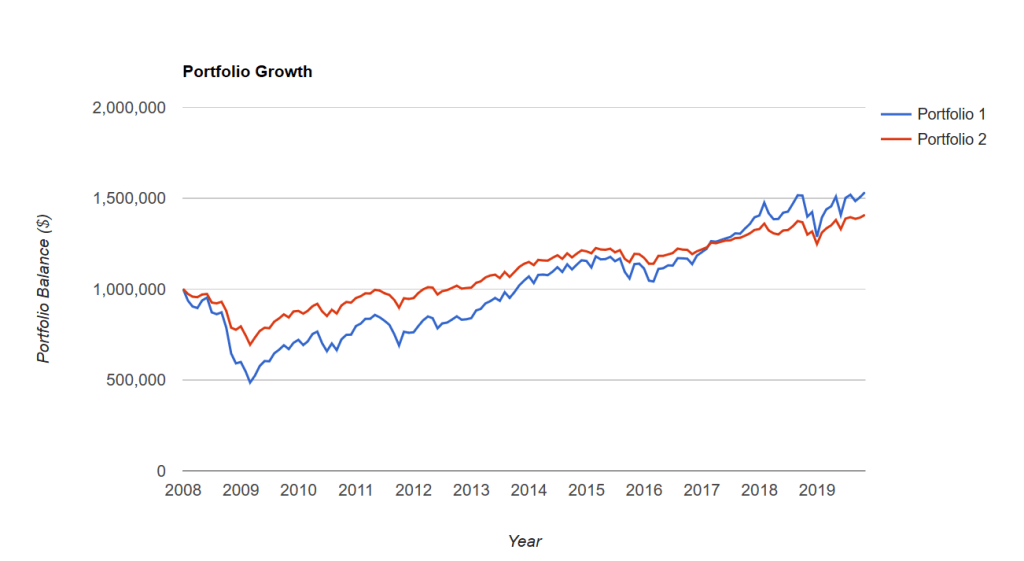

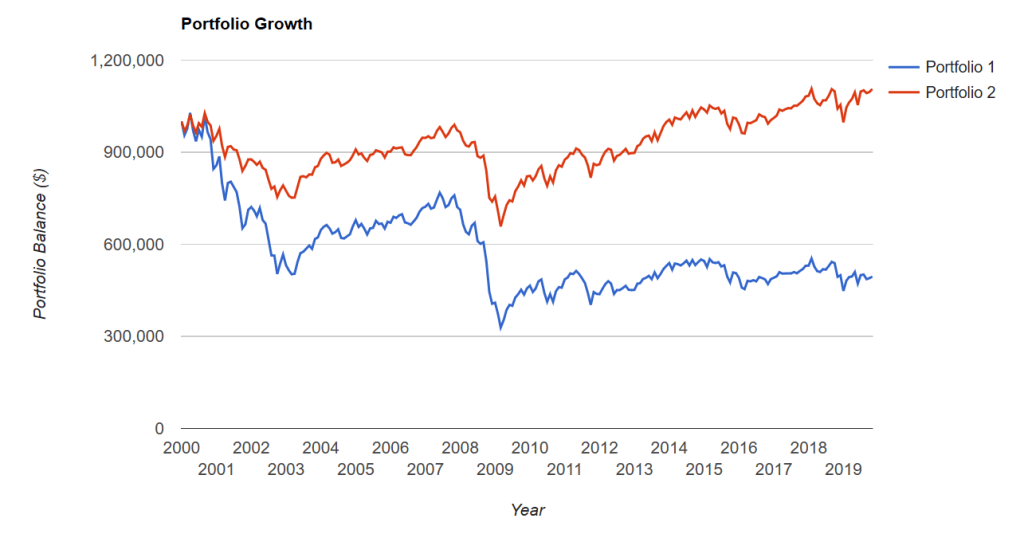

Here’s how a classic 60/40 Balanced Portfolio would have performed, as Portfolio 2.

And what about the financial crisis?

The financial crisis took down US stock markets by over 50%. But of course, the markets recovered quite ‘quickly’. A severe drop followed by a mostly robust recovery.

Portfolio 1 is all stock.

Portfolio 2 is the Balanced Portfolio.

While the all-stock portfolio would now sit at a greater portfolio value, it was in permanent impairment territory in 2010 and into 2013. The portfolio was in danger. It was only ‘saved’ by the longest bull market in US history. Stock market corrections typically arrive every 4 to 5 years. If the stock markets had stuck to the script, that portfolio (and retiree) would have been in severe danger.

While the all-stock portfolio would now sit at a greater portfolio value, it was in permanent impairment territory in 2010 and into 2013. The portfolio was in danger. It was only ‘saved’ by the longest bull market in US history. Stock market corrections typically arrive every 4 to 5 years. If the stock markets had stuck to the script, that portfolio (and retiree) would have been in severe danger.

On a risk assessment I’d say the all-stock portfolio failed in the last two major market corrections. Yes, even though it survived. Risk is about protecting from probabilities. And that’s the paradox. Proponents of an all-stock approach can say ‘but it worked’.

So we might say the all-stock portfolio batted .500 or it batted zero. You can make up your own mind on that. I asked notable retirement specialist and financial planner Alexandra Macqueen what she thought of the all-equity approach. And that is what does she think of the approach when the funds are actually required to do the bulk of the heavy lifting for retirement funding. This was offered …

It’s a bit like getting on a plane and hearing the pilot say, “if all goes well, we’ll have you on the ground in 2 hours. We don’t really have a plan to land safely, as we’ve really only focused on getting you in the air. But here’s hoping!”

Personally I want to increase the odds of a safe landing. It’s a personal decision. And that’s why they call it personal finance. I’d suggest investors look at Ed’s chart. It also shows the incredible success rate of the Balanced Growth model. It does not take a significant weighting to bonds to help the cause. And not all bonds are the same as I suggested in this post on our personal and recent portfolio moves.

What about you? Got bonds? How are you managing the risks? Or are you rolling the dice? FIRE away in the comment section.

Thanks for reading, Dale

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. This blog originally appeared on Dale’s site on November 20, 2019 and is republished on the Hub with his permission.

Dale Roberts is the Chief Disruptor at cutthecrapinvesting.com. A former ad guy and investment advisor, Dale now helps Canadians say goodbye to paying some of the highest investment fees in the world. This blog originally appeared on Dale’s site on November 20, 2019 and is republished on the Hub with his permission.

Great article. Very informative and helpful. Curious whether regular re-balancing was part of the equation. Do you think the extremely low bond yields currently, could affect the extrapolation of these historical results, I have bonds but I am focused on short duration.

I’m “rolling the dice” in a different way with a hybrid portfolio comprised of a concentrated mix of Canadian dividend stocks and a fairly typical mix of index etf’s. However, on the index etf side, I’m planning a rising equity glide path starting with a 70:30 mix, increasing the equity side at the decade mark into retirement by about 1% per year to a maximum of 90% equities. But this is on top of some additional safety levers such as working a couple of extra years to start with a larger nestegg among other things. I also think that one’s retirement plan needs to be somewhat dynamic based on what’s going on at a macro and personal level versus a static, set it and forget it perspective (annuity holders and DB pensioners being a likely exception) with respect to the statement in the article “Retirement funding is tricky business. It’s much more complicated than the accumulation stage. “